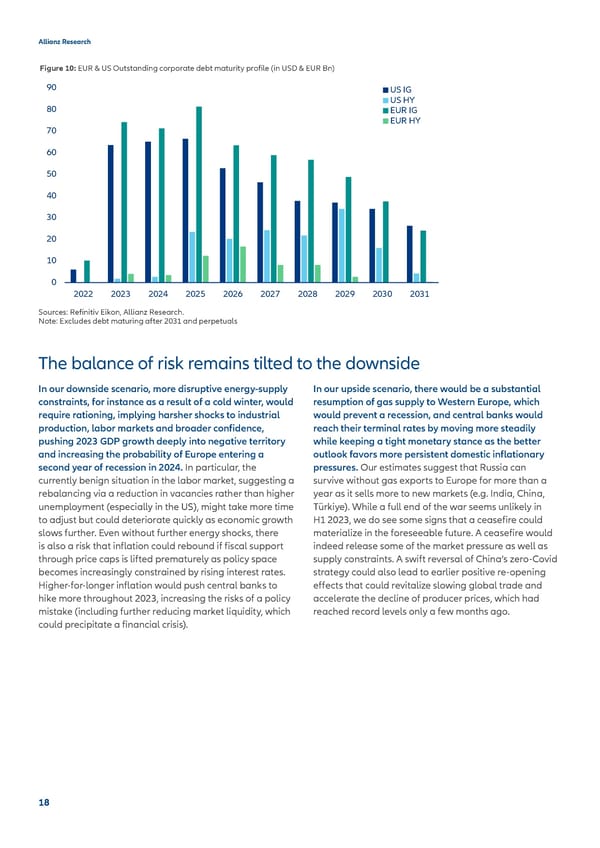

Allianz Research Figure 10: EUR & US Outstanding corporate debt maturity profile (in USD & EUR Bn) 90 US IG US HY 80 EUR IG EUR HY 70 60 50 40 30 20 10 0 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Sources: Refinitiv Eikon, Allianz Research. Note: Excludes debt maturing after 2031 and perpetuals The balance of risk remains tilted to the downside In our downside scenario, more disruptive energy-supply In our upside scenario, there would be a substantial constraints, for instance as a result of a cold winter, would resumption of gas supply to Western Europe, which require rationing, implying harsher shocks to industrial would prevent a recession, and central banks would production, labor markets and broader confidence, reach their terminal rates by moving more steadily pushing 2023 GDP growth deeply into negative territory while keeping a tight monetary stance as the better and increasing the probability of Europe entering a outlook favors more persistent domestic inflationary second year of recession in 2024. In particular, the pressures. Our estimates suggest that Russia can currently benign situation in the labor market, suggesting a survive without gas exports to Europe for more than a rebalancing via a reduction in vacancies rather than higher year as it sells more to new markets (e.g. India, China, unemployment (especially in the US), might take more time Türkiye). While a full end of the war seems unlikely in to adjust but could deteriorate quickly as economic growth H1 2023, we do see some signs that a ceasefire could slows further. Even without further energy shocks, there materialize in the foreseeable future. A ceasefire would is also a risk that inflation could rebound if fiscal support indeed release some of the market pressure as well as through price caps is lifted prematurely as policy space supply constraints. A swift reversal of China’s zero-Covid becomes increasingly constrained by rising interest rates. strategy could also lead to earlier positive re-opening Higher-for-longer inflation would push central banks to effects that could revitalize slowing global trade and hike more throughout 2023, increasing the risks of a policy accelerate the decline of producer prices, which had mistake (including further reducing market liquidity, which reached record levels only a few months ago. could precipitate a financial crisis). 18

Allianz 2022 Outlook final Page 17 Page 19

Allianz 2022 Outlook final Page 17 Page 19