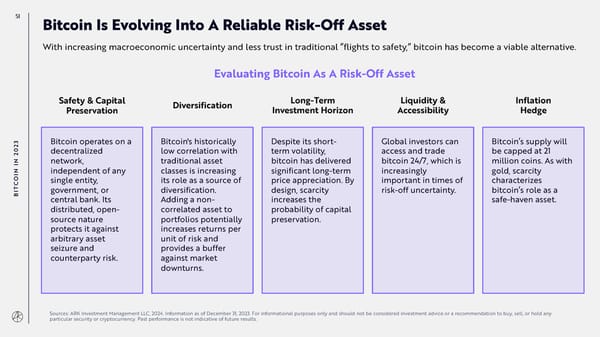

51 Bitcoin Is Evolving Into A Reliable Risk-Off Asset With increasing macroeconomic uncertainty and less trust in traditional ”flights to safety,” bitcoin has become a viable alternative. Evaluating Bitcoin As A Risk-Off Asset Safety & Capital Diversification Long-Term Liquidity & Inflation Preservation Investment Horizon Accessibility Hedge 3 Bitcoin operates on a Bitcoin's historically Despite its short- Global investors can Bitcoin’s supply will 2 0 decentralized low correlation with term volatility, access and trade be capped at 21 2 N network, traditional asset bitcoin has delivered bitcoin 24/7, which is million coins. As with I N independent of any classes is increasing significant long-term increasingly gold, scarcity OI single entity, its role as a source of price appreciation. By important in times of characterizes C T government, or diversification. design, scarcity risk-off uncertainty. bitcoin’s role as a BI central bank. Its Adding a non- increases the safe-haven asset. distributed, open- correlated asset to probability of capital source nature portfolios potentially preservation. protects it against increases returns per arbitrary asset unit of risk and seizure and provides a buffer counterparty risk. against market downturns. Sources: ARK Investment Management LLC, 2024. Information as of December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

Annual Research Report | Big Ideas 2024 Page 50 Page 52

Annual Research Report | Big Ideas 2024 Page 50 Page 52