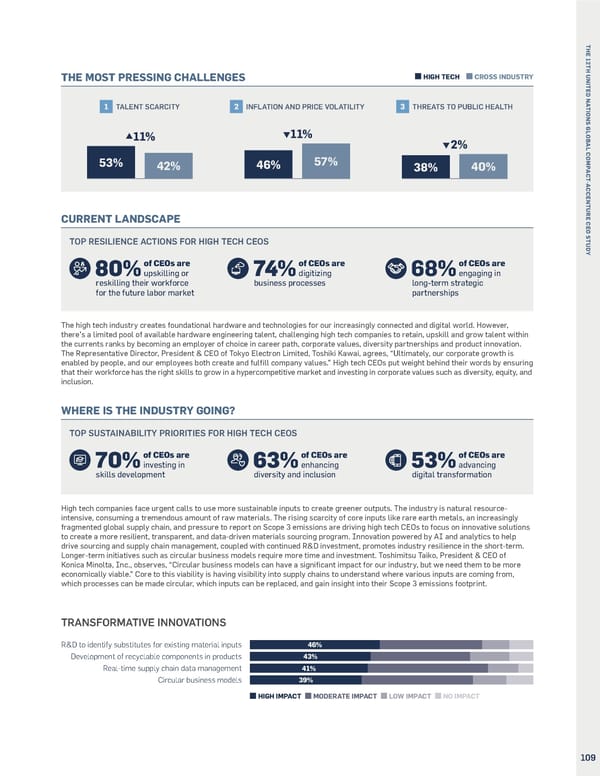

T H E 1 2 T H U THE MOST PRESSING CHALLENGES HIGH TECH CROSS INDUSTRY N I T E D N A 1 TALENT SCARCITY 2 INFLATION AND PRICE VOLATILITY 3 THREATS TO PUBLIC HEALTH T I O N S G L 11% O 11% B A 2% L C O 57% M 53% 46% P 42% 38% 40% A C T - A C C E High tech CEOs face ongoing N T U supply chain disruptions, R CURRENT LANDSCAPE E C inflationary pressure, trade E O S T wars, and geopolitical conflicts TOP RESILIENCE ACTIONS FOR HIGH TECH CEOS U D impacting profitability and Y business operations. In response, CH of CEOs are of CEOs are of CEOs are upskilling or digitizing engaging in 80% 74% 68% CEOs plan to decouple their reskilling their workforce business processes long-term strategic business from volatile regions for the future labor market partnerships by re-networking supply chains, doubling down on talent and The high tech industry creates foundational hardware and technologies for our increasingly connected and digital world. However, focusing on raw material there’s a limited pool of available hardware engineering talent, challenging high tech companies to retain, upskill and grow talent within the currents ranks by becoming an employer of choice in career path, corporate values, diversity partnerships and product innovation. procurement to strengthen their The Representative Director, President & CEO of Tokyo Electron Limited, Toshiki Kawai, agrees, “Ultimately, our corporate growth is business resiliency.enabled by people, and our employees both create and fulfill company values.” High tech CEOs put weight behind their words by ensuring that their workforce has the right skills to grow in a hypercompetitive market and investing in corporate values such as diversity, equity, and TE inclusion. WHERE IS THE INDUSTRY GOING? TOP SUSTAINABILITY PRIORITIES FOR HIGH TECH CEOS of CEOs are of CEOs are of CEOs are investing in enhancing advancing H 70% 63% 53% skills development diversity and inclusion digital transformation “We have been driving significant geographic diversity in our supply chain to eliminate reliance on any High tech companies face urgent calls to use more sustainable inputs to create greener outputs. The industry is natural resource- intensive, consuming a tremendous amount of raw materials. The rising scarcity of core inputs like rare earth metals, an increasingly country – a complicated action, Gfragmented global supply chain, and pressure to report on Scope 3 emissions are driving high tech CEOs to focus on innovative solutions especially in the semiconductor to create a more resilient, transparent, and data-driven materials sourcing program. Innovation powered by AI and analytics to help industry.” drive sourcing and supply chain management, coupled with continued R&D investment, promotes industry resilience in the short-term. Longer-term initiatives such as circular business models require more time and investment. Toshimitsu Taiko, President & CEO of Chuck Robbins, Konica Minolta, Inc., observes, “Circular business models can have a significant impact for our industry, but we need them to be more Chair and CEO of Ciscoeconomically viable.” Core to this viability is having visibility into supply chains to understand where various inputs are coming from, which processes can be made circular, which inputs can be replaced, and gain insight into their Scope 3 emissions footprint. HI TRANSFORMATIVE INNOVATIONS R&D to identify substitutes for existing material inputs 46% Development of recyclable components in products 43% Real-time supply chain data management 41% Circular business models 39% HIGH IMPACT MODERATE IMPACT LOW IMPACT NO IMPACT 108 109

Accenture CEO Study United Nations Global Compact Page 108 Page 110

Accenture CEO Study United Nations Global Compact Page 108 Page 110