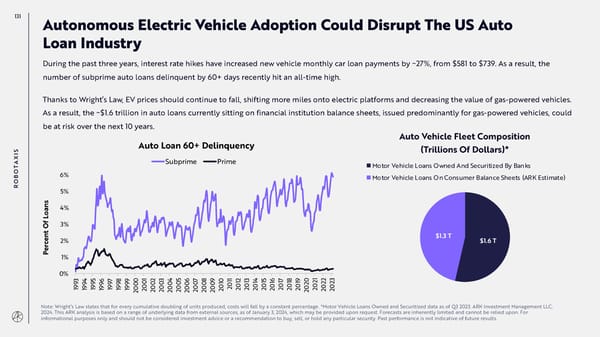

131 Autonomous Electric Vehicle Adoption Could Disrupt The US Auto Loan Industry During the past three years, interest rate hikes have increased new vehicle monthly car loan payments by ~27%, from $581 to $739. As a result, the number of subprime auto loans delinquent by 60+ days recently hit an all-time high. Thanks to Wright’s Law, EV prices should continue to fall, shifting more miles onto electric platforms and decreasing the value of gas-powered vehicles. As a result, the ~$1.6 trillion in auto loans currently sitting on financial institution balance sheets, issued predominantly for gas-powered vehicles, could be at risk over the next 10 years. Auto Loan 60+ Delinquency Auto Vehicle Fleet Composition IS (Trillions Of Dollars)* X Subprime Prime A Motor Vehicle Loans Owned And Securitized By Banks T O 6% B Motor Vehicle Loans On Consumer Balance Sheets (ARK Estimate) RO 5% ans4% o L f 3% O nt $1.3 T ce 2% $1.6 T r e P 1% 0% 3 4 5 6 7 8 9 1 2 3 4 5 6 7 8 9 1 2 3 4 5 6 7 8 9 0 0 1 1 1 1 1 1 1 1 1 21 9 9 9 9 9 9 9 0 0 0 0 0 0 0 0 0 0 1 20 20 2223 191919 19191919 20202020 2020202020 2020 20 20202020 20202020 202020 Note: Wright’s Law states that for every cumulative doubling of units produced, costs will fall by a constant percentage. *Motor Vehicle Loans Owned and Securitized data as of Q3 2023. ARK Investment Management LLC, 2024. This ARK analysis is based on a range of underlying data from external sources, as of January 3, 2024, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Annual Research Report | Big Ideas 2024 Page 130 Page 132

Annual Research Report | Big Ideas 2024 Page 130 Page 132