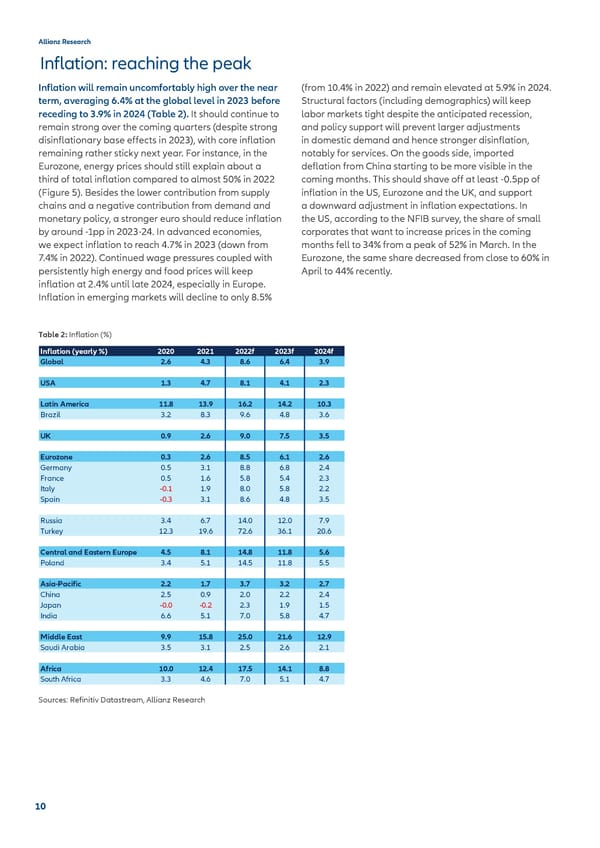

Allianz Research Inflation: reaching the peak Inflation will remain uncomfortably high over the near (from 10.4% in 2022) and remain elevated at 5.9% in 2024. term, averaging 6.4% at the global level in 2023 before Structural factors (including demographics) will keep receding to 3.9% in 2024 (Table 2). It should continue to labor markets tight despite the anticipated recession, remain strong over the coming quarters (despite strong and policy support will prevent larger adjustments disinflationary base effects in 2023), with core inflation in domestic demand and hence stronger disinflation, remaining rather sticky next year. For instance, in the notably for services. On the goods side, imported Eurozone, energy prices should still explain about a deflation from China starting to be more visible in the third of total inflation compared to almost 50% in 2022 coming months. This should shave off at least -0.5pp of (Figure 5). Besides the lower contribution from supply inflation in the US, Eurozone and the UK, and support chains and a negative contribution from demand and a downward adjustment in inflation expectations. In monetary policy, a stronger euro should reduce inflation the US, according to the NFIB survey, the share of small by around -1pp in 2023-24. In advanced economies, corporates that want to increase prices in the coming we expect inflation to reach 4.7% in 2023 (down from months fell to 34% from a peak of 52% in March. In the 7.4% in 2022). Continued wage pressures coupled with Eurozone, the same share decreased from close to 60% in persistently high energy and food prices will keep April to 44% recently. inflation at 2.4% until late 2024, especially in Europe. Inflation in emerging markets will decline to only 8.5% Table 2: Inflation (%) Inflation (yearly %) 2020 2021 2022f 2023f 2024f Global 2.6 4.3 8.6 6.4 3.9 USA 1.3 4.7 8.1 4.1 2.3 Latin America 11.8 13.9 16.2 14.2 10.3 Brazil 3.2 8.3 9.6 4.8 3.6 UK 0.9 2.6 9.0 7.5 3.5 Eurozone 0.3 2.6 8.5 6.1 2.6 Germany 0.5 3.1 8.8 6.8 2.4 France 0.5 1.6 5.8 5.4 2.3 Italy -0.1 1.9 8.0 5.8 2.2 Spain -0.3 3.1 8.6 4.8 3.5 Russia 3.4 6.7 14.0 12.0 7.9 Turkey 12.3 19.6 72.6 36.1 20.6 Central and Eastern Europe 4.5 8.1 14.8 11.8 5.6 Poland 3.4 5.1 14.5 11.8 5.5 Asia-Pacific 2.2 1.7 3.7 3.2 2.7 China 2.5 0.9 2.0 2.2 2.4 Japan -0.0 -0.2 2.3 1.9 1.5 India 6.6 5.1 7.0 5.8 4.7 Middle East 9.9 15.8 25.0 21.6 12.9 Saudi Arabia 3.5 3.1 2.5 2.6 2.1 Africa 10.0 12.4 17.5 14.1 8.8 South Africa 3.3 4.6 7.0 5.1 4.7 Sources: Refinitiv Datastream, Allianz Research 10

Allianz 2022 Outlook final Page 9 Page 11

Allianz 2022 Outlook final Page 9 Page 11