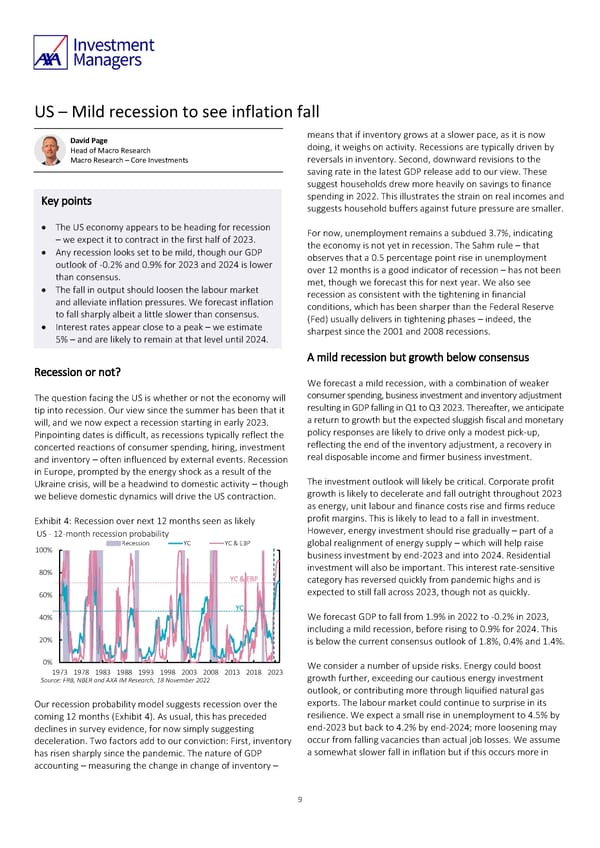

US – Mild recession to see inflation fall David Page means that if inventory grows at a slower pace, as it is now Head of Macro Research doing, it weighs on activity. Recessions are typically driven by Macro Research – Core Investments reversals in inventory. Second, downward revisions to the saving rate in the latest GDP release add to our view. These suggest households drew more heavily on savings to finance Key points spending in 2022. This illustrates the strain on real incomes and suggests household buffers against future pressure are smaller. • The US economy appears to be heading for recession – we expect it to contract in the first half of 2023. For now, unemployment remains a subdued 3.7%, indicating • Any recession looks set to be mild, though our GDP the economy is not yet in recession. The Sahm rule – that outlook of -0.2% and 0.9% for 2023 and 2024 is lower observes that a 0.5 percentage point rise in unemployment than consensus. over 12 months is a good indicator of recession – has not been • The fall in output should loosen the labour market met, though we forecast this for next year. We also see and alleviate inflation pressures. We forecast inflation recession as consistent with the tightening in financial to fall sharply albeit a little slower than consensus. conditions, which has been sharper than the Federal Reserve • Interest rates appear close to a peak – we estimate (Fed) usually delivers in tightening phases – indeed, the 5% – and are likely to remain at that level until 2024. sharpest since the 2001 and 2008 recessions. A mild recession but growth below consensus Recession or not? We forecast a mild recession, with a combination of weaker The question facing the US is whether or not the economy will consumer spending, business investment and inventory adjustment tip into recession. Our view since the summer has been that it resulting in GDP falling in Q1 to Q3 2023. Thereafter, we anticipate will, and we now expect a recession starting in early 2023. a return to growth but the expected sluggish fiscal and monetary Pinpointing dates is difficult, as recessions typically reflect the policy responses are likely to drive only a modest pick-up, concerted reactions of consumer spending, hiring, investment reflecting the end of the inventory adjustment, a recovery in and inventory – often influenced by external events. Recession real disposable income and firmer business investment. in Europe, prompted by the energy shock as a result of the Ukraine crisis, will be a headwind to domestic activity – though The investment outlook will likely be critical. Corporate profit we believe domestic dynamics will drive the US contraction. growth is likely to decelerate and fall outright throughout 2023 as energy, unit labour and finance costs rise and firms reduce Exhibit 4: Recession over next 12 months seen as likely profit margins. This is likely to lead to a fall in investment. US - 12-month recession probability However, energy investment should rise gradually – part of a Recession YC YC & EBP global realignment of energy supply – which will help raise 100% 1 business investment by end-2023 and into 2024. Residential 80% investment will also be important. This interest rate-sensitive YC & EBP category has reversed quickly from pandemic highs and is 60% expected to still fall across 2023, though not as quickly. YC 40% We forecast GDP to fall from 1.9% in 2022 to -0.2% in 2023, including a mild recession, before rising to 0.9% for 2024. This 20% is below the current consensus outlook of 1.8%, 0.4% and 1.4%. 0% 0 We consider a number of upside risks. Energy could boost 1973 1978 1983 1988 1993 1998 2003 2008 2013 2018 2023 growth further, exceeding our cautious energy investment Source: FRB, NBER and AXA IM Research, 18 November 2022 outlook, or contributing more through liquified natural gas Our recession probability model suggests recession over the exports. The labour market could continue to surprise in its coming 12 months (Exhibit 4). As usual, this has preceded resilience. We expect a small rise in unemployment to 4.5% by declines in survey evidence, for now simply suggesting end-2023 but back to 4.2% by end-2024; more loosening may deceleration. Two factors add to our conviction: First, inventory occur from falling vacancies than actual job losses. We assume has risen sharply since the pandemic. The nature of GDP a somewhat slower fall in inflation but if this occurs more in accounting – measuring the change in change of inventory – 9

AXA IM Outlook 2023 full report Page 8 Page 10

AXA IM Outlook 2023 full report Page 8 Page 10