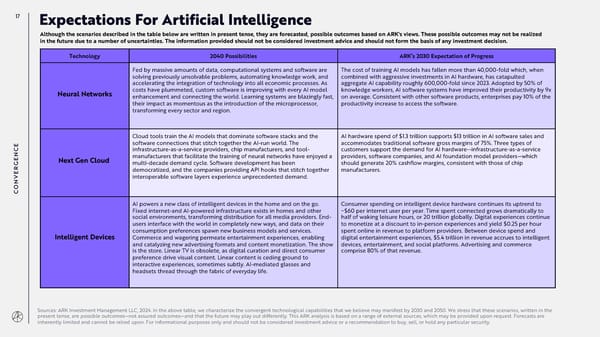

17 Expectations For Artificial Intelligence Although the scenarios described in the table below are written in present tense, they are forecasted, possible outcomes based on ARK's views. These possible outcomes may not be realized in the future due to a number of uncertainties. The information provided should not be considered investment advice and should not form the basis of any investment decision. Technology 2040 Possibilities ARK’s 2030 Expectation of Progress Fed by massive amounts of data, computational systems and software are The cost of training AI models has fallen more than 40,000-fold which, when solving previously unsolvable problems, automating knowledge work, and combined with aggressive investments in AI hardware, has catapulted accelerating the integration of technology into all economic processes. As aggregate AI capability roughly 600,000-fold since 2023. Adopted by 50% of Neural Networks costs have plummeted, custom software is improving with every AI model knowledge workers, AI software systems have improved their productivity by 9x enhancement and connecting the world. Learning systems are blazingly fast, on average. Consistent with other software products, enterprises pay 10% of the their impact as momentous as the introduction of the microprocessor, productivity increase to access the software. transforming every sector and region. Cloud tools train the AI models that dominate software stacks and the AI hardware spend of $1.3 trillion supports $13 trillion in AI software sales and software connections that stitch together the AI-run world. The accommodates traditional software gross margins of 75%. Three types of CE infrastructure-as-a-service providers, chip manufacturers, and tool- customers support the demand for AI hardware--infrastructure-as-a-service N manufacturers that facilitate the training of neural networks have enjoyed a providers, software companies, and AI foundation model providers—which E Next Gen Cloud multi-decade demand cycle. Software development has been should generate 20% cashflow margins, consistent with those of chip G R democratized, and the companies providing API hooks that stitch together manufacturers. E V interoperable software layers experience unprecedented demand. N CO AI powers a new class of intelligent devices in the home and on the go. Consumer spending on intelligent device hardware continues its uptrend to Fixed internet-and AI-powered infrastructure exists in homes and other ~$60 per internet user per year. Time spent connected grows dramatically to social environments, transforming distribution for all media providers. End- half of waking leisure hours, or 20 trillion globally. Digital experiences continue users interface with the world in completely new ways, and data on their to monetize at a discount to in-person experiences and yield $0.25 per hour Intelligent Devices consumption preferences spawn new business models and services. spent online in revenue to platform providers. Between device spend and Commerce and wagering permeate entertainment experiences, enabling digital entertainment experiences, $5.4 trillion in revenue accrues to intelligent and catalyzing new advertising formats and content monetization. The show devices, entertainment, and social platforms. Advertising and commerce is the store. Linear TV is obsolete, as digital curation and direct consumer comprise 80% of that revenue. preference drive visual content. Linear content is ceding ground to interactive experiences, sometimes subtly. AI-mediated glasses and headsets thread through the fabric of everyday life. Sources: ARK Investment Management LLC, 2024. In the above table, we characterize the convergent technological capabilities that we believe may manifest by 2030 and 2050. We stress that these scenarios, written in the present tense, are possible outcomes—not assured outcomes—and that the future may play out differently. This ARK analysis is based on a range of external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Annual Research Report | Big Ideas 2024 Page 16 Page 18

Annual Research Report | Big Ideas 2024 Page 16 Page 18