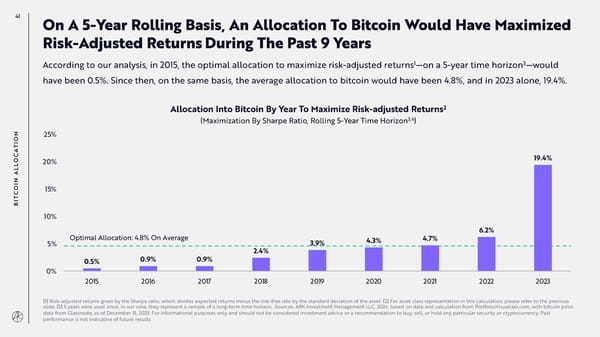

41 On A 5-Year Rolling Basis, An Allocation To Bitcoin Would Have Maximized Risk-Adjusted ReturnsDuring The Past 9 Years 1 3 According to our analysis, in 2015, the optimal allocation to maximize risk-adjusted returns—on a 5-year time horizon —would have been 0.5%. Since then, on the same basis, the average allocation to bitcoin would have been 4.8%, and in 2023 alone, 19.4%. 2 Allocation Into Bitcoin By Year To Maximize Risk-adjusted Returns 3,4 (Maximization By Sharpe Ratio, Rolling 5-Year Time Horizon ) ON 25% I T A OC 20% 19.4% L L A N OI 15% C T BI 10% 6.2% 5% Optimal Allocation: 4.8% On Average 3.9% 4.3% 4.7% 2.4% 0.5% 0.9% 0.9% 0% 2015 2016 2017 2018 2019 2020 2021 2022 2023 [1] Risk-adjusted returns given by the Sharpe ratio, which divides expected returns minus the risk-free rate by the standard deviation of the asset. [2] For asset class representation in this calculation, please refer to the previous slide. [3] 5 years were used since, in our view, they represent a sample of a long-term time horizon.. Sources: ARK Investment Management LLC, 2024, based on data and calculation from PortfolioVisualizer.com, with bitcoin price data from Glassnode, as of December 31, 2023. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Past performance is not indicative of future results.

Annual Research Report | Big Ideas 2024 Page 40 Page 42

Annual Research Report | Big Ideas 2024 Page 40 Page 42