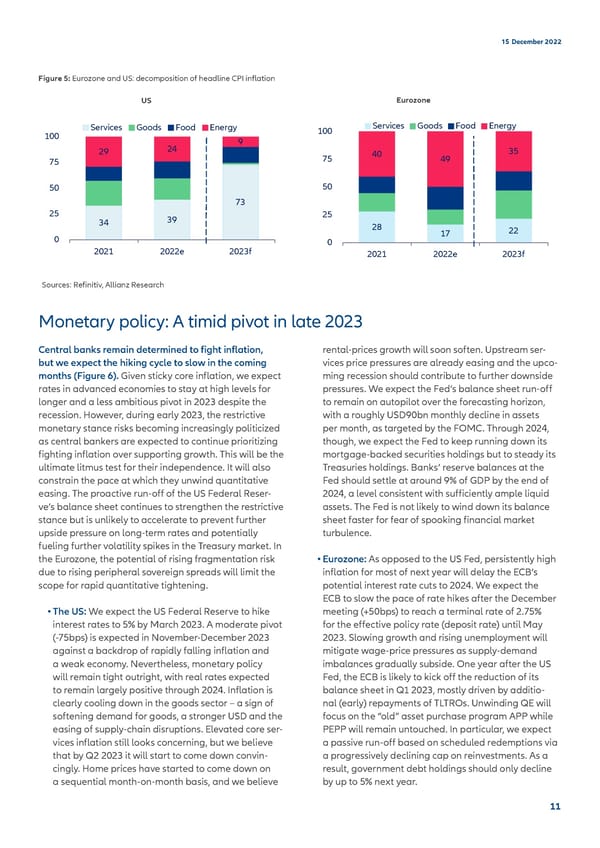

15 December 2022 Figure 5: Eurozone and US: decomposition of headline CPI inflation US Eurozone Services Goods Food Energy 100 Services Goods Food Energy 100 9 29 24 40 35 75 75 49 50 50 73 25 39 25 34 28 22 0 17 0 2021 2022e 2023f 2021 2022e 2023f Sources: Refinitiv, Allianz Research Monetary policy: A timid pivot in late 2023 Central banks remain determined to fight inflation, rental-prices growth will soon soften. Upstream ser- but we expect the hiking cycle to slow in the coming vices price pressures are already easing and the upco- months (Figure 6). Given sticky core inflation, we expect ming recession should contribute to further downside rates in advanced economies to stay at high levels for pressures. We expect the Fed’s balance sheet run-off longer and a less ambitious pivot in 2023 despite the to remain on autopilot over the forecasting horizon, recession. However, during early 2023, the restrictive with a roughly USD90bn monthly decline in assets monetary stance risks becoming increasingly politicized per month, as targeted by the FOMC. Through 2024, as central bankers are expected to continue prioritizing though, we expect the Fed to keep running down its fighting inflation over supporting growth. This will be the mortgage-backed securities holdings but to steady its ultimate litmus test for their independence. It will also Treasuries holdings. Banks’ reserve balances at the constrain the pace at which they unwind quantitative Fed should settle at around 9% of GDP by the end of easing. The proactive run-off of the US Federal Reser- 2024, a level consistent with sufficiently ample liquid ve’s balance sheet continues to strengthen the restrictive assets. The Fed is not likely to wind down its balance stance but is unlikely to accelerate to prevent further sheet faster for fear of spooking financial market upside pressure on long-term rates and potentially turbulence. fueling further volatility spikes in the Treasury market. In the Eurozone, the potential of rising fragmentation risk • Eurozone: As opposed to the US Fed, persistently high due to rising peripheral sovereign spreads will limit the inflation for most of next year will delay the ECB’s scope for rapid quantitative tightening. potential interest rate cuts to 2024. We expect the ECB to slow the pace of rate hikes after the December • The US: We expect the US Federal Reserve to hike meeting (+50bps) to reach a terminal rate of 2.75% interest rates to 5% by March 2023. A moderate pivot for the effective policy rate (deposit rate) until May (-75bps) is expected in November-December 2023 2023. Slowing growth and rising unemployment will against a backdrop of rapidly falling inflation and mitigate wage-price pressures as supply-demand a weak economy. Nevertheless, monetary policy imbalances gradually subside. One year after the US will remain tight outright, with real rates expected Fed, the ECB is likely to kick off the reduction of its to remain largely positive through 2024. Inflation is balance sheet in Q1 2023, mostly driven by additio- clearly cooling down in the goods sector – a sign of nal (early) repayments of TLTROs. Unwinding QE will softening demand for goods, a stronger USD and the focus on the “old” asset purchase program APP while easing of supply-chain disruptions. Elevated core ser- PEPP will remain untouched. In particular, we expect vices inflation still looks concerning, but we believe a passive run-off based on scheduled redemptions via that by Q2 2023 it will start to come down convin- a progressively declining cap on reinvestments. As a cingly. Home prices have started to come down on result, government debt holdings should only decline a sequential month-on-month basis, and we believe by up to 5% next year. 11

Allianz 2022 Outlook final Page 10 Page 12

Allianz 2022 Outlook final Page 10 Page 12