Annual Research Report | Big Ideas 2024

January 31, 2024 - For informational purposes only

4 21 0 2 , 1 3 Y R A U N JA BIG IDEAS Y L N O S E S O P 2024 R U P L A N O I T A M R FO N I R FO Annual Research 4 Report 02 2 S EA D I ARK Investment Management LLC. This is not a recommendation in relation to any named particular securities/cryptocurrencies and no warranty or guarantee is provided. Any references to particular securities/cryptocurrencies G are for illustrative purposes only. There is no assurance that the Adviser will make any investments with the same or similar characteristics as any investment presented. The reader should not assume that an investment BI identified was or will be profitable. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE PERFORMANCE, FUTURE RETURNS ARE NOT GUARANTEED.

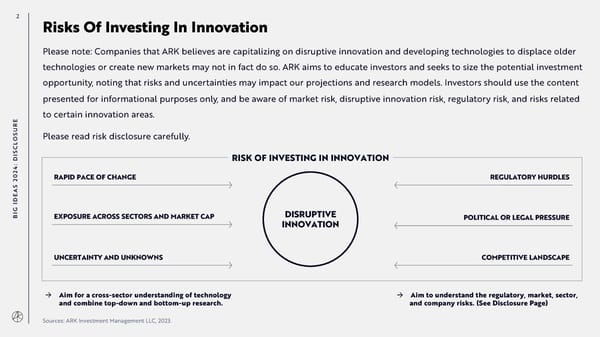

2 Risks Of Investing In Innovation Please note: Companies that ARK believes are capitalizing on disruptive innovation and developing technologies to displace older technologies or create new markets may not in fact do so. ARK aims to educate investors and seeks to size the potential investment opportunity, noting that risks and uncertainties may impact our projections and research models. Investors should use the content presented for informational purposes only, and be aware of market risk, disruptive innovation risk, regulatory risk, and risks related E to certain innovation areas. R U Please read risk disclosure carefully. OS L C S RISK OF INVESTING IN INNOVATION DI : 4 2 0 RAPID PACE OF CHANGE REGULATORY HURDLES 2 S A DE I G DISRUPTIVE BI EXPOSURE ACROSS SECTORS AND MARKET CAP POLITICAL OR LEGAL PRESSURE INNOVATION UNCERTAINTY AND UNKNOWNS COMPETITIVE LANDSCAPE à Aim for a cross-sector understanding of technology à Aim to understand the regulatory, market, sector, and combine top-down and bottom-up research. and company risks. (See Disclosure Page) Sources: ARK Investment Management LLC, 2023.

3 Big Ideas 2024 Disrupting The Norm, Defining The Future ARK Invest proudly presents "Big Ideas 2024: Disrupting the Norm, Defining the Future." A tradition since 2017, ON Big Ideas offers a comprehensive analysis of technological convergence and its potential to revolutionize I T C industries and economies. ODU R T N I : 4 ARK seeks to deliver long-term capital appreciation by investing in the leaders, enablers, and beneficiaries of 2 0 2 S disruptive innovation. With a belief that innovation is key not only to growth but also to resilience, ARK A DE I emphasizes the necessity of a strategic allocation to innovation in every investor's portfolio. This approach aims G BI to tap into the exponential growth opportunities often overlooked in broad-based indices, while simultaneously providing a hedge against the risks posed by incumbents facing disruption. We hope you enjoy Big Ideas 2024.

4 Technological Convergence 5 Artificial Intelligence 19 Bitcoin Allocation 34 Bitcoin In 2023 43 Smart Contracts 53 TS Digital Consumers 64 N Digital Wallets TE 75 N O C Precision Therapies 87 F O LE Multiomic Tools & Technology 96 B TA Electric Vehicles 104 Robotics 113 Robotaxis 122 Autonomous Logistics 133 Reusable Rockets 143 3D Printing 153

55 Research By: Brett Winton Chief Futurist ARK Venture Investment Committee Member Technological 4 2 0 2 S A E D I G BI Convergence Sources: ARK Investment Management LLC, 2024. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

6 According to ARK’s research, convergence among disruptive technologies will define this decade. Five major technology platforms—Artificial Intelligence, Public Blockchains, Multiomic Sequencing, Energy Storage, and Robotics—are coalescing and should transform global economic activity. Technological convergence could create tectonic macroeconomic shifts more impactful than the first and second industrial revolutions. Globally, real economic growth could accelerate from 3% CE on average during the past 125 years to more than 7% during the next 7 years as robots reinvigorate N E manufacturing, robotaxis transform transportation, and artificial intelligence amplifies knowledge G R E V worker productivity. N CO Catalyzed by breakthroughs in artificial intelligence, the global equity market value associated with disruptive innovation could increase from 16% of the total* to more than 60% by 2030. As a result, the annualized equity return associated with disruptive innovation could exceed 40% during the next seven years, increasing its market capitalization from ~$19 trillion today to roughly $220 trillion by 2030. *Throughout this section, we include public blockchain value as part of all calculations and forecasts of “equity market value.” Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying data from external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

7 Public Blockchains Upon large-scale adoption, all money and contracts likely will migrate onto Public Blockchains that enableand verifydigital Multiomic scarcityand proof of ownership. The financial ecosystem is likely to reconfigure to accommodate the rise of Cryptocurrencies and Smart Contracts. These technologies Sequencing increase transparency, reduce the influence of capital and The cost to gather, sequence, and understand regulatory controls, and collapse contract execution costs. In digital biological data is falling precipitously. such a world, Digital Wallets would become increasingly Multiomic Technologies provide research necessary as more assets become money-like, and corporations scientists, therapeutic organizations and health Five Innovation and consumers adapt to the new financial infrastructure. platforms with unprecedented access to DNA, Corporate structures themselves may be called into question. RNA, protein, and digital health data. Cancer care should transform with pan-cancer blood tests. Platforms Are Artificial Intelligence Multiomic data should feed into novel Precision Therapies using emerging gene editing techniques Computational systems and software that evolve with data can that target and cure rare diseases and chronic Converging And solve intractable problems, automate knowledge work, and conditions. Multiomics shouldunlock entirely new accelerate technology’s integration into every economic sector. The Programmable Biology capabilities, including the adoption of Neural Networks should prove more momentous than design and synthesis of novel biological Defining This the introduction of the internet and potentially create 10s of trillion constructs with applications across industries, CE dollars of value. At scale these systems will require unprecedented particularly agriculture and food production. N computational resources, and AI-specific compute hardware should E Technological Era dominate the Next Gen Cloud datacenters that train and operate AI G models. The potential for end-users is clear: a constellation of AI- R driven Intelligent Devices that pervade people's lives, changing the E V way that they spend, work, and play. The adoption of artificial N intelligence should transform every sector, impact every business, CO and catalyze every innovation platform. Energy Storage Robotics Declining costs of Advanced Battery Technology should cause Catalyzed by artificial intelligence, Adaptive Robots can an explosion in form factors, enabling Autonomous Mobility operate alongside humans and navigate legacy systems that collapse the cost of getting people and things from infrastructure, changing the way products are made and place to place. Electric drivetrain cost declines should unlock sold. 3D Printing should contribute to the digitization of micro-mobility and aerial systems, including flying taxis, manufacturing, increasing not only the performance and enabling business models that transform the landscape of cities. precision of end-use parts but also the resilience of Autonomy should reduce the cost of taxi, delivery, and supply chains. Meanwhile, the world’s fastest robots, surveillance by an order of magnitude, enabling frictionless Reusable Rockets, should continue to reduce the cost of transport that could increase the velocity of e-commerce and launching satellite constellations and enable make individual car ownership the exception rather than the uninterruptible connectivity. A nascent innovation rule. These innovations combined with large-scale stationary platform, robotics could collapse the cost of distance batteries should cause a transformation in energy, substituting with hypersonic travel, the cost of manufacturing electricity for liquid fuel and pushing generation infrastructure complexity with 3D printers, and the cost of production towards the edge of the network. with AI-guided robots. Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying data from external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

8 Converging Technologies Are Generating A Historic Technological Wave Estimated Economic Impact of General Purpose Technologies (Annual Percentage Point Additions to Real GDP Growth And Consumer Surplus) 18 3D Printing Reusable Rockets Adaptiverobots Advanced Batteries Internal Combustion Engine Autonomous Mobility 13 Electricity Internet Cloud Computing Telephone Cell phones Radio GPS CE Refrigeration The Web AI N Air Conditioning E Chemicals & Synthetic G 8 PCs E-Commerce R Materials E Automobile Biotech Renewables V Railroads Fiber optics N Telegraph Assembly Line Intelligent Devices CO Photography Television Integrated Circuit Multiomic Technology Steam Engine Bicycle Jet Engine Nuclear Power Precision Therapies 3 Containerization Programmable Biology Digital Wallets Smart Contracts Cryptocurrencies -2 0 5 0 5 0 5 0 5 0 5 0 5 0 5 0 5 0 5 0 5 0 5 0 5 0 5 0 5 5 0 5 0 5 0 5 0 5 5 0 5 0 5 F 0F 8 9 0 10 15 2 2 3 3 4 4 5 5 6 7 7 8 8 9 9 0 10 15 2 2 3 3 0 4 5 5 6 7 7 8 8 0 9 0 1 1 20 253 8 9 0 18 6 0 19 4 6 9 0 25 0 17 17 17 17 18 18 18 18 18 18 18 18 18 18 18 18 18 18 18 18 18 18 18 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 20 20 20 20 20 2020203 20 Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying sources, including Bekar et al. 2017, which may be provided upon request. The chart uses GPT 4 prompting to survey a comprehensive list of general purpose technologies using the identification framework detailed therein. Where available, academic literature is also used to assess attributable economic impact. A GPT-4 scoring rubric assesses technology-by-technology impacts. The impact measured directly is matched against the scoring to tune all scores to produce technology-by-technology estimates of economic impact (even when direct measures of economic impact are unattainable). Consistent with General Purpose Technology theory, these technologies are assumed to go through a period of investment in which economic impact is negative before productivity advances begin to realize into economic data. All technologies are assumed to have the same diffusion and realization cycle. If recent technologies are assumed to diffuse more quickly, the current wave would appear steeper. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

9 AI Serves As The Central Technology Catalyst The Technology Convergence matrix illustrates the relationships between and among technologies. Cryptocurrencies Convergence Score Smart Contracts Highest Digital Wallets Precision Therapies Multiomic High Technology Programmable Biology gy Neural Mid o Networks l o n h Next Gen Tec Cloud Intelligent Devices Low Autonomous Mobility Advanced Battery Technology Renewable Lowest Rockets Adaptive Robotics 3D Printing Crypto- Smart Digital Precision Multiomic Programmable Neural Next Gen Intelligent Autonomous Advanced Renewable Adaptive 3D currencies Contracts Wallets Therapies Technology Biology Networks Cloud Devices Mobility Battery Rockets Robotics Printing Technology Catalyzing Technology More detailed version of this graphic, including detailed scoring information and justification available here. Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying data from external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

10 AI Is Accelerating Faster Than Forecasters Anticipated Expected Years Until Launch Of A General Artificial Intelligence System Pre GPT-3 average (Log Scale) 100 80 years OpenAIannounces GPT-3 Google demonstrates advanced 50 conversational agent, LLaMda2 years ChatGPTlaunches to the public s 34 years CE r a N e GPT-4 launches E Y G f o 18 years R E r V e10 N b m CO Nu 8 years If for ecast is wel l - tun e d If for ecast er r or con tin ues 1 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Sources: ARK Investment Management LLC, 2024, based on data from Metaculus, including benchmark details, as of January 3, 2024. Benchmark broadly requires the successful passage of an adversarial two-hour Tuning test, broad success on a Q&A knowledge and logic benchmark, and the successful interpretation of and execution complex model car assembly instruction, all within a single system. Green lines are derived estimates for time to general purpose AI (strongly formulated) based upon forecasts for a weaker benchmark. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

11 Individual Technology Advances Can Coalesce And Cascade Into Massive New Market Opportunities Neural Networks Advanced Battery Technology Autonomous Mobility Advanced AI enables robotaxis Battery electric drivetrains The combination of AI and battery to rely on fewer, less expensive + reduce robotaxi operating = electric drivetrains enables robotaxi sensors. costs by 60%. systems to scale. CE Robotaxi Manufacturing Costs RobotaxiOperating Cost Per Mile N (Per Vehicle, 2024)* By Drivetrain Type E Adaptive Robotics G R 200 E V $0.31 N In addition to better batteries and AI, CO 150 general purpose robots will require better: 100 • Electric motors Thousands, $ $0.12 • Power electronics 50 • Sensors • Power-efficient compute Waymo Tesla Internal combustion Electric As robotaxis scale, the cost of each 5 LIDARs, 29 cameras, 6 9 Cameras technology should decline according radars, 8 ultrasonic to its learning curve. sensors *Waymo manufacturing costs are estimated based upon public statements. Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

12 The Impact Of These Technologies On The Economy Should Prove Dramatic Economic Impact of Select Major Technologies (Cumulative Increase In Real GDP Attributable to Technology After Introduction) 140% 120% 100% CE N E G 80% R E V N CO 60% 40% 20% 0% Industrial robots Information Technology Adaptive robotics * Autonomous Mobility * Steam engine AI* Industrial Robots Adaptive Robotics * Steam Engine (1997 to 2007) (2023 to 2030) (1830 to 1910) (1997 to 2007) (1995 to 2005) (2023 to 2030) (2023 to 2030) (1830 to 1910) (2023 to 2030) *Adaptive Robotics, Autonomous Mobility, and AI Impact are ARK Invest estimates. AI estimate includes consumer surpluses that may not be captured in traditional economic statistics. IT productivity impact likely also undercounts consumer surplus. Industrial Robot and IT impact measures impact on US, Europe, and Japanese economies. Steam Engine impact is measured against the UK economy. Sources: ARK Investment Management LLC, 2024, based on data from Crafts 2004, O’Mahony et al. 2009, and McKinsey Global Institute 2017. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

13 Technological Innovation Could Be Disruptive Enough To Dominate Global Equity Market Capitalizations 2023 2030 Annual Growth Equity Market Cap Estimate Equity Market Cap Forecast Forecast Non-innovation $98 trillion Non-innovation $140 trillion 3% Disruptive Innovation $19 trillion Disruptive Innovation $220 trillion 42% Total $117 trillion Total $360 trillion 17% Multiomic CE Sequencing N ArtificiaI Intelligence E Robotics G R 37% E Public V Energy Storage N Blockchains 50% CO Public Blockchains 48% Energy Robotics Storage 78% AI Multiomic Sequencing 39% Note: Forecasted numbers are rounded. Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of external sources, including the World Federation of Exchanges and the MSCI ACWI IMI Innovation Index which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

14 Expectations For Public Blockchains Although the scenarios described in the table below are written in present tense, they are forecasted, possible outcomes based on ARK's views. These possible outcomes may not be realized in the future due to a number of uncertainties. The information provided should not be considered investment advice and should not form the basis of any investment decision. Technology 2040 Possibilities ARK’s 2030 Expectation of Progress Cryptocurrencies have displaced most permission-based, centrally Global money supply has grown in tandem with GDP, and cryptocurrencies now controlled monetary systems, enabling financial ecosystems to reformulate account for ~10% of the total. Little of that value accrual is attributable to the around a digital asset that can eliminate counterparty risk while continuing direct displacement of money though there are instances in emerging markets. to facilitate transaction flows. The reformulation began at the edges of the Much of the appreciation is a function of low single-digit percent allocations by Cryptocurrencies traditional financial system in geographies with broken money systems and institutional and high net worth individuals as well as corporate and nation-state in markets otherwise mis-served by traditional financial intermediaries. In treasuries. Cryptocurrencies continue to displace gold as a flight-to-safety asset, developed markets, cryptocurrencies initially served as a store of value, taking 40% share of the market. Utility use cases such as remittances and global providing little direct utility. Over time, the efficiencies of a truly neutral settlements account for ~10% and~ 5% of volumes, respectively digital currency, primarily bitcoin, have prevailed over other financial architectures. CE Most contracts have migrated to open-source protocols that enable and Global financial assets as percent of GDP have continued to increase, with less N verify digital scarcity and proof of ownership. Risk-sharing arrangements are than 5% secured by smart contracting platforms—a dynamic consistent with the E more transparent, assets of all sorts are securitized, bought, and sold more adoption curve of dialup internet. At 1%, the gross take from tokenized assets on G easily, and counterparty risks have diminished substantially. The importance decentralized protocols is less than a third of the fees that traditional financial R of traditional financial intermediaries has dwindled, even as more human institutions extract. Application protocols, which pay a larger share of fees to E V Smart Contracts activity becomes commercialized. Decentralized protocols, enabled by incentivize network participants, account for 75% of gross decentralized protocol N balance-sheet-light digital wallet platforms, facilitate most traditional revenues. The blended net take rate between application layer protocols and CO financial functions. Consumer internet services rely on business models Level 1 protocols is roughly 60bps. enabled by digital asset ownership. Every corporate entity and every consumer has adapted as centralized corporate structures themselves are called into question. Digital wallets enable nearly every person with a connected device to Roughly 90% of smartphone users rely on digital wallets to some degree. The transmit and receive money instantly, fundamentally transforming the majority uses digital wallets as the front-end for more than half of meaningful through-flow of commercial and financial experiences. Digital wallets that financial functions. Digital wallet platform providers continue to rely on traditional facilitate wholesale pricing of financial services for individual users have ecosystems to facilitate financial activities like lending but can extract lead disrupted retail banking relationships, fundamentally transforming consumer generation fees of 5-20% for delivering customers to those institutions. They also Digital Wallets relationships with financial service providers. In addition to their financial can capture 3-10% commerce facilitation fees for e-commerce activity directed functions, digital wallets are distribution platforms for a variety of digital through their platforms. services—from ride-hailing to e-commerce—and are secure repositories for digital health and other sensitive data. Traditional financial service institutions and their associated payment processing value chains have given way largely to internet-enabled digital wallets for most economic activity. Sources: ARK Investment Management LLC, 2024. In the above table, we characterize the convergent technological capabilities that we believe may manifest by 2030 and 2050. We stress that these scenarios, written in the present tense, are possible outcomes—not assured outcomes—and that the future may play out differently. This ARK analysis is based on a range of external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

15 Expectations For Multiomic Sequencing Although the scenarios described in the table below are written in present tense, they are forecasted, possible outcomes based on ARK's views. These possible outcomes may not be realized in the future due to a number of uncertainties. The information provided should not be considered investment advice and should not form the basis of any investment decision. Technology 2040 Possibilities ARK’s 2030 Expectation of Progress Technology enables the manipulation of molecular biological systems, Precision therapies make up 25% of newly released drugs. By improving the quality of life, catalyzing a new generation of more efficacious and durable precision lowering ancillary medical costs, and often effectively curing diseases, they command therapies. CRISPR-based gene-editing enables the manipulation of DNA average price premiums of 7x relative to traditional drugs. Combined with expected directly with increasing specificity. RNA-acting therapeutic techniques improvements in R&D efficiencies, these drugs add 15% or ~$300 billion to drug revenues in Precision Therapies restrict the area of DNA that can be transcribed into proteins. AI-advances 2030. enable the targeting of specific proteins that cause underlying disorders. These breakthroughs have shortened development timelines for and increased the efficacy of curative therapies that command higher prices than traditional therapies. Researchers are aiming to cure most rare diseases. Traditional health service spending declines, ceding economic terrain to molecular cures. CE Catalyzed by the precipitous fall in sequencing costs, researchers and At full penetration, R&D efficiency associated with drug development could double, thanks N clinicians routinely collect patients’ epigenomic, transcriptomic, and to AI-enhanced multiomic technology. By 2030, nearly all new drug development programs E proteomic data. With increasingly comprehensive digital health readouts incorporate multiomics into preclinical R&D, and ~50% incorporate AI into clinical G from intelligent devices and emerging AI tools, they align this panoply of programs. Realized returns on R&D have improved by 10% with line-of-sight to a near R multiomic data to understand, predict, and treat disease. As a result, cancer E doubling of R&D returns by 2035. Early detection multi-cancer blood tests have become V care has transformed completely: multiomic technologies detect cancer at standard of care as they have cut cancer mortality by 25% for some age cohorts. In N early stages, target treatment more precisely, and provide recurrence CO Multiomic Technologies monitoring. Regular blood-based pan-cancer tests are a standard of care for developed markets, 30% of patients benefit from the new diagnostics regime. patients in middle age. Multiomic technology has increased biotech R&D efficiency, as clinical trials target patient populations and measure outcomes more precisely and easily. Combined with AI, multiomic technology has transformed the relationship between patients and health systems. Digital health providers, diagnostic tool companies, and molecular testing companies are leading the charge. Legacy drug franchises and health service systems have lost their prominence. Wasteful healthcare spending declines as healthy lives extend. AI tools, improved genomic synthesis techniques, and scalable biological Still restricted to early stage and development projects, gene synthesis generates $10 manufacturing techniques enable novel, lower cost biological constructs billion in annual revenue. Programmable biology platforms capture 10% of precision with predictable performance, powering a renaissance in agriculture and therapy revenue. Those platforms generate another $30 billion in revenue with gross Programmable Biology materials science. Programmable biology enables breakthroughs in margins at ~70%, EBITDA margins in the 35% range, and free cash flow margins at ~20%. materials science and bio-based fuels that increase food production and reduce environmental externalities. Molecular biological primitives offer a substrate for new robust computation architectures. Sources: ARK Investment Management LLC, 2024. In the above table, we characterize the convergent technological capabilities that we believe may manifest by 2030 and 2050. We stress that these scenarios, written in the present tense, are possible outcomes—not assured outcomes—and that the future may play out differently. This ARK analysis is based on a range of external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

16 Expectations For Energy Storage Although the scenarios described in the table below are written in present tense, they are forecasted, possible outcomes based on ARK's views. These possible outcomes may not be realized in the future due to a number of uncertainties. The information provided should not be considered investment advice and should not form the basis of any investment decision. Technology 2040 Possibilities ARK’s 2030 Expectation of Progress Robots move people and parcels from place to place and have changed the Autonomous robotaxis have transformed global transport, as point-to-point economics of physical movement entirely. The cost of taxi, delivery, and transportation is available in nearly every country at an average price of ~$.50 per observation have fallen by an order of magnitude. Traveling by robotaxi is the mile. Given the compelling price-point and utility, robotaxis have traveled 13 norm and owning a personal vehicle the exception. Frictionless drone and trillion vehicle miles and are gaining traction. Autonomous robotaxi platforms Autonomous Mobility robot delivery has catalyzed the velocity of ecommerce. The data generated charge platform fees or take-rates of 50%+, generate ~50% operating margins, by autonomous mobility systems provide pervasive, real-time insights into the and give asset owner-operators the opportunity to generate reasonable rates of state of the world. Consumers and businesses that harness autonomous return on capital. The number of autonomous vehicles facilitating this travel is mobility platforms are benefitting, while prior incumbents in the automotive, ~100 million, and most of the incremental vehicle production is autonomous- logistics, retail, and insurance sectors have been upended. capable. CE N Declining battery costs have ignited a Cambrian explosion in mobility form As ridership shifts to electric autonomous platforms, the number of autonomous E factors, pushing electrical supply out to end-nodes on networks. Electric capable EVs sold annually is ~74 million, accounting for most of the automotive G R vehicles dominate transport as internal combustion dies. Micro-mobility and market. At an average selling price of ~$20,000, EV manufacturers generate $1.4 E aerial systems that include flying taxis enable innovative business models that trillion in annual revenue, ~20% gross margins, and ~10% EBIT margins. With V N Advanced Battery transform urban landscapes. All these innovations drive fundamental demand manufacturing consolidation, margins increase. Batteries account for ~20% of the CO Systems for electrical energy at the expense of liquid fuel. They also provide electrical value of EVs. Much like that of EVs, battery manufacturing is capital-intensive and energy more efficiently, reducing the vulnerability of grids, operational low-margin. Supplying the EV OEMs, battery manufacturers generate revenue of expenses, and the capital intensity of transmission and distribution. $300 billion per year. Stationary energy storage requires a volume of batteries Oil demand is in decline, and traditional automotive manufacturers and roughly equivalent to that consumed by EVs, generating another $300 billion in suppliers have been displaced by a smaller number of vertically integrated revenue. technology providers. Sources: ARK Investment Management LLC, 2024. In the above table, we characterize the convergent technological capabilities that we believe may manifest by 2030 and 2050. We stress that these scenarios, written in the present tense, are possible outcomes—not assured outcomes—and that the future may play out differently. This ARK analysis is based on a range of external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

17 Expectations For Artificial Intelligence Although the scenarios described in the table below are written in present tense, they are forecasted, possible outcomes based on ARK's views. These possible outcomes may not be realized in the future due to a number of uncertainties. The information provided should not be considered investment advice and should not form the basis of any investment decision. Technology 2040 Possibilities ARK’s 2030 Expectation of Progress Fed by massive amounts of data, computational systems and software are The cost of training AI models has fallen more than 40,000-fold which, when solving previously unsolvable problems, automating knowledge work, and combined with aggressive investments in AI hardware, has catapulted accelerating the integration of technology into all economic processes. As aggregate AI capability roughly 600,000-fold since 2023. Adopted by 50% of Neural Networks costs have plummeted, custom software is improving with every AI model knowledge workers, AI software systems have improved their productivity by 9x enhancement and connecting the world. Learning systems are blazingly fast, on average. Consistent with other software products, enterprises pay 10% of the their impact as momentous as the introduction of the microprocessor, productivity increase to access the software. transforming every sector and region. Cloud tools train the AI models that dominate software stacks and the AI hardware spend of $1.3 trillion supports $13 trillion in AI software sales and software connections that stitch together the AI-run world. The accommodates traditional software gross margins of 75%. Three types of CE infrastructure-as-a-service providers, chip manufacturers, and tool- customers support the demand for AI hardware--infrastructure-as-a-service N manufacturers that facilitate the training of neural networks have enjoyed a providers, software companies, and AI foundation model providers—which E Next Gen Cloud multi-decade demand cycle. Software development has been should generate 20% cashflow margins, consistent with those of chip G R democratized, and the companies providing API hooks that stitch together manufacturers. E V interoperable software layers experience unprecedented demand. N CO AI powers a new class of intelligent devices in the home and on the go. Consumer spending on intelligent device hardware continues its uptrend to Fixed internet-and AI-powered infrastructure exists in homes and other ~$60 per internet user per year. Time spent connected grows dramatically to social environments, transforming distribution for all media providers. End- half of waking leisure hours, or 20 trillion globally. Digital experiences continue users interface with the world in completely new ways, and data on their to monetize at a discount to in-person experiences and yield $0.25 per hour Intelligent Devices consumption preferences spawn new business models and services. spent online in revenue to platform providers. Between device spend and Commerce and wagering permeate entertainment experiences, enabling digital entertainment experiences, $5.4 trillion in revenue accrues to intelligent and catalyzing new advertising formats and content monetization. The show devices, entertainment, and social platforms. Advertising and commerce is the store. Linear TV is obsolete, as digital curation and direct consumer comprise 80% of that revenue. preference drive visual content. Linear content is ceding ground to interactive experiences, sometimes subtly. AI-mediated glasses and headsets thread through the fabric of everyday life. Sources: ARK Investment Management LLC, 2024. In the above table, we characterize the convergent technological capabilities that we believe may manifest by 2030 and 2050. We stress that these scenarios, written in the present tense, are possible outcomes—not assured outcomes—and that the future may play out differently. This ARK analysis is based on a range of external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

18 Expectations For Robotics Although the scenarios described in the table below are written in present tense, they are forecasted, possible outcomes based on ARK's views. These possible outcomes may not be realized in the future due to a number of uncertainties. The information provided should not be considered investment advice and should not form the basis of any investment decision. Technology 2040 Possibilities ARK’s 2030 Expectation of Progress Reusable rockets are inexpensive and have spawned new business models. Led by SpaceX’s Starship launch volumes, a 40,000 strong satellite network is Low-earth orbit constellations connect every smartphone user on earth to a in orbit, facilitating direct-to-satellite communications for nearly all censor-resistant data feed. Hypersonic point-to-point travel is becoming a smartphones and delivering broadband-type speeds to ships, RVs, airplanes, Reusable Rockets reality, disrupting long-haul flight, transforming military asset delivery, and and rural residents in developed and developing countries. Given the relative shrinking global supply chains. Extra-planetary human exploration has ease with which customers can be on-boarded—a power outlet, an antenna, begun ramping. and a clear path to the sky—most customers are engaged in an addressable market totaling $130 billion annually. Adaptive robots powered by artificial intelligence are transforming the Adaptive robots have penetrated manufacturing processes enough to increase economy. The cost of humanoid robots that are backward-compatible with productivity by 15%, and annual unit sales of humanoid robots have grown to existing infrastructure has dropped below that of human manufacturing 10% of the number of humans in the manufacturing workforce. Less expensive CE labor for many applications. Previously intractable household tasks are robots in human form-factors have begun to populate households, particularly N submitting to automation at price points that create compelling end- in developed countries. While still limited in capability, these robots address a E markets. Fleets of robots grow more performant with every AI software third of household chores, their sticker prices justified by the time that G Adaptive Robotics R upgrade. A virtuous circle of fleet data generation and AI model training household members save. Robot manufacturers enjoy margins at the higher E drives performance forward. Manufacturing productivity growth accelerates end of capital equipment suppliers, thanks to software. V N as a wider array of physical goods submit to technologically-driven cost CO declines. Robots continue to penetrate the service sector as well. The economy has entered a period of undeniable and unprecedented explosive growth. 3D printing has removed design barriers and reduced cost, weight, and time 3D printing continues to dominate the prototyping market and has penetrated to production, dramatically transforming traditional manufacturing substantial parts of the intermediate tooling market, enabling low-cost design methods.Healthcare tools created with 3D printing are personalized and iterations across injection molding and metal casting applications. Most custom-made, resulting in better experiences for both patients and doctors. important to industry growth, 3D printing has begun to see meaningful uptake 3D Printing Lighter 3D-printed aerospace parts reduce global emissions and give flight into end-use applications across aerospace and automotive, markets that to new aircraft both for earth and outer space. Replacement parts across collectively sell more than $4 trillion in equipment per year. Across all industries are printed on demand at a fraction of previous costs, ultimately industries, nearly $900 billion in end-use parts could adopt 3D printing, though short-circuiting supply-chain shortfalls. 3D printing enables artificial that penetration remains in the teens. intelligence to design parts once impossible to manufacture. Sources: ARK Investment Management LLC, 2024. In the above table, we characterize the convergent technological capabilities that we believe may manifest by 2030 and 2050. We stress that these scenarios, written in the present tense, are possible outcomes—not assured outcomes—and that the future may play out differently. This ARK analysis is based on a range of external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

1919 Research By: Frank Downing Jozef Soja Director of Research, Research Associate Next Generation Internet Artificial 4 2 0 2 S A E D I G Intelligence BI Scaling Global Intelligence And Redefining Work Sources: ARK Investment Management LLC, 2024. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

20 With superhuman performance on a wide range of tests, AI models like GPT-4 should catalyze an unprecedented boom in productivity. Jolted by ChatGPT’s “iPhone” like moment, enterprises are scrambling to harness the potential of artificial intelligence (AI). E C N AI promises more than efficiency gains, thanks to rapidly falling costs and open- E G I L source models. If knowledge worker productivity were to quadruple by 2030, as we L E T N I believe is likely, growth in real GDP could accelerate and break records during the AL I C next five to ten years. I F I T AR Sources: ARK Investment Management LLC, 2024. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

21 ChatGPTDelighted Consumers And Amazed Enterprises Building on years of progress since Google invented transformer architecture in 2017, ChatGPT catalyzed the public’s understanding of generative AI. No longer a tool just for developers, ChatGPT’s simple chat interface enabled anyone speaking any language to harness the power of large language models (LLMs). In 2023, enterprises scrambled to understand and deploy generative AI. ChatGPTUsers Hit 100 Million Users In Two Months The Number of AI Mentions Tripled On Earnings Calls E C ChatGPT WeChat TikTok Alphabet Apple Amazon Meta Microsoft N E Instagram YouTube FaceBook G I L L 100 180 E Post-ChatGPT Average T N 90 160 I s AL r 80 ns140 I e C s 70 io I U F ) nt120 I e ns60 e T iv M 100 io AR l 50 f Act o il 80 y r hl(M40 e Pre-ChatGPT Average b 60 nt 30 m o u 40 M 20 N 10 20 0 0 0 1 2 3 4 5 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Years *values between 0 and 100 million users are estimates Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of data sources, which are available upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

22 AI Already Has Boosted Productivity Significantly Coding assistants like GitHub Copilot and Replit AI are early success stories that have boosted the productivity and job satisfaction of software developers. AI-powered assistants are increasing the performance of knowledge workers and, interestingly, benefiting underperforming workers relatively more than high performers. Productivity of Developers On Coding Productivity of Consultants Using Gen AI In 2023 Tasks Using Github Copilot in 2023 Task Speed Task Quality E C N 1.25x E G 1.17x I L L E T N 2.2x I 1.43x AL I C I F I T AR Without Copilot With Copilot Without Gen AI With Gen AI Without Gen AI With Gen AI Task Quality, Top 50th Percentile of Workers Task Quality, Bottom 50th Percentile of Workers Sources: ARK Investment Management LLC, 2024. The data used to analyze productivity were collected from several different studies with varying numbers of participants and definitions of task quality. The sources used are Dell’Acqua et al. 2023 and GitHub 2022. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

23 Foundation Models Are Improving Across Domains With larger training datasets and more parameters, GPT-4 outperforms GPT-3.5 significantly. Increasingly, foundation models are becoming “multimodal”—supporting text, images, audio, and video—and are not only more dynamic and user friendly, but also more performant. GPT-3.5, GPT-4, and Claude 2 Results on Professional and Academic Exams GPT-3.5 GPT-4 Claude 2 GPT-4 Vision E 100% C N E 90% G I L 80% L E 70% T N e I il 60% AL nt I ce 50% C I r F e 40% I P T AR 30% 20% 10% 0% 0 al g e h y T t y s y s y s e y 2 y 2 C e e 0 g W m t n r c g c g c r 1 r 1 2 c r A i i i v r s g n b n a a o i o B u i 0 r R n x o e t t o o t t c t C s a t C t ti t s l m l m s i 2 e B i e M LS m s i i s s u a a r i E s i t o o o o ta i u g r l V E c i i i y l R a r T n H a n h n t m H AM n e AM T W S a H r t B c e h u t s n E l e t S o y o n P d c a i e fi SA E a B SA S v c s c a h l al L L c i GR t U o Ar AP e P e u C r h h r m GR n rm G AP o o Q AP o C s s o e e o AP r r W li li f S m f AP S ac AP ic E AP AP g g e * n i U M M n n d O o Un GR AP E E Co B ir AP AP AP A nv AP AP US E AP *USA Biology Olympiad, a prestigious national competition testing high school students in biology. Sources: ARK Investment Management LLC, 2024, based on data from OpenAI and Anthropic as of Jan. 9, 2024. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

24 Text-To-Image Models Are Reinventing Graphic Design Eight years after researchers at the University of Toronto introduced the first modern text-to-image model, the output from image models now rivals that of professional graphic designers. A human designer can create an image—like a herd of elephants walking across a green grass field—in several hours for several hundred dollars. Text-to-image models can produce the same graphic in seconds for pennies. Professional apps like Adobe Photoshop and consumer apps like Lensa and ChatGPT are integrating image models into their products and services. E C N E A herd of elephants walking across a green grass field G I L L E T N I AL I C I F I T AR February 2016 February 2022 November 2022 December 2023 alignDRAW Midjourney v1 Midjourney v4 Midjourney v6 Sources: ARK Investment Management LLC, 2024. Images sourced from Masimov et al. 2016 and Midjourney. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

25 The Cost Of Authoring The Written Word Has Collapsed Over the past century, the cost of authoring written content has been relatively constant in real terms. During the past two years, as the writing quality of LLMs has improved, the cost has collapsed. TheCost of Authoring Written Content $1,000 E C N E $100 G GPT4 32k I L L $0.16 E T Median GRE N I $10 Analytic Writing AL I C I F I T $1 Claude 2 AR $0.04 Top Decile GRE $0.10 $0 Analytic Writing Cost Per 1000 Words Written, 2023 Dollars, Log Scale$0 2 5 8 11 0 3 6 9 2 5 8 1 4 7 0 3 6 9 2 5 8 1 4 7 0 3 6 9 2 5 8 1 4 7 0 3 6 9 0 0 0 19 14 17 2 2 2 2 3 3 3 4 4 4 5 5 5 5 6 6 6 7 7 7 8 8 8 8 9 9 9 0 0 0 1 1 1 1 22 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 20 20 20 20 20 20 20 20 Post 1997 assumes constant words per employed writer over time Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of data sources as of Jan 9, 2024, which are available upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

26 AI Training Performance Is Improving Rapidly AI researchers are innovating across training and inference, hardware, and model designs to increase performance and lower costs. Model Training Performance Gains Other Algorithmic Innovations Moore’s Law Accelerator Optimizations Algorithmic Optimizations Increase Decrease Total • Llama2 suggests superior writing ability >5x of LLMs is fundamentally driven by E reinforcement learning from human C N E feedback (RLHF) G I L L E T N I • Optimized prompts can outperform AL I human prompts by over 50% C I F I T AR • Speculative Decoding speeds up Base = 1x inference 2-3x on certain models • Flash Attention 2 results in a 2.8x 2023 Performance NVIDIA’s Outperformance Other Software training speedup in GPT models of Moore’s Law Innovations Moore’s Law Chinchilla 2024 Performance Predicted Improvement Optimal Scaling Forecast Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of data sources, including Benaich 2023, Touvron et al. 2023, Yang et al. 2023, Leviathan et al. 2022, and Dao 2023, which are available upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

27 Training Costs Should Continue To Fall 75% Per Year According to Wright’s Law, improvements in accelerated compute hardware should reduce AI-relative compute unit (RCU) production costs by 53% per year, while algorithmic model enhancements could lower training costs further by 47% per year. In other words, the convergence of hardware and software could drive AI training costs down by 75% at an annual rate through 2030. AI Training Hardware Cost AI Software Training Cost Using Neural Networks E Actual $ / RCU Predicted $ / RCU Actual Compute Estimated Compute C $100,000.00 1.000 N E G I L $10,000.00 L 0.100 E T N $1,000.00 I ) * ) AL e e 0.010 I $100.00 C ays cal I cal D S F S - I g g T $ / RCUo $10.00 o AR (L TFS (L 0.001 $1.00 0.000 $0.10 $0.01 0.000 0 1 100 10,000 1,000,000 100,000,000 0 1 100 10,000 1,000,000 Cumulative RCUs Produced Cumulative RCUs Produced (Millions) (Log Scale) (Millions) (Log Scale) *TFS-Days is a measure of compute required to train a model. Wright’s Law states that for every cumulative doubling of units produced, cost will fall by a constant percentage. Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of data sources as of Jan. 9, 2024, which are available upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

28 As Production Use Cases Emerge, AI Focus Is Shifting To Inference Costs After focusing initially on LLM training cost optimization, researchers now are prioritizing inference costs. Based on enterprise scale use cases, inference costs seem to be falling at an annual rate of ~86%, even faster than training costs. Today, the inference costs associated with GPT-4 Turbo are lower than those for GPT-3 a year ago. GPT-3 and GPT-4 API Inference Costs Per 1,000 Tokens E GPT-4-32k: C $0.08 N GPT-4-32k Context E G Window: I L $0.07 32k Tokens L E GPT-3 Speed: T N $0.06 12 Tokens/Sec I AL I $0.05 C I F 86% Annualized Cost Decline 92% Annualized Cost Decline I T $0.04 AR $0.03 GPT-3 GPT-4 Turbo: $0.02 GPT-4 Turbo Context Window: 128k Tokens, ↑4x $0.01 Speed: GPT-3.5 Turbo 44 Tokens/Sec, ↑4x $- 11/18/2021 9/1/2022 11/6/2023 3/14/2023 11/6/2023 Date of Price Change Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of data sources, including Patel and Kostovic 2023, and ARK Investment Management LLC 2023, which are available upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

29 The Open-Source Community Is Competing With Private Models Challenging closed-source models from OpenAI and Google, the open-source community and its corporate champion, Meta, are democratizing access to generative AI. On balance, the performance of open-source models is improving faster than that of closed-source models, helped recently by models from China. Open Source vs Private Models 5-Shot MMLU Performance E Private Open Source C Private (Doesn't Outperform Previous Models on 5-Shot MMLU) Open Source (Doesn't Outperform Previous Models on 5-Shot MMLU) N E 1.0 G GPT-4 (OpenAI) I L Flan-PaLM 2 (Alphabet) Gemini Ultra (Alphabet) L ance 0.9 E Claude 2 (Anthropic) T m N r 0.8 PaLM-2 (Alphabet) I o f Qwen-72B (Alibaba, China) r Claude 1.3 (Anthropic) AL e I P 0.7 Flan-PaLM (Alphabet) C I U PaLM 540B (Alphabet) Yi-34B (01.AI, China) F L I M 0.6 Grok-1 (X.ai) T M Chinchilla 70B (Alphabet) GPT-3.5 (OpenAI) AR r 0.5 o Mixtral 8x7B (Mistral) r r GPT-3 (OpenAI, Fine-Tuned) E 0.4 Falcon 180 (TII, UAE) g LlaMA 2 70B (Meta) o GPT-2 1.5B (OpenAI, Fine-Tuned) L LlaMA 65B (Meta) e 0.3 t Flan-T5-XXL (Alphabet) u l Average Human Performance o 0.2 s Ab 0.1 - 10/27/2018 5/15/2019 12/1/2019 6/18/2020 1/4/2021 7/23/2021 2/8/2022 8/27/2022 3/15/2023 10/1/2023 4/18/2024 Note: The chart’s trendlines are fit to the most performant open- or closed-source models on 5-Shot MMLU (Massive Multitask Language Understanding) at the time of their release. Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of data sources as of Jan. 9, 2024, which are available upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

30 Language Model Performance Advances Require Nuanced Techniques GPT-4 performs significantly better than the average human on standardized education tests, from the SAT to the Advanced Sommelier exam. Yet, it lags human-level capability in commonsense reasoning, as measured by WinnoGrande. Stanford’s framework—Holistic Evaluation of Language Models (HELM)—is one of the most comprehensive, continuously updated evaluation methodologies, having tested over 80 models against a combination of 73 scenarios and 65 metrics. E Select GPT-4 Benchmark Results HELM Evaluation Metrics C N E Human Avg. GPT-4 G I Accuracy Comparison with ground truth data L L 100 E T N 90 I Calibration Probability distribution assessment AL 80 I C 70 I Robustness Stress testing with perturbed inputs F I e T r 60 AR co 50 Fairness Performance across diverse groups S 40 30 Bias Analysis of decision patterns for skew 20 10 Toxicity Detection rate of harmful content 0 USABO* Uniform Bar SAT Advanced WinoGrande Efficiency Resource usage during task execution Semifinal 2020 Exam Sommelier (commonsense) *USA Biology Olympiad, a prestigious national competition testing high school students in biology. Sources: ARK Investment Management LLC, 2024, based on data from Life Architect 2023 and Bomasani et al. 2023 as of Jan. 9, 2024. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

31 Will LLMs Run Out Of Data, Limiting Their Performance? Computing power and high-quality training data appear to be the primary contributors to model performance. As models grow and require more training data, will a lack of fresh data cause model performance to plateau? Epoch AI estimates that high- quality language/data sources like books and scientific papers could be exhausted by 2024, though a larger set of untapped vision data still exists. s Untapped Data Sources E Leading LLM Training Set vs. n C e N k o • 30 quadrillion words spoken E Language Token Stock T G I 30 n annually L o L i l E l i T 25 r N d • Speech-to-text tools that I a ) u AL ns 20 Q capture the estimated 80+ I C io 0 I l trillion words spoken daily. F il ~4 I r T (T 15 AR • Synthetic data that augments ns e 10 k primary data. o T 5 • Autonomous taxis, trucks, 0 drones, and other robots that GPT-3 Llama 2 GPT-4 Tokens Posted On X Spoken Language generate large volumes of GPT-3 Llama 2 GPT-4 Tokens Posted On X Spoken Language Tokens Training Tokens Training Tokens Training Tokens Annual Estimate Tokens physical world data. Training Tokens Training Tokens Training Tokens Annual Estimate Annual Estimate Annual Estimate Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of data sources as of Jan 9, 2024, which are available upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

32 Customized AI Offerings Should Enjoy More Pricing Power As open-source alternatives emerge and costs decline, software vendors tailoring AI to end-use applications should be able to monetize them more readily. Conversely, simple generative AI applications are likely to commoditize rapidly. Take-Rate Of Notable Enterprise Software Solutions 25% E d 20% C e N r E u G t I ap 15% L C L E e T u N 10% I Val AL f I o C I % 5% F I T AR 0% Business Email Email Marketing IT Service Management CRM IT Incident Smart Transportation Cloud-Based Security Response Analytics Platforms Low Value Capture High Value Capture • Horizontal, Commoditized Tools • Verticalized, Highly Differentiated Tools • < 5% Value Captured • 20%+ Value Captured • Example: AI Meeting Summaries • Example: Autonomous Ride-hail Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of data sources, including Sirohi 2023 and McKinsey & Co. 2023 as of Jan. 9, 2024, which are available upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

33 Accelerating The Growth Of Knowledge Worker Productivity Represents A Potential Multi-Trillion Dollar Opportunity Artificial intelligence has the potential to automate most tasks in knowledge-based professions by 2030, dramatically increasing the average worker's productivity. Software solutions that automate and accelerate knowledge work tasks should be prime beneficiaries. E AI Total Addressable Market (TAM) Forecast In 2030 Impact of AI on Software Growth C N Software Vendor Value Capture % Of Productivity Gain 2.5x Uplift 4.5x Uplift 6.5x Uplift E G I 54% L $20 L CAGR E T 1% 10% 20% $18 N I AL $16 I ) 46% C I e $14 CAGR F l I ip 2.5 $0.7T $7T $14T T t $12 l ns AR u io M l ( $10 il t r 34% if T l $8 CAGR p 4.5 $1.3T $13T $26T $ U $6 y it iv $4 t c 16% Annual Growth Rate u d $2 o 6.5 $1.9T $19T $37T Pr $- 2016 2023 2030 Forecast CAGR = Compound Annual Growth Rate. Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of data sources, including McKinsey & Co. 2023, which are available upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

3434 Research By: Yassine Elmandjra David Puell Director of Digital Assets Research Associate Bitcoin 4 2 0 2 S A E D I G Allocation BI Growing The Role Of Bitcoin In Investment Portfolios Sources: ARK Investment Management LLC, 2024. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

35 Important Information Bitcoin is a relatively new asset class, and the market for bitcoin is subject to rapid changes and uncertainty. Bitcoin is largely unregulated and bitcoin investments may be more susceptible to fraud and manipulation than more regulated investments. Bitcoin is subject to unique and substantial risks, including significant price volatility and lack of liquidity, and theft. Bitcoin is subject to rapid price swings, including as a result of actions and statements by influencers and the media, changes in the supply of and demand for bitcoin, and other factors. There is no assurance that bitcoin will maintain its value over the long term. The information provided on the following slides is based on ARK’s research and is not intended to be investment advice. ARK researches the utility of bitcoin as an investment in order to determine its potential future value as presented on the following slides. This material does not constitute, either explicitly or implicitly, any provision of services or products by ARK, and investors should determine for themselves whether a particular investment management service is suitable for their investment needs. ARK strongly encourages any investor considering an investment in bitcoin or any other digital asset to consult with a financial professional before investing. All statements made regarding bitcoin are strictly beliefs and points of view held by ARK and are not recommendations by ARK to buy, sell or hold bitcoin. Historical results are not indications of future results. Important Terms and Concepts ON The research presented on the following slides contains some terms and concepts that may not be familiar to some readers, so below we provide explanations to help provide a basis for evaluating I T the research. A OC • Sharpe Ratio is a well-known and well-reputed measure of risk-adjusted return on an investment or portfolio, which indicates how well an investment performs in comparison to the rate of return L L on a risk-free investment such as U.S. government treasury bonds or bills. Sharpe ratio is calculated by first calculating the expected return on an investment portfolio or individual investment A and then subtracting the risk-free rate of return. Normally, a higher Sharpe Ratio indicates good investment performance, given the risk, while a Sharpe Ratio less than 1 is considered less than N good. Sharpe ratio is used in our research to determine, hypothetically, at what allocation percentage bitcoin would maximize the risk-adjusted return of an overall portfolio consisting of other OI commonly used asset classes. C T BI • Efficient Frontier is the set of optimal portfolios that offer the highest expected return for a defined level of risk or the lowest risk for a given level of expected return. In other words, it graphically represents portfolios that maximize returns for the risk assumed. Portfolios that lie below the efficient frontier are considered sub-optimal because they do not provide enough return for the level of risk, and portfolios that cluster to the right of the efficient frontier are also considered sub-optimal because they have a higher level of risk for the defined rate of return. The Efficient Frontier chart is used in this section to illustrate that the simulated portfolio we constructed with an allocation to bitcoin lies along the efficient frontier as compared to the portfolios consisting of single asset classes which would be considered sub-optimal. • Compound Annual Growth Rate (“CAGR”) is the average annual amount an investment grows over a period of years assuming profits are reinvested during the period. In other words, it breaks an investment's total return over a number of years into a single average rate. CAGR is typically used to compare assets or portfolios over a longer time period by using an average as opposed to analyzing each year individually as returns from year to year may be uneven. We use CAGR in our research to determine the expected return of a portfolio or asset class over a period of years, typically 5 years. • Standard Deviation is a measure of risk, or volatility, in a portfolio by indicating how much the investment will deviate from its expected return. An investment with higher volatility means a higher standard deviation, and therefore more risk. We use standard deviation to determine the amount of return that would be commensurate with certain levels of risk. Sources: ARK Investment Management LLC, 2024 Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

36 Digital Assets Like Bitcoin Are A New Asset Class According to ARK’s research, bitcoin has emerged as an independent asset class worthy of a strategic allocation in institutional portfolios. Bitcoin Commodities Real Estate Bonds Equities (Including Gold) (Including Emerging Markets) Created during the Global Financial Earliest known private Earliest known bond was issued Origins trace back thousands of th Origins trace back to the 1600s Crisis in 2009 by an individual or property rights took by the city of Venice in the 12 History group under the pseudonym Satoshi years to commodities like gold shape in ancient century, but the concept of with the establishment of the Nakamoto being used as a store of value Greece and Rome debt/lending can be traced back Amsterdam Stock Exchange to ancient Mesopotamia ON Highly liquid and accessible to Fairly liquid and accessible through Illiquid, purchased Highly liquid. Traded on bond Highly liquid. Traded on stock I anyone with access to the internet. T Investability physical coins and ETFs through directly or through markets, accessible through exchanges, accessible through A Traded on crypto exchanges and banks and brokers. REITs brokers brokers OC through spot ETFs L L Tied to demand for a decentralized, Tied to supply and demand, Tied to interest rates, A Basis Of Value independent monetary system influenced by global economic property markets, and Tied to interest rate policies and Tied to expectations of future N credit risk cash flow OI powered by open-source software conditions local economic factors C T BI Correlation Low correlation with traditional Typically inversely correlated with Typically low to Inversely correlated recently, but Correlated with the health of Of Returns asset classes asset classes, especially during moderate correlation not always throughout economic global economy and market economic uncertainty with stocks and bonds history, with equities sentiment Decentralized and community- Governed by local and Governed by issuance terms set Governed by company Governance driven, leveraging open-source Governed by mining regulation national property laws by government or corporations management and regulated by software for decision making government agencies Scarce digital store of value, its Industrial activity, wealth Personal residence, Fixed income investment, with Company ownership, often with Use Cases currency native to the internet preservation, and hedging rental income regular interest payments and voting rights and dividends return of principal at maturity Sources: ARK Investment Management LLC, 2024 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

37 Bitcoin Has Outperformed Every Major Asset Over Longer Time Horizons During the last seven years, bitcoin’s annualized return has averaged ~44%, while that of other major assets has averaged 5.7%. Annualized Returns Across Major Asset Classes* Bitcoin Gold Commodities Real Estate Bonds Equities Emerging Markets 80% 70% ON 60% I T A OC 50% Average Bitcoin CAGR: ~44% L L ) A (%40% N OI C AGR30% T C Average Asset Class CAGR: 5.7% BI 20% 10% 0% -10% Last 7 Years Last 6 Years** Last 5 Years Last 4 Years Last 3 Years** *Asset classes are represented by the following instruments: SPDR S&P 500 ETF Trust (SPY, equities), Vanguard Total Bond Market Index Fund Investor Shares (VBMFX, bonds), Vanguard Real Estate Market Index Fund Investor Shares (VGSIX, real estate), SPDR Gold Trust (GLD, gold), iShares S&P GSCI Commodity-Indexed Trust ETF (GSG, commodities), and Vanguard Emerging Markets Stock Index Fund Investor Shares (VEIEX, emerging markets). The performance used to represent each asset class reflects the net asset value (NAV) performance of each ETF/fund for the time periods shown. **“Last 6 Years” includes 2018, 2021, and 2022; “Last 3 Years” includes 2021 and 2022, all years of market downturn or relatively low returns for bitcoin. Sources: ARK Investment Management LLC, 2024, based on data and calculation from PortfolioVisualizer.com, with bitcoin price data from Glassnode, as of December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

38 Generally, Bitcoin Investors With A Long-Term Time Horizon Have Benefited Over Time Bitcoin Realized Returns “Time, Not Timing”* Days Held 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 Bitcoin’s volatility can obfuscate its long-term 2011 returns. While significant appreciation or 2012 depreciation can occur over the short term, a long- 2013 ON I 2014 T A term investment horizon has been key to investing OC t 2015 L in bitcoin. n L e A m 2016 N t s OI e C v 2017 T n Instead of “when,” the better question is “for how I BI f o 2018 e long?” t Da2019 Historically, investors who bought and held bitcoin 2020 for at least 5 years have profited, no matter when 2021 they made their purchases. 2022 2023 *Adage first put forth in this configuration by Mizuho Financial Group. Sources: ARK Investment Management LLC, 2024, based on data from Glassnode as of December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

39 Bitcoin's Correlation To Traditional Assets Is Low Historically, bitcoin’s price movements have not correlated highly to those of other asset classes. During the past five years, the correlation of bitcoin’s returns relative to traditional asset classes has averaged only 0.27. 1,2 Asset Class Correlation Matrix (12-Month As Of December 2023) High correlation: coefficient value lies between ± 0.66 and ±1 Moderate correlation: coefficient value lies between ± 0..4 and ± 0.66 Low correlation: coefficient value lies below ± 0.4 ON I T Bitcoin Gold Commodities Real Estate Bonds Equities Emerging Markets A OC Bitcoin 0.2 0.1 0.4 0.26 0.41 0.23 L L A Gold 0.2 -0.03 0.28 0.46 0.26 0.34 N OI C Commodities 0.1 -0.03 0.42 -0.12 0.43 0.5 T BI Real Estate 0.4 0.28 0.42 0.57 0.86 0.68 Bonds 0.26 0.46 -0.12 0.57 0.48 0.46 Equities 0.41 0.26 0.43 0.86 0.48 0.73 Emerging Markets 0.23 0.34 0.5 0.68 0.46 0.73 AVERAGE 0.27 0.25 0.21 0.53 0.35 0.53 0.49 [1] A correlation of 1 connotes that assets perfectly move in tandem; 0 means their movement is completely independent from each other; -1 suggests that they move in perfectly opposite directions. [2] Asset classes are represented by the following instruments: SPDR S&P 500 ETF Trust (SPY, equities), Vanguard Total Bond Market Index Fund Investor Shares (VBMFX, bonds), Vanguard Real Estate Market Index Fund Investor Shares (VGSIX, real estate), SPDR Gold Trust (GLD, gold), iShares S&P GSCI Commodity-Indexed Trust ETF (GSG, commodities), and Vanguard Emerging Markets Stock Index Fund Investor Shares (VEIEX, emerging markets). The performance used to represent each asset class reflects the net asset value (NAV) performance of each ETF/fund for the time periods shown. Sources: ARK Investment Management LLC, 2024, based on data and calculation from PortfolioVisualizer.com, with bitcoin price data from Glassnode, as of December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

40 Bitcoin Could Play An Important Role In Maximizing Risk-Adjusted Returns Focused on the volatility and return profiles of traditional asset classes, ARK’s research suggests that a portfolio seeking to 1 maximize risk-adjusted returns would have allocated 19.4% to bitcoin in 2023. 2,3 Simulated Optimal Portfolio Allocation Targets By Year 2023 Simulated Portfolio Optimization3,4,5 6 (Rolling 5-Year As Of End Of Every Year ) Based On Monthly Asset Class Returns (No Limit, Rolling 5-Year6) Bitcoin Gold Commodities Bonds Equities Commodities High 9.6% Bitcoin Bitcoin ON 2015 0.5% 0% 0% 82.5% 16.9% 19.4% I T A 2016 0.9% 0% 0% 62.1% 36.9% 2023 OC n Tangency L r Portfolio L 2017 0.9% 0% 0% 58.7% 40.3% u Equities A t Gold e 30.2% N R 40.7% 2018 2.4% 0% 0% 77.3% 20.2% OI d C e T ct BI 2019 3.9% 1.4% 0% 70.4% 24.2% e p x E 2020 4.3% 4.1% 0% 75.6% 15.8% Equities 2021 4.7% 7.3% 0% 65.3% 22.6% Gold Commodities Real Estate 2022 6.2% 52.8% 9.1% 0% 31.8% Bonds Emerging Markets 2023 19.4% 40.7% 9.6% 0% 30.3% Low High Standard Deviation [1] Measurement of returns of an asset against its risk (in this case, volatility). [2] Real Estate and Emerging Markets are calculated out of these tangency portfolios given their low participation in maximizing risk-adjusted returns relative to the other asset classes included in this table. [3] Asset classes are represented by the following instruments: SPDR S&P 500 ETF Trust (SPY, equities), Vanguard Total Bond Market Index Fund Investor Shares (VBMFX, bonds), Vanguard Real Estate Market Index Fund Investor Shares (VGSIX, real estate), SPDR Gold Trust (GLD, gold), iShares S&P GSCI Commodity-Indexed Trust ETF (GSG, commodities), and Vanguard Emerging Markets Stock Index Fund Investor Shares (VEIEX, emerging markets). The performance used to represent each asset class reflects the net asset value (NAV) performance of each ETF/fund for the time periods shown. [4] This simulation, also known as “efficient frontier”, is a set of theoretical investment portfolios expected to provide the highest returns at multiple levels of risk. [5] The dots under the efficient frontier in the chart represent portfolios comprised of a single asset class. [6] 5 years were used since, in our view, they represent a sample of a long-term time horizon. Sources: ARK Investment Management LLC, 2024, based on data and calculation from PortfolioVisualizer.com, with bitcoin price data from Glassnode, as of December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

41 On A 5-Year Rolling Basis, An Allocation To Bitcoin Would Have Maximized Risk-Adjusted ReturnsDuring The Past 9 Years 1 3 According to our analysis, in 2015, the optimal allocation to maximize risk-adjusted returns—on a 5-year time horizon —would have been 0.5%. Since then, on the same basis, the average allocation to bitcoin would have been 4.8%, and in 2023 alone, 19.4%. 2 Allocation Into Bitcoin By Year To Maximize Risk-adjusted Returns 3,4 (Maximization By Sharpe Ratio, Rolling 5-Year Time Horizon ) ON 25% I T A OC 20% 19.4% L L A N OI 15% C T BI 10% 6.2% 5% Optimal Allocation: 4.8% On Average 3.9% 4.3% 4.7% 2.4% 0.5% 0.9% 0.9% 0% 2015 2016 2017 2018 2019 2020 2021 2022 2023 [1] Risk-adjusted returns given by the Sharpe ratio, which divides expected returns minus the risk-free rate by the standard deviation of the asset. [2] For asset class representation in this calculation, please refer to the previous slide. [3] 5 years were used since, in our view, they represent a sample of a long-term time horizon.. Sources: ARK Investment Management LLC, 2024, based on data and calculation from PortfolioVisualizer.com, with bitcoin price data from Glassnode, as of December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.