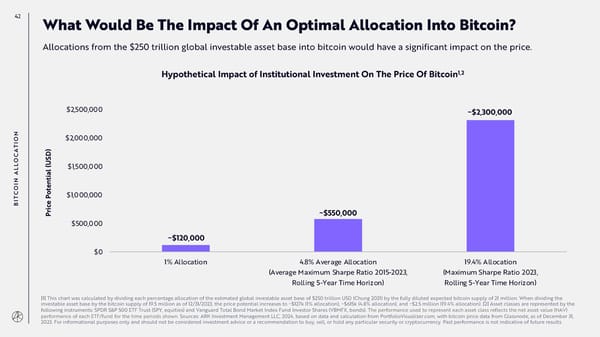

42 What Would Be The Impact Of An Optimal Allocation Into Bitcoin? Allocations from the $250 trillion global investable asset base into bitcoin would have a significant impact on the price. Hypothetical Impact of Institutional Investment On The Price Of Bitcoin1,2 $2,500,000 ~$2,300,000 ON $2,000,000 I T ) A D OC S L (U $1,500,000 L A ial N nt OI e t C o $1,000,000 T P BI ice r ~$550,000 P $500,000 ~$120,000 $0 1% Allocation 4.8% Average Allocation 19.4% Allocation (Average Maximum Sharpe Ratio 2015-2023, (Maximum Sharpe Ratio 2023, Rolling 5-Year Time Horizon) Rolling 5-Year Time Horizon) [1] This chart was calculated by dividing each percentage allocation of the estimated global investable asset base of $250 trillion USD (Chung 2021) by the fully diluted expected bitcoin supply of 21 million. When dividing the investable asset base by the bitcoin supply of 19.5 million as of 12/31/2023, the price potential increases to ~$127k (1% allocation), ~$615k (4.8% allocation), and ~$2.5 million (19.4% allocation). [2] Asset classes are represented by the following instruments: SPDR S&P 500 ETF Trust (SPY, equities) and Vanguard Total Bond Market Index Fund Investor Shares (VBMFX, bonds). The performance used to represent each asset class reflects the net asset value (NAV) performance of each ETF/fund for the time periods shown. Sources: ARK Investment Management LLC, 2024, based on data and calculation from PortfolioVisualizer.com, with bitcoin price data from Glassnode, as of December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

Annual Research Report | Big Ideas 2024 Page 41 Page 43

Annual Research Report | Big Ideas 2024 Page 41 Page 43