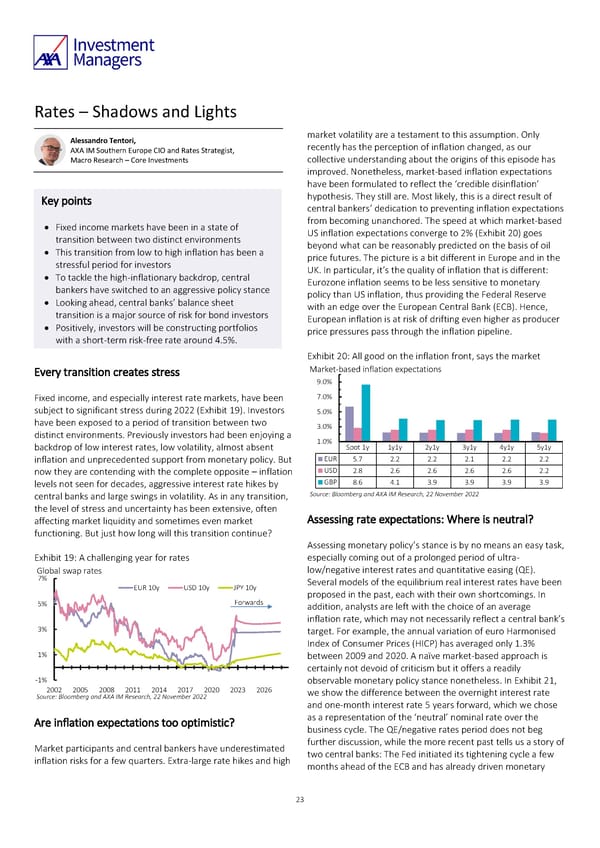

Rates – Shadows and Lights Alessandro Tentori, market volatility are a testament to this assumption. Only AXA IM Southern Europe CIO and Rates Strategist, recently has the perception of inflation changed, as our Macro Research – Core Investments collective understanding about the origins of this episode has improved. Nonetheless, market-based inflation expectations have been formulated to reflect the ‘credible disinflation’ Key points hypothesis. They still are. Most likely, this is a direct result of central bankers’ dedication to preventing inflation expectations • Fixed income markets have been in a state of from becoming unanchored. The speed at which market-based transition between two distinct environments US inflation expectations converge to 2% (Exhibit 20) goes • This transition from low to high inflation has been a beyond what can be reasonably predicted on the basis of oil stressful period for investors price futures. The picture is a bit different in Europe and in the • To tackle the high-inflationary backdrop, central UK. In particular, it’s the quality of inflation that is different: bankers have switched to an aggressive policy stance Eurozone inflation seems to be less sensitive to monetary • Looking ahead, central banks’ balance sheet policy than US inflation, thus providing the Federal Reserve transition is a major source of risk for bond investors with an edge over the European Central Bank (ECB). Hence, • Positively, investors will be constructing portfolios European inflation is at risk of drifting even higher as producer with a short-term risk-free rate around 4.5%. price pressures pass through the inflation pipeline. Exhibit 20: All good on the inflation front, says the market Every transition creates stress Market-based inflation expectations 9.0% Fixed income, and especially interest rate markets, have been 7.0% subject to significant stress during 2022 (Exhibit 19). Investors 5.0% have been exposed to a period of transition between two 3.0% distinct environments. Previously investors had been enjoying a 1.0% backdrop of low interest rates, low volatility, almost absent Spot 1y 1y1y 2y1y 3y1y 4y1y 5y1y inflation and unprecedented support from monetary policy. But EUR 5.7 2.2 2.2 2.1 2.2 2.2 now they are contending with the complete opposite – inflation USD 2.8 2.6 2.6 2.6 2.6 2.2 levels not seen for decades, aggressive interest rate hikes by GBP 8.6 4.1 3.9 3.9 3.9 3.9 central banks and large swings in volatility. As in any transition, Source: Bloomberg and AXA IM Research, 22 November 2022 the level of stress and uncertainty has been extensive, often affecting market liquidity and sometimes even market Assessing rate expectations: Where is neutral? functioning. But just how long will this transition continue? Assessing monetary policy’s stance is by no means an easy task, Exhibit 19: A challenging year for rates especially coming out of a prolonged period of ultra- Global swap rates low/negative interest rates and quantitative easing (QE). 7% Several models of the equilibrium real interest rates have been EUR 10y USD 10y JPY 10y proposed in the past, each with their own shortcomings. In 5% Forwards addition, analysts are left with the choice of an average inflation rate, which may not necessarily reflect a central bank’s 3% target. For example, the annual variation of euro Harmonised Index of Consumer Prices (HICP) has averaged only 1.3% 1% between 2009 and 2020. A naïve market-based approach is certainly not devoid of criticism but it offers a readily -1% observable monetary policy stance nonetheless. In Exhibit 21, 2002 2005 2008 2011 2014 2017 2020 2023 2026 we show the difference between the overnight interest rate Source: Bloomberg and AXA IM Research, 22 November 2022 and one-month interest rate 5 years forward, which we chose Are inflation expectations too optimistic? as a representation of the ‘neutral’ nominal rate over the business cycle. The QE/negative rates period does not beg Market participants and central bankers have underestimated further discussion, while the more recent past tells us a story of inflation risks for a few quarters. Extra-large rate hikes and high two central banks: The Fed initiated its tightening cycle a few months ahead of the ECB and has already driven monetary 23

AXA IM Outlook 2023 full report Page 22 Page 24

AXA IM Outlook 2023 full report Page 22 Page 24