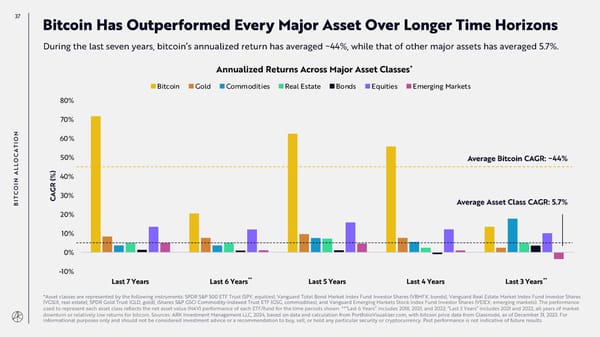

37 Bitcoin Has Outperformed Every Major Asset Over Longer Time Horizons During the last seven years, bitcoin’s annualized return has averaged ~44%, while that of other major assets has averaged 5.7%. Annualized Returns Across Major Asset Classes* Bitcoin Gold Commodities Real Estate Bonds Equities Emerging Markets 80% 70% ON 60% I T A OC 50% Average Bitcoin CAGR: ~44% L L ) A (%40% N OI C AGR30% T C Average Asset Class CAGR: 5.7% BI 20% 10% 0% -10% Last 7 Years Last 6 Years** Last 5 Years Last 4 Years Last 3 Years** *Asset classes are represented by the following instruments: SPDR S&P 500 ETF Trust (SPY, equities), Vanguard Total Bond Market Index Fund Investor Shares (VBMFX, bonds), Vanguard Real Estate Market Index Fund Investor Shares (VGSIX, real estate), SPDR Gold Trust (GLD, gold), iShares S&P GSCI Commodity-Indexed Trust ETF (GSG, commodities), and Vanguard Emerging Markets Stock Index Fund Investor Shares (VEIEX, emerging markets). The performance used to represent each asset class reflects the net asset value (NAV) performance of each ETF/fund for the time periods shown. **“Last 6 Years” includes 2018, 2021, and 2022; “Last 3 Years” includes 2021 and 2022, all years of market downturn or relatively low returns for bitcoin. Sources: ARK Investment Management LLC, 2024, based on data and calculation from PortfolioVisualizer.com, with bitcoin price data from Glassnode, as of December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

Annual Research Report | Big Ideas 2024 Page 36 Page 38

Annual Research Report | Big Ideas 2024 Page 36 Page 38