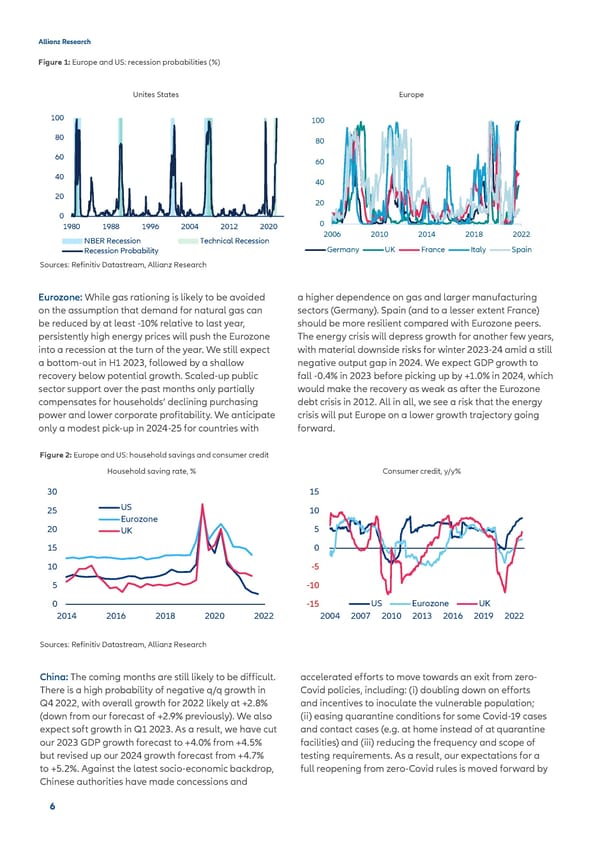

Allianz Research Figure 1: Europe and US: recession probabilities (%) Unites States Europe 100 100 80 80 60 60 40 40 20 20 0 1980 1988 1996 2004 2012 2020 0 NBER Recession Technical Recession 2006 2010 2014 2018 2022 Recession Probability Germany UK France Italy Spain Sources: Refinitiv Datastream, Allianz Research Eurozone: While gas rationing is likely to be avoided a higher dependence on gas and larger manufacturing on the assumption that demand for natural gas can sectors (Germany). Spain (and to a lesser extent France) be reduced by at least -10% relative to last year, should be more resilient compared with Eurozone peers. persistently high energy prices will push the Eurozone The energy crisis will depress growth for another few years, into a recession at the turn of the year. We still expect with material downside risks for winter 2023-24 amid a still a bottom-out in H1 2023, followed by a shallow negative output gap in 2024. We expect GDP growth to recovery below potential growth. Scaled-up public fall -0.4% in 2023 before picking up by +1.0% in 2024, which sector support over the past months only partially would make the recovery as weak as after the Eurozone compensates for households’ declining purchasing debt crisis in 2012. All in all, we see a risk that the energy power and lower corporate profitability. We anticipate crisis will put Europe on a lower growth trajectory going only a modest pick-up in 2024-25 for countries with forward. Figure 2: Europe and US: household savings and consumer credit Household saving rate, % Consumer credit, y/y% 30 15 25 US 10 Eurozone 20 UK 5 15 0 10 -5 5 -10 0 -15 US Eurozone UK 2014 2016 2018 2020 2022 2004 2007 2010 2013 2016 2019 2022 Sources: Refinitiv Datastream, Allianz Research China: The coming months are still likely to be difficult. accelerated efforts to move towards an exit from zero- There is a high probability of negative q/q growth in Covid policies, including: (i) doubling down on efforts Q4 2022, with overall growth for 2022 likely at +2.8% and incentives to inoculate the vulnerable population; (down from our forecast of +2.9% previously). We also (ii) easing quarantine conditions for some Covid-19 cases expect soft growth in Q1 2023. As a result, we have cut and contact cases (e.g. at home instead of at quarantine our 2023 GDP growth forecast to +4.0% from +4.5% facilities) and (iii) reducing the frequency and scope of but revised up our 2024 growth forecast from +4.7% testing requirements. As a result, our expectations for a to +5.2%. Against the latest socio-economic backdrop, full reopening from zero-Covid rules is moved forward by Chinese authorities have made concessions and 6

Allianz 2022 Outlook final Page 5 Page 7

Allianz 2022 Outlook final Page 5 Page 7