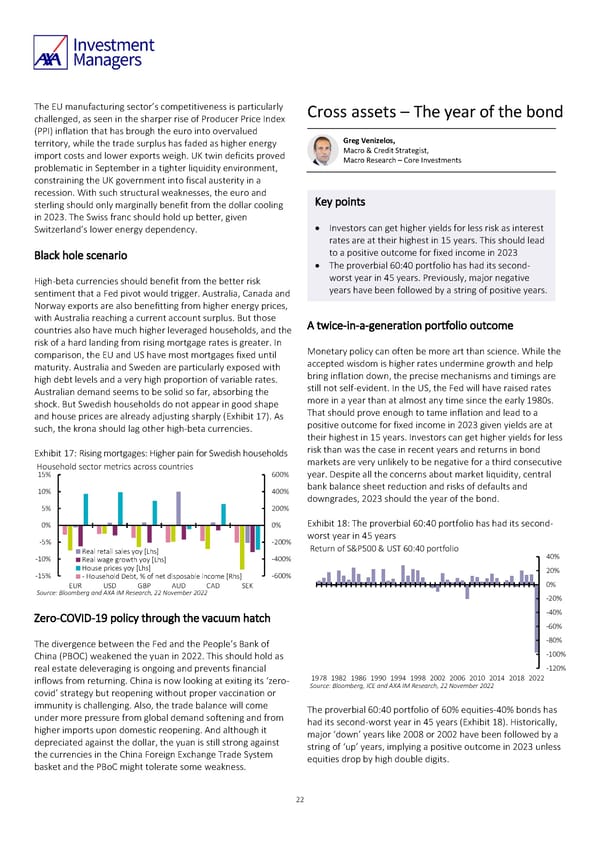

The EU manufacturing sector’s competitiveness is particularly Cross assets – The year of the bond challenged, as seen in the sharper rise of Producer Price Index (PPI) inflation that has brough the euro into overvalued territory, while the trade surplus has faded as higher energy Greg Venizelos, import costs and lower exports weigh. UK twin deficits proved Macro & Credit Strategist, problematic in September in a tighter liquidity environment, Macro Research – Core Investments constraining the UK government into fiscal austerity in a recession. With such structural weaknesses, the euro and Key points sterling should only marginally benefit from the dollar cooling in 2023. The Swiss franc should hold up better, given Switzerland’s lower energy dependency. • Investors can get higher yields for less risk as interest rates are at their highest in 15 years. This should lead Black hole scenario to a positive outcome for fixed income in 2023 • The proverbial 60:40 portfolio has had its second- High-beta currencies should benefit from the better risk worst year in 45 years. Previously, major negative sentiment that a Fed pivot would trigger. Australia, Canada and years have been followed by a string of positive years. Norway exports are also benefitting from higher energy prices, with Australia reaching a current account surplus. But those A twice-in-a-generation portfolio outcome countries also have much higher leveraged households, and the risk of a hard landing from rising mortgage rates is greater. In Monetary policy can often be more art than science. While the comparison, the EU and US have most mortgages fixed until accepted wisdom is higher rates undermine growth and help maturity. Australia and Sweden are particularly exposed with bring inflation down, the precise mechanisms and timings are high debt levels and a very high proportion of variable rates. still not self-evident. In the US, the Fed will have raised rates Australian demand seems to be solid so far, absorbing the more in a year than at almost any time since the early 1980s. shock. But Swedish households do not appear in good shape That should prove enough to tame inflation and lead to a and house prices are already adjusting sharply (Exhibit 17). As positive outcome for fixed income in 2023 given yields are at such, the krona should lag other high-beta currencies. their highest in 15 years. Investors can get higher yields for less risk than was the case in recent years and returns in bond Exhibit 17: Rising mortgages: Higher pain for Swedish households markets are very unlikely to be negative for a third consecutive Household sector metrics across countries 15% 600% year. Despite all the concerns about market liquidity, central 10% 400% bank balance sheet reduction and risks of defaults and downgrades, 2023 should the year of the bond. 5% 200% 0% 0% Exhibit 18: The proverbial 60:40 portfolio has had its second- -5% -200% worst year in 45 years Real retail sales yoy [Lhs] Return of S&P500 & UST 60:40 portfolio -10% Real wage growth yoy [Lhs] -400% 40% House prices yoy [Lhs] 20% -15% - Household Debt, % of net disposable income [Rhs] -600% EUR USD GBP AUD CAD SEK 0% Source: Bloomberg and AXA IM Research, 22 November 2022 -20% -40% Zero-COVID-19 policy through the vacuum hatch -60% -80% The divergence between the Fed and the People’s Bank of China (PBOC) weakened the yuan in 2022. This should hold as -100% real estate deleveraging is ongoing and prevents financial -120% inflows from returning. China is now looking at exiting its ‘zero- 1978 1982 1986 1990 1994 1998 2002 2006 2010 2014 2018 2022 Source: Bloomberg, ICE and AXA IM Research, 22 November 2022 covid’ strategy but reopening without proper vaccination or immunity is challenging. Also, the trade balance will come The proverbial 60:40 portfolio of 60% equities-40% bonds has under more pressure from global demand softening and from had its second-worst year in 45 years (Exhibit 18). Historically, higher imports upon domestic reopening. And although it depreciated against the dollar, the yuan is still strong against major ‘down’ years like 2008 or 2002 have been followed by a the currencies in the China Foreign Exchange Trade System string of ‘up’ years, implying a positive outcome in 2023 unless basket and the PBoC might tolerate some weakness. equities drop by high double digits. 22

AXA IM Outlook 2023 full report Page 21 Page 23

AXA IM Outlook 2023 full report Page 21 Page 23