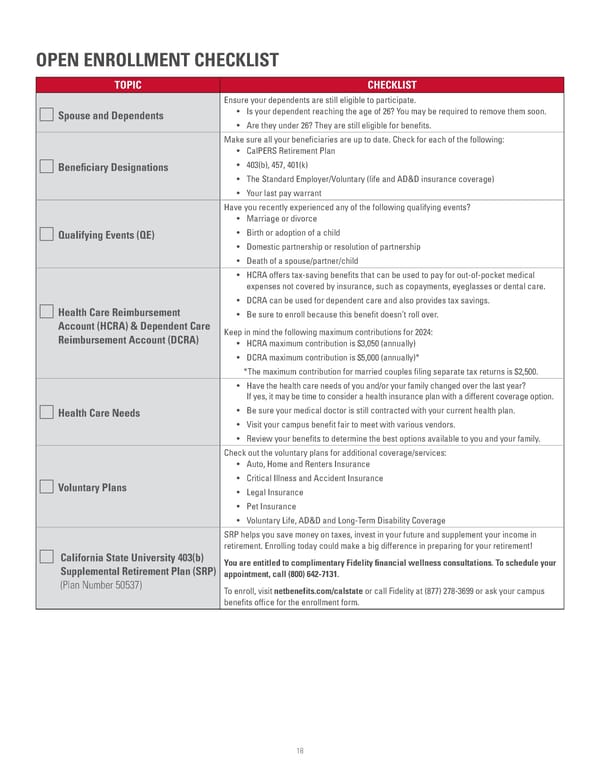

OPEN ENROLLMENT CHECKLIST TOPIC CHECKLIST Ensure your dependents are still eligible to participate. Spouse and Dependents • Is your dependent reaching the age of 26? You may be required to remove them soon. • Are they under 26? They are still eligible for benefts. Make sure all your benefciaries are up to date. Check for each of the following: • CalPERS Retirement Plan Benefciary Designations • 403(b), 457, 401(k) • The Standard Employer/Voluntary (life and AD&D insurance coverage) • Your last pay warrant Have you recently experienced any of the following qualifying events? • Marriage or divorce Qualifying Events (QE) • Birth or adoption of a child • Domestic partnership or resolution of partnership • Death of a spouse/partner/child • HCRA offers tax-saving benefts that can be used to pay for out-of-pocket medical expenses not covered by insurance, such as copayments, eyeglasses or dental care. • DCRA can be used for dependent care and also provides tax savings. Health Care Reimbursement • Be sure to enroll because this beneft doesn’t roll over. Account (HCRA) & Dependent Care Keep in mind the following maximum contributions for 2024: Reimbursement Account (DCRA) • HCRA maximum contribution is $3,050 (annually) • DCRA maximum contribution is $5,000 (annually)* *The maximum contribution for married couples fling separate tax returns is $2,500. • Have the health care needs of you and/or your family changed over the last year? If yes, it may be time to consider a health insurance plan with a different coverage option. Health Care Needs • Be sure your medical doctor is still contracted with your current health plan. • Visit your campus beneft fair to meet with various vendors. • Review your benefts to determine the best options available to you and your family. Check out the voluntary plans for additional coverage/services: • Auto, Home and Renters Insurance • Critical Illness and Accident Insurance Voluntary Plans • Legal Insurance • Pet Insurance • Voluntary Life, AD&D and Long-Term Disability Coverage SRP helps you save money on taxes, invest in your future and supplement your income in retirement. Enrolling today could make a big difference in preparing for your retirement! California State University 403(b) You are entitled to complimentary Fidelity fnancial wellness consultations. To schedule your Supplemental Retirement Plan (SRP) appointment, call (800) 642-7131. (Plan Number 50537) To enroll, visit netbenefits.com/calstate or call Fidelity at (877) 278-3699 or ask your campus benefts offce for the enrollment form. 18

2023 Open Enrollment Page 18 Page 20

2023 Open Enrollment Page 18 Page 20