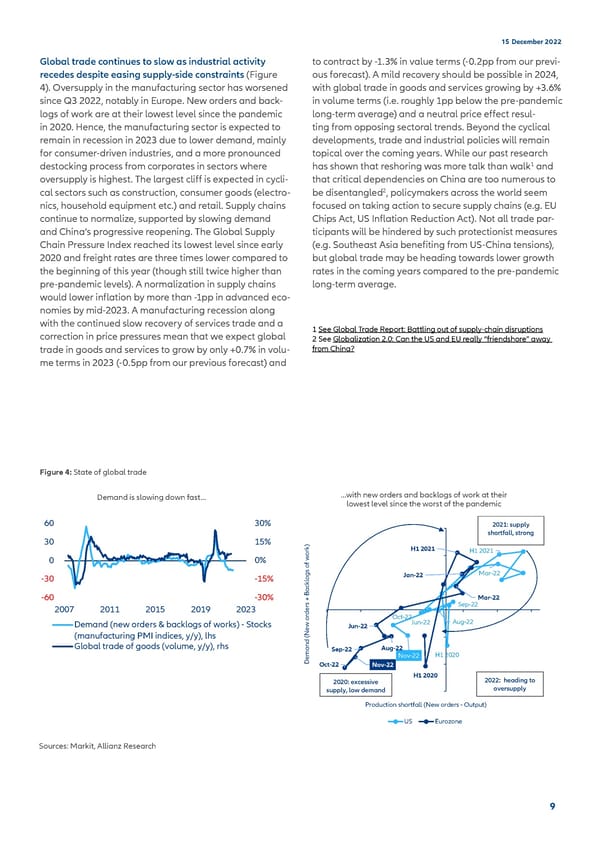

15 December 2022 Global trade continues to slow as industrial activity to contract by -1.3% in value terms (-0.2pp from our previ- recedes despite easing supply-side constraints (Figure ous forecast). A mild recovery should be possible in 2024, 4). Oversupply in the manufacturing sector has worsened with global trade in goods and services growing by +3.6% since Q3 2022, notably in Europe. New orders and back- in volume terms (i.e. roughly 1pp below the pre-pandemic logs of work are at their lowest level since the pandemic long-term average) and a neutral price effect resul- in 2020. Hence, the manufacturing sector is expected to ting from opposing sectoral trends. Beyond the cyclical remain in recession in 2023 due to lower demand, mainly developments, trade and industrial policies will remain for consumer-driven industries, and a more pronounced topical over the coming years. While our past research 1 destocking process from corporates in sectors where has shown that reshoring was more talk than walk and oversupply is highest. The largest cliff is expected in cycli- that critical dependencies on China are too numerous to 2 cal sectors such as construction, consumer goods (electro- be disentangled , policymakers across the world seem nics, household equipment etc.) and retail. Supply chains focused on taking action to secure supply chains (e.g. EU continue to normalize, supported by slowing demand Chips Act, US Inflation Reduction Act). Not all trade par- and China’s progressive reopening. The Global Supply ticipants will be hindered by such protectionist measures Chain Pressure Index reached its lowest level since early (e.g. Southeast Asia benefiting from US-China tensions), 2020 and freight rates are three times lower compared to but global trade may be heading towards lower growth the beginning of this year (though still twice higher than rates in the coming years compared to the pre-pandemic pre-pandemic levels). A normalization in supply chains long-term average. would lower inflation by more than -1pp in advanced eco- nomies by mid-2023. A manufacturing recession along with the continued slow recovery of services trade and a 1 See Global Trade Report: Battling out of supply-chain disruptions correction in price pressures mean that we expect global 2 See Globalization 2.0: Can the US and EU really “friendshore” away trade in goods and services to grow by only +0.7% in volu- from China? me terms in 2023 (-0.5pp from our previous forecast) and Figure 4: State of global trade Demand is slowing down fast… …with new orders and backlogs of work at their lowest level since the worst of the pandemic 60 30% 2021: supply shortfall, strong 30 15% k) r H1 2021 H1 2021 o 0 0% w f o Mar-22 gs Jan-22 -30 -15% o kl -60 -30% Bac Mar-22 + 2007 2011 2015 2019 2023 s Sep-22 der r Oct-22 Demand (new orders & backlogs of works) - Stocks o Jun-22 Jun-22 Aug-22 ew (manufacturing PMI indices, y/y), lhs N Global trade of goods (volume, y/y), rhs d ( Aug-22 an Sep-22 Nov-22 H1 2020 em D Oct-22 Nov-22 H1 2020 2022: headingto 2020: excessive supply, low demand oversupply Production shortfall (New orders - Output) US Eurozone Sources: Markit, Allianz Research 9

Allianz 2022 Outlook final Page 8 Page 10

Allianz 2022 Outlook final Page 8 Page 10