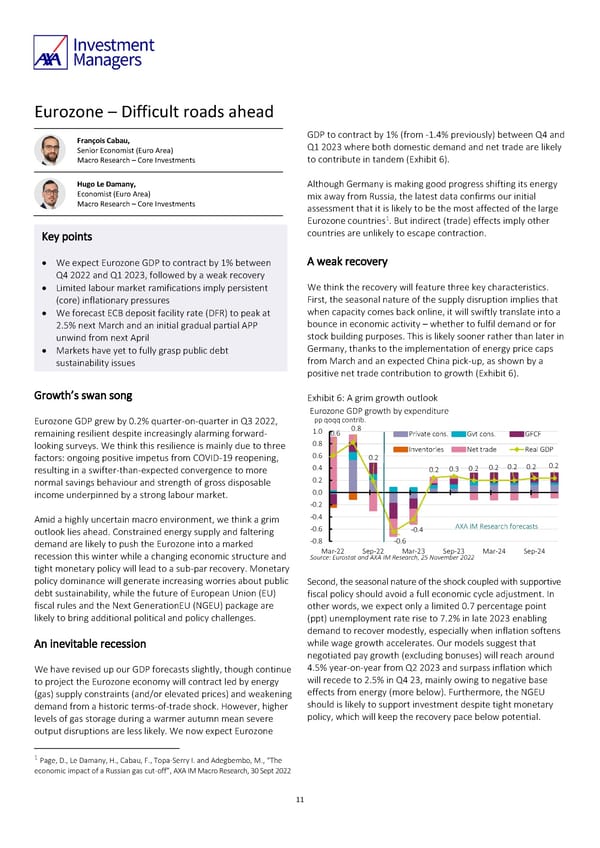

Eurozone – Difficult roads ahead François Cabau, GDP to contract by 1% (from -1.4% previously) between Q4 and Senior Economist (Euro Area) Q1 2023 where both domestic demand and net trade are likely Macro Research – Core Investments to contribute in tandem (Exhibit 6). Hugo Le Damany, Although Germany is making good progress shifting its energy Economist (Euro Area) mix away from Russia, the latest data confirms our initial Macro Research – Core Investments assessment that it is likely to be the most affected of the large 1 Eurozone countries . But indirect (trade) effects imply other Key points countries are unlikely to escape contraction. • We expect Eurozone GDP to contract by 1% between A weak recovery Q4 2022 and Q1 2023, followed by a weak recovery • Limited labour market ramifications imply persistent We think the recovery will feature three key characteristics. (core) inflationary pressures First, the seasonal nature of the supply disruption implies that • We forecast ECB deposit facility rate (DFR) to peak at when capacity comes back online, it will swiftly translate into a 2.5% next March and an initial gradual partial APP bounce in economic activity – whether to fulfil demand or for unwind from next April stock building purposes. This is likely sooner rather than later in • Markets have yet to fully grasp public debt Germany, thanks to the implementation of energy price caps sustainability issues from March and an expected China pick-up, as shown by a positive net trade contribution to growth (Exhibit 6). Growth’s swan song Exhibit 6: A grim growth outlook Eurozone GDP growth by expenditure Eurozone GDP grew by 0.2% quarter-on-quarter in Q3 2022, pp qoqq contrib. remaining resilient despite increasingly alarming forward- 1.0 0.6 0.8 Private cons. Gvt cons. GFCF looking surveys. We think this resilience is mainly due to three 0.8 Inventories Net trade Real GDP factors: ongoing positive impetus from COVID-19 reopening, 0.6 0.2 resulting in a swifter-than-expected convergence to more 0.4 0.2 0.3 0.2 0.2 0.2 0.2 0.2 normal savings behaviour and strength of gross disposable 0.2 income underpinned by a strong labour market. 0.0 -0.2 Amid a highly uncertain macro environment, we think a grim -0.4 outlook lies ahead. Constrained energy supply and faltering -0.6 -0.4 AXA IMResearch forecasts demand are likely to push the Eurozone into a marked -0.8 -0.6 recession this winter while a changing economic structure and Mar-22 Sep-22 Mar-23 Sep-23 Mar-24 Sep-24 Source: Eurostat and AXA IM Research, 25 November 2022 tight monetary policy will lead to a sub-par recovery. Monetary policy dominance will generate increasing worries about public Second, the seasonal nature of the shock coupled with supportive debt sustainability, while the future of European Union (EU) fiscal policy should avoid a full economic cycle adjustment. In fiscal rules and the Next GenerationEU (NGEU) package are other words, we expect only a limited 0.7 percentage point likely to bring additional political and policy challenges. (ppt) unemployment rate rise to 7.2% in late 2023 enabling demand to recover modestly, especially when inflation softens An inevitable recession while wage growth accelerates. Our models suggest that negotiated pay growth (excluding bonuses) will reach around We have revised up our GDP forecasts slightly, though continue 4.5% year-on-year from Q2 2023 and surpass inflation which to project the Eurozone economy will contract led by energy will recede to 2.5% in Q4 23, mainly owing to negative base (gas) supply constraints (and/or elevated prices) and weakening effects from energy (more below). Furthermore, the NGEU demand from a historic terms-of-trade shock. However, higher should is likely to support investment despite tight monetary levels of gas storage during a warmer autumn mean severe policy, which will keep the recovery pace below potential. output disruptions are less likely. We now expect Eurozone 1 Page, D., Le Damany, H., Cabau, F., Topa-Serry I. and Adegbembo, M., “The economic impact of a Russian gas cut-off”, AXA IM Macro Research, 30 Sept 2022 11

AXA IM Outlook 2023 full report Page 10 Page 12

AXA IM Outlook 2023 full report Page 10 Page 12