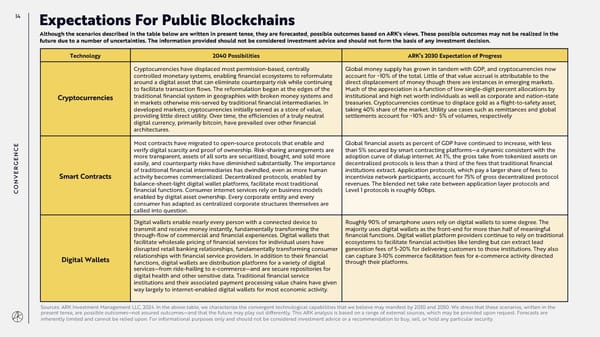

14 Expectations For Public Blockchains Although the scenarios described in the table below are written in present tense, they are forecasted, possible outcomes based on ARK's views. These possible outcomes may not be realized in the future due to a number of uncertainties. The information provided should not be considered investment advice and should not form the basis of any investment decision. Technology 2040 Possibilities ARK’s 2030 Expectation of Progress Cryptocurrencies have displaced most permission-based, centrally Global money supply has grown in tandem with GDP, and cryptocurrencies now controlled monetary systems, enabling financial ecosystems to reformulate account for ~10% of the total. Little of that value accrual is attributable to the around a digital asset that can eliminate counterparty risk while continuing direct displacement of money though there are instances in emerging markets. to facilitate transaction flows. The reformulation began at the edges of the Much of the appreciation is a function of low single-digit percent allocations by Cryptocurrencies traditional financial system in geographies with broken money systems and institutional and high net worth individuals as well as corporate and nation-state in markets otherwise mis-served by traditional financial intermediaries. In treasuries. Cryptocurrencies continue to displace gold as a flight-to-safety asset, developed markets, cryptocurrencies initially served as a store of value, taking 40% share of the market. Utility use cases such as remittances and global providing little direct utility. Over time, the efficiencies of a truly neutral settlements account for ~10% and~ 5% of volumes, respectively digital currency, primarily bitcoin, have prevailed over other financial architectures. CE Most contracts have migrated to open-source protocols that enable and Global financial assets as percent of GDP have continued to increase, with less N verify digital scarcity and proof of ownership. Risk-sharing arrangements are than 5% secured by smart contracting platforms—a dynamic consistent with the E more transparent, assets of all sorts are securitized, bought, and sold more adoption curve of dialup internet. At 1%, the gross take from tokenized assets on G easily, and counterparty risks have diminished substantially. The importance decentralized protocols is less than a third of the fees that traditional financial R of traditional financial intermediaries has dwindled, even as more human institutions extract. Application protocols, which pay a larger share of fees to E V Smart Contracts activity becomes commercialized. Decentralized protocols, enabled by incentivize network participants, account for 75% of gross decentralized protocol N balance-sheet-light digital wallet platforms, facilitate most traditional revenues. The blended net take rate between application layer protocols and CO financial functions. Consumer internet services rely on business models Level 1 protocols is roughly 60bps. enabled by digital asset ownership. Every corporate entity and every consumer has adapted as centralized corporate structures themselves are called into question. Digital wallets enable nearly every person with a connected device to Roughly 90% of smartphone users rely on digital wallets to some degree. The transmit and receive money instantly, fundamentally transforming the majority uses digital wallets as the front-end for more than half of meaningful through-flow of commercial and financial experiences. Digital wallets that financial functions. Digital wallet platform providers continue to rely on traditional facilitate wholesale pricing of financial services for individual users have ecosystems to facilitate financial activities like lending but can extract lead disrupted retail banking relationships, fundamentally transforming consumer generation fees of 5-20% for delivering customers to those institutions. They also Digital Wallets relationships with financial service providers. In addition to their financial can capture 3-10% commerce facilitation fees for e-commerce activity directed functions, digital wallets are distribution platforms for a variety of digital through their platforms. services—from ride-hailing to e-commerce—and are secure repositories for digital health and other sensitive data. Traditional financial service institutions and their associated payment processing value chains have given way largely to internet-enabled digital wallets for most economic activity. Sources: ARK Investment Management LLC, 2024. In the above table, we characterize the convergent technological capabilities that we believe may manifest by 2030 and 2050. We stress that these scenarios, written in the present tense, are possible outcomes—not assured outcomes—and that the future may play out differently. This ARK analysis is based on a range of external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Annual Research Report | Big Ideas 2024 Page 13 Page 15

Annual Research Report | Big Ideas 2024 Page 13 Page 15