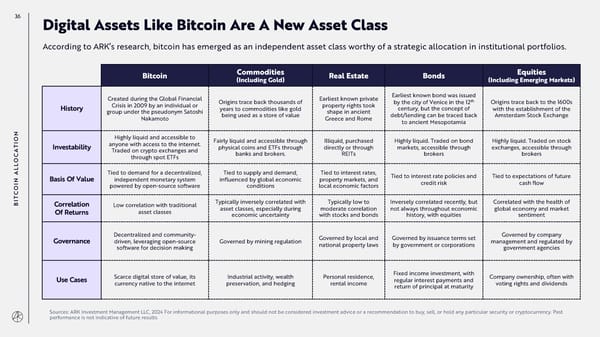

36 Digital Assets Like Bitcoin Are A New Asset Class According to ARK’s research, bitcoin has emerged as an independent asset class worthy of a strategic allocation in institutional portfolios. Bitcoin Commodities Real Estate Bonds Equities (Including Gold) (Including Emerging Markets) Created during the Global Financial Earliest known private Earliest known bond was issued Origins trace back thousands of th Origins trace back to the 1600s Crisis in 2009 by an individual or property rights took by the city of Venice in the 12 History group under the pseudonym Satoshi years to commodities like gold shape in ancient century, but the concept of with the establishment of the Nakamoto being used as a store of value Greece and Rome debt/lending can be traced back Amsterdam Stock Exchange to ancient Mesopotamia ON Highly liquid and accessible to Fairly liquid and accessible through Illiquid, purchased Highly liquid. Traded on bond Highly liquid. Traded on stock I anyone with access to the internet. T Investability physical coins and ETFs through directly or through markets, accessible through exchanges, accessible through A Traded on crypto exchanges and banks and brokers. REITs brokers brokers OC through spot ETFs L L Tied to demand for a decentralized, Tied to supply and demand, Tied to interest rates, A Basis Of Value independent monetary system influenced by global economic property markets, and Tied to interest rate policies and Tied to expectations of future N credit risk cash flow OI powered by open-source software conditions local economic factors C T BI Correlation Low correlation with traditional Typically inversely correlated with Typically low to Inversely correlated recently, but Correlated with the health of Of Returns asset classes asset classes, especially during moderate correlation not always throughout economic global economy and market economic uncertainty with stocks and bonds history, with equities sentiment Decentralized and community- Governed by local and Governed by issuance terms set Governed by company Governance driven, leveraging open-source Governed by mining regulation national property laws by government or corporations management and regulated by software for decision making government agencies Scarce digital store of value, its Industrial activity, wealth Personal residence, Fixed income investment, with Company ownership, often with Use Cases currency native to the internet preservation, and hedging rental income regular interest payments and voting rights and dividends return of principal at maturity Sources: ARK Investment Management LLC, 2024 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

Annual Research Report | Big Ideas 2024 Page 35 Page 37

Annual Research Report | Big Ideas 2024 Page 35 Page 37