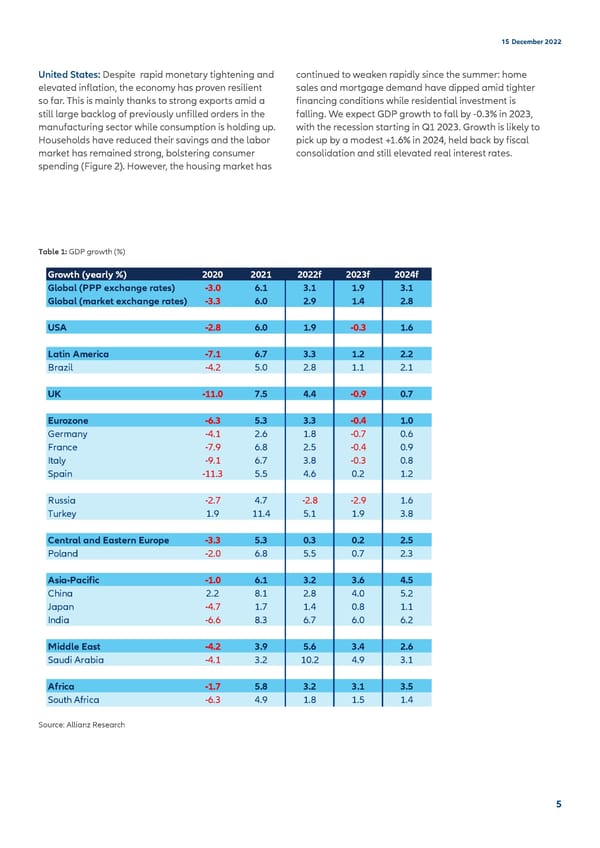

15 December 2022 United States: Despite rapid monetary tightening and continued to weaken rapidly since the summer: home elevated inflation, the economy has proven resilient sales and mortgage demand have dipped amid tighter so far. This is mainly thanks to strong exports amid a financing conditions while residential investment is still large backlog of previously unfilled orders in the falling. We expect GDP growth to fall by -0.3% in 2023, manufacturing sector while consumption is holding up. with the recession starting in Q1 2023. Growth is likely to Households have reduced their savings and the labor pick up by a modest +1.6% in 2024, held back by fiscal market has remained strong, bolstering consumer consolidation and still elevated real interest rates. spending (Figure 2). However, the housing market has Table 1: GDP growth (%) Growth (yearly %) 2020 2021 2022f 2023f 2024f Global (PPP exchange rates) -3.0 6.1 3.1 1.9 3.1 Global (market exchange rates) -3.3 6.0 2.9 1.4 2.8 USA -2.8 6.0 1.9 -0.3 1.6 Latin America -7.1 6.7 3.3 1.2 2.2 Brazil -4.2 5.0 2.8 1.1 2.1 UK -11.0 7.5 4.4 -0.9 0.7 Eurozone -6.3 5.3 3.3 -0.4 1.0 Germany -4.1 2.6 1.8 -0.7 0.6 France -7.9 6.8 2.5 -0.4 0.9 Italy -9.1 6.7 3.8 -0.3 0.8 Spain -11.3 5.5 4.6 0.2 1.2 Russia -2.7 4.7 -2.8 -2.9 1.6 Turkey 1.9 11.4 5.1 1.9 3.8 Central and Eastern Europe -3.3 5.3 0.3 0.2 2.5 Poland -2.0 6.8 5.5 0.7 2.3 Asia-Pacific -1.0 6.1 3.2 3.6 4.5 China 2.2 8.1 2.8 4.0 5.2 Japan -4.7 1.7 1.4 0.8 1.1 India -6.6 8.3 6.7 6.0 6.2 Middle East -4.2 3.9 5.6 3.4 2.6 Saudi Arabia -4.1 3.2 10.2 4.9 3.1 Africa -1.7 5.8 3.2 3.1 3.5 South Africa -6.3 4.9 1.8 1.5 1.4 Source: Allianz Research 5

Allianz 2022 Outlook final Page 4 Page 6

Allianz 2022 Outlook final Page 4 Page 6