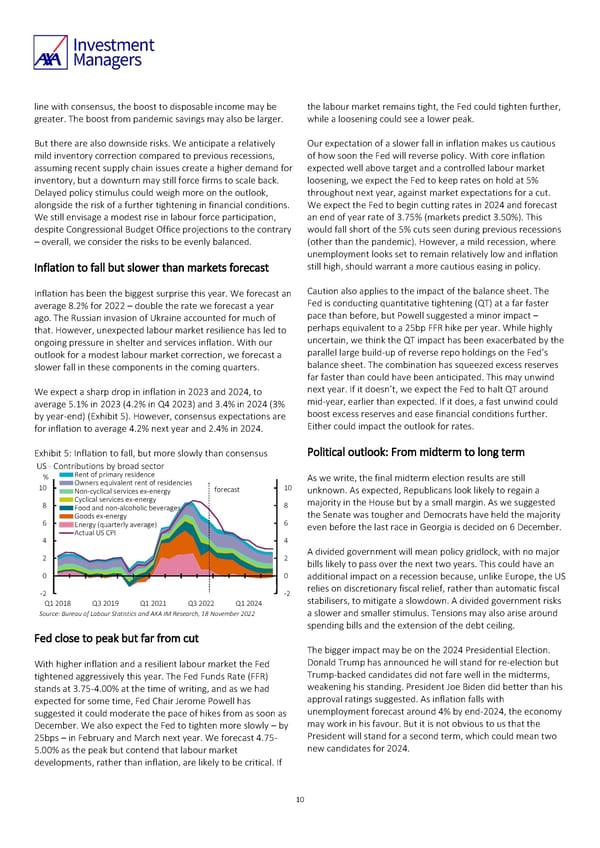

line with consensus, the boost to disposable income may be the labour market remains tight, the Fed could tighten further, greater. The boost from pandemic savings may also be larger. while a loosening could see a lower peak. But there are also downside risks. We anticipate a relatively Our expectation of a slower fall in inflation makes us cautious mild inventory correction compared to previous recessions, of how soon the Fed will reverse policy. With core inflation assuming recent supply chain issues create a higher demand for expected well above target and a controlled labour market inventory, but a downturn may still force firms to scale back. loosening, we expect the Fed to keep rates on hold at 5% Delayed policy stimulus could weigh more on the outlook, throughout next year, against market expectations for a cut. alongside the risk of a further tightening in financial conditions. We expect the Fed to begin cutting rates in 2024 and forecast We still envisage a modest rise in labour force participation, an end of year rate of 3.75% (markets predict 3.50%). This despite Congressional Budget Office projections to the contrary would fall short of the 5% cuts seen during previous recessions – overall, we consider the risks to be evenly balanced. (other than the pandemic). However, a mild recession, where unemployment looks set to remain relatively low and inflation Inflation to fall but slower than markets forecast still high, should warrant a more cautious easing in policy. Inflation has been the biggest surprise this year. We forecast an Caution also applies to the impact of the balance sheet. The average 8.2% for 2022 – double the rate we forecast a year Fed is conducting quantitative tightening (QT) at a far faster ago. The Russian invasion of Ukraine accounted for much of pace than before, but Powell suggested a minor impact – that. However, unexpected labour market resilience has led to perhaps equivalent to a 25bp FFR hike per year. While highly ongoing pressure in shelter and services inflation. With our uncertain, we think the QT impact has been exacerbated by the outlook for a modest labour market correction, we forecast a parallel large build-up of reverse repo holdings on the Fed’s slower fall in these components in the coming quarters. balance sheet. The combination has squeezed excess reserves far faster than could have been anticipated. This may unwind We expect a sharp drop in inflation in 2023 and 2024, to next year. If it doesn’t, we expect the Fed to halt QT around average 5.1% in 2023 (4.2% in Q4 2023) and 3.4% in 2024 (3% mid-year, earlier than expected. If it does, a fast unwind could by year-end) (Exhibit 5). However, consensus expectations are boost excess reserves and ease financial conditions further. for inflation to average 4.2% next year and 2.4% in 2024. Either could impact the outlook for rates. Exhibit 5: Inflation to fall, but more slowly than consensus Political outlook: From midterm to long term US - Contributions by broad sector % Rent of primary residence F As we write, the final midterm election results are still 10 Owners equivalent rent of residencies forecast 10 unknown. As expected, Republicans look likely to regain a Non-cyclical services ex-energy 8 Cyclical services ex-energy 8 majority in the House but by a small margin. As we suggested Food and non-alcoholic beverages the Senate was tougher and Democrats have held the majority 6 Goods ex-energy 6 Energy (quarterly average) even before the last race in Georgia is decided on 6 December. Actual US CPI 4 4 2 2 A divided government will mean policy gridlock, with no major bills likely to pass over the next two years. This could have an 0 0 additional impact on a recession because, unlike Europe, the US -2 -2 relies on discretionary fiscal relief, rather than automatic fiscal Q1 2018 Q3 2019 Q1 2021 Q3 2022 Q1 2024 stabilisers, to mitigate a slowdown. A divided government risks Source: Bureau of Labour Statistics and AXA IM Research, 18 November 2022 a slower and smaller stimulus. Tensions may also arise around spending bills and the extension of the debt ceiling. Fed close to peak but far from cut The bigger impact may be on the 2024 Presidential Election. With higher inflation and a resilient labour market the Fed Donald Trump has announced he will stand for re-election but tightened aggressively this year. The Fed Funds Rate (FFR) Trump-backed candidates did not fare well in the midterms, stands at 3.75-4.00% at the time of writing, and as we had weakening his standing. President Joe Biden did better than his expected for some time, Fed Chair Jerome Powell has approval ratings suggested. As inflation falls with suggested it could moderate the pace of hikes from as soon as unemployment forecast around 4% by end-2024, the economy December. We also expect the Fed to tighten more slowly – by may work in his favour. But it is not obvious to us that the 25bps – in February and March next year. We forecast 4.75- President will stand for a second term, which could mean two 5.00% as the peak but contend that labour market new candidates for 2024. developments, rather than inflation, are likely to be critical. If 10

AXA IM Outlook 2023 full report Page 9 Page 11

AXA IM Outlook 2023 full report Page 9 Page 11