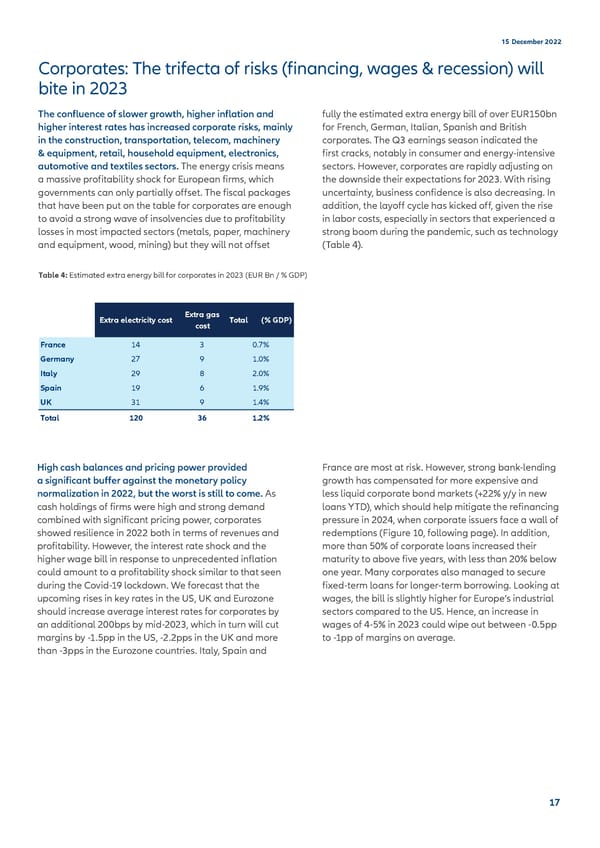

15 December 2022 Corporates: The trifecta of risks (financing, wages & recession) will bite in 2023 The confluence of slower growth, higher inflation and fully the estimated extra energy bill of over EUR150bn higher interest rates has increased corporate risks, mainly for French, German, Italian, Spanish and British in the construction, transportation, telecom, machinery corporates. The Q3 earnings season indicated the & equipment, retail, household equipment, electronics, first cracks, notably in consumer and energy-intensive automotive and textiles sectors. The energy crisis means sectors. However, corporates are rapidly adjusting on a massive profitability shock for European firms, which the downside their expectations for 2023. With rising governments can only partially offset. The fiscal packages uncertainty, business confidence is also decreasing. In that have been put on the table for corporates are enough addition, the layoff cycle has kicked off, given the rise to avoid a strong wave of insolvencies due to profitability in labor costs, especially in sectors that experienced a losses in most impacted sectors (metals, paper, machinery strong boom during the pandemic, such as technology and equipment, wood, mining) but they will not offset (Table 4). Table 4: Estimated extra energy bill for corporates in 2023 (EUR Bn / % GDP) Extra electricity cost Extra gas Total (% GDP) cost France 14 3 0.7% Germany 27 9 1.0% Italy 29 8 2.0% Spain 19 6 1.9% UK 31 9 1.4% Total 120 36 1.2% High cash balances and pricing power provided France are most at risk. However, strong bank-lending a significant buffer against the monetary policy growth has compensated for more expensive and normalization in 2022, but the worst is still to come. As less liquid corporate bond markets (+22% y/y in new cash holdings of firms were high and strong demand loans YTD), which should help mitigate the refinancing combined with significant pricing power, corporates pressure in 2024, when corporate issuers face a wall of showed resilience in 2022 both in terms of revenues and redemptions (Figure 10, following page). In addition, profitability. However, the interest rate shock and the more than 50% of corporate loans increased their higher wage bill in response to unprecedented inflation maturity to above five years, with less than 20% below could amount to a profitability shock similar to that seen one year. Many corporates also managed to secure during the Covid-19 lockdown. We forecast that the fixed-term loans for longer-term borrowing. Looking at upcoming rises in key rates in the US, UK and Eurozone wages, the bill is slightly higher for Europe’s industrial should increase average interest rates for corporates by sectors compared to the US. Hence, an increase in an additional 200bps by mid-2023, which in turn will cut wages of 4-5% in 2023 could wipe out between -0.5pp margins by -1.5pp in the US, -2.2pps in the UK and more to -1pp of margins on average. than -3pps in the Eurozone countries. Italy, Spain and 17

Allianz 2022 Outlook final Page 16 Page 18

Allianz 2022 Outlook final Page 16 Page 18