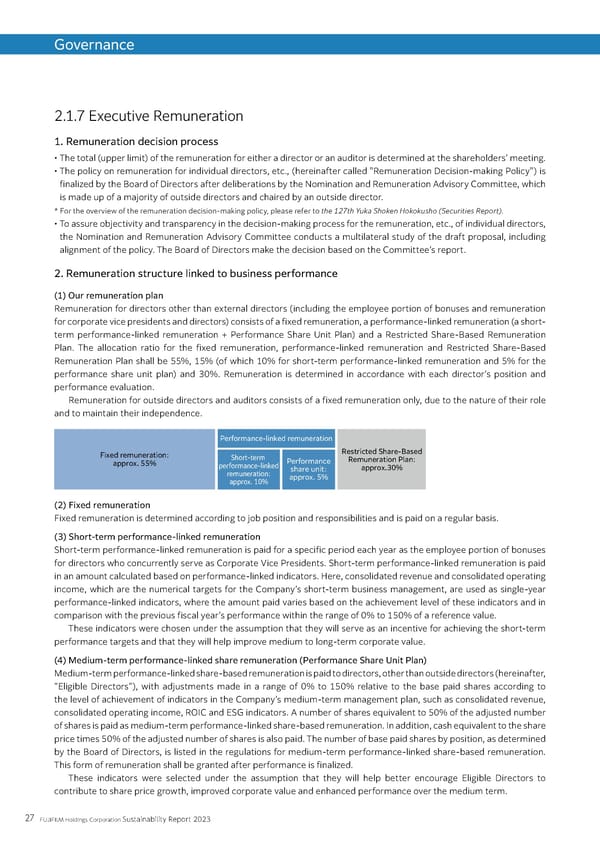

Governance 2.1.7 Executive Remuneration 1. Remuneration decision process • The total (upper limit) of the remuneration for either a director or an auditor is determined at the shareholders’ meeting. • The policy on remuneration for individual directors, etc., (hereinafter called "Remuneration Decision-making Policy") is finalized by the Board of Directors after deliberations by the Nomination and Remuneration Advisory Committee, which is made up of a majority of outside directors and chaired by an outside director. * For the overview of the remuneration decision-making policy, please refer to the 127th Yuka Shoken Hokokusho (Securities Report). • To assure objectivity and transparency in the decision-making process for the remuneration, etc., of individual directors, the Nomination and Remuneration Advisory Committee conducts a multilateral study of the draft proposal, including alignment of the policy. The Board of Directors make the decision based on the Committee’s report. 2. Remuneration structure linked to business performance (1) Our remuneration plan Remuneration for directors other than external directors (including the employee portion of bonuses and remuneration for corporate vice presidents and directors) consists of a fixed remuneration, a performance-linked remuneration (a short- term performance-linked remuneration + Performance Share Unit Plan) and a Restricted Share-Based Remuneration Plan. The allocation ratio for the fixed remuneration, performance-linked remuneration and Restricted Share-Based Remuneration Plan shall be 55%, 15% (of which 10% for short-term performance-linked remuneration and 5% for the performance share unit plan) and 30%. Remuneration is determined in accordance with each director’s position and performance evaluation. Remuneration for outside directors and auditors consists of a fixed remuneration only, due to the nature of their role and to maintain their independence. Performance-linked remuneration Fixed remuneration: Short-term Restricted Share-Based approx. 55% performance-linked Performance Remuneration Plan: remuneration: share unit: approx.30% approx. 10% approx. 5% (2) Fixed remuneration Fixed remuneration is determined according to job position and responsibilities and is paid on a regular basis. (3) Short-term performance-linked remuneration Short-term performance-linked remuneration is paid for a specific period each year as the employee portion of bonuses for directors who concurrently serve as Corporate Vice Presidents. Short-term performance-linked remuneration is paid in an amount calculated based on performance-linked indicators. Here, consolidated revenue and consolidated operating income, which are the numerical targets for the Company’s short-term business management, are used as single-year performance-linked indicators, where the amount paid varies based on the achievement level of these indicators and in comparison with the previous fiscal year’s performance within the range of 0% to 150% of a reference value. These indicators were chosen under the assumption that they will serve as an incentive for achieving the short-term performance targets and that they will help improve medium to long-term corporate value. (4) Medium-term performance-linked share remuneration (Performance Share Unit Plan) Medium-term performance-linked share-based remuneration is paid to directors, other than outside directors (hereinafter, “Eligible Directors”), with adjustments made in a range of 0% to 150% relative to the base paid shares according to the level of achievement of indicators in the Company’s medium-term management plan, such as consolidated revenue, consolidated operating income, ROIC and ESG indicators. A number of shares equivalent to 50% of the adjusted number of shares is paid as medium-term performance-linked share-based remuneration. In addition, cash equivalent to the share price times 50% of the adjusted number of shares is also paid. The number of base paid shares by position, as determined by the Board of Directors, is listed in the regulations for medium-term performance-linked share-based remuneration. This form of remuneration shall be granted after performance is finalized. These indicators were selected under the assumption that they will help better encourage Eligible Directors to contribute to share price growth, improved corporate value and enhanced performance over the medium term. 27 FUJIFILM Holdings Corporation Sustainability Report 2023

2023 | Sustainability Report Page 27 Page 29

2023 | Sustainability Report Page 27 Page 29