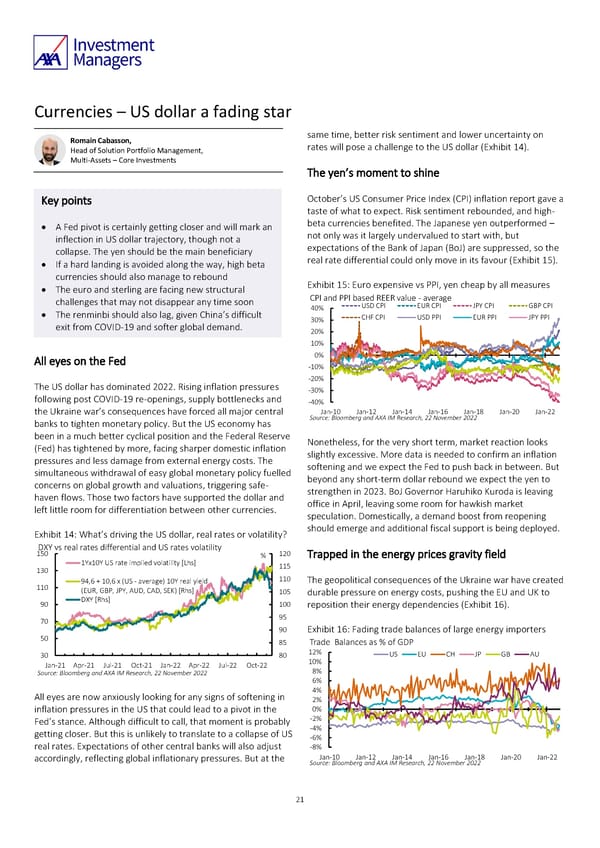

Currencies – US dollar a fading star Romain Cabasson, same time, better risk sentiment and lower uncertainty on Head of Solution Portfolio Management, rates will pose a challenge to the US dollar (Exhibit 14). Multi-Assets – Core Investments The yen’s moment to shine Key points October’s US Consumer Price Index (CPI) inflation report gave a taste of what to expect. Risk sentiment rebounded, and high- • A Fed pivot is certainly getting closer and will mark an beta currencies benefited. The Japanese yen outperformed – inflection in US dollar trajectory, though not a not only was it largely undervalued to start with, but collapse. The yen should be the main beneficiary expectations of the Bank of Japan (BoJ) are suppressed, so the • If a hard landing is avoided along the way, high beta real rate differential could only move in its favour (Exhibit 15). currencies should also manage to rebound • The euro and sterling are facing new structural Exhibit 15: Euro expensive vs PPI, yen cheap by all measures challenges that may not disappear any time soon CPI and PPI based REER value - average • The renminbi should also lag, given China’s difficult 40% USD CPI EUR CPI JPY CPI GBP CPI 30% CHF CPI USD PPI EUR PPI JPY PPI exit from COVID-19 and softer global demand. 20% 10% All eyes on the Fed 0% -10% The US dollar has dominated 2022. Rising inflation pressures -20% -30% following post COVID-19 re-openings, supply bottlenecks and -40% the Ukraine war’s consequences have forced all major central Jan-10 Jan-12 Jan-14 Jan-16 Jan-18 Jan-20 Jan-22 banks to tighten monetary policy. But the US economy has Source: Bloomberg and AXA IM Research, 22 November 2022 been in a much better cyclical position and the Federal Reserve (Fed) has tightened by more, facing sharper domestic inflation Nonetheless, for the very short term, market reaction looks pressures and less damage from external energy costs. The slightly excessive. More data is needed to confirm an inflation simultaneous withdrawal of easy global monetary policy fuelled softening and we expect the Fed to push back in between. But concerns on global growth and valuations, triggering safe- beyond any short-term dollar rebound we expect the yen to haven flows. Those two factors have supported the dollar and strengthen in 2023. BoJ Governor Haruhiko Kuroda is leaving left little room for differentiation between other currencies. office in April, leaving some room for hawkish market speculation. Domestically, a demand boost from reopening Exhibit 14: What’s driving the US dollar, real rates or volatility? should emerge and additional fiscal support is being deployed. DXY vs real rates differential and US rates volatility 150 % 120 Trapped in the energy prices gravity field 1Yx10Y US rate implied volatility [Lhs] 115 130 94,6 + 10,6 x (US - average) 10Y real yield 110 The geopolitical consequences of the Ukraine war have created 110 (EUR, GBP, JPY, AUD, CAD, SEK) [Rhs] 105 durable pressure on energy costs, pushing the EU and UK to 90 DXY [Rhs] 100 reposition their energy dependencies (Exhibit 16). 70 95 90 Exhibit 16: Fading trade balances of large energy importers 50 85 Trade Balances as % of GDP 30 80 12% US EU CH JP GB AU Jan-21 Apr-21 Jul-21 Oct-21 Jan-22 Apr-22 Jul-22 Oct-22 10% Source: Bloomberg and AXA IM Research, 22 November 2022 8% 6% All eyes are now anxiously looking for any signs of softening in 4% 2% inflation pressures in the US that could lead to a pivot in the 0% -2% Fed’s stance. Although difficult to call, that moment is probably -4% getting closer. But this is unlikely to translate to a collapse of US -6% real rates. Expectations of other central banks will also adjust -8% accordingly, reflecting global inflationary pressures. But at the Jan-10 Jan-12 Jan-14 Jan-16 Jan-18 Jan-20 Jan-22 Source: Bloomberg and AXA IM Research, 22 November 2022 21

AXA IM Outlook 2023 full report Page 20 Page 22

AXA IM Outlook 2023 full report Page 20 Page 22