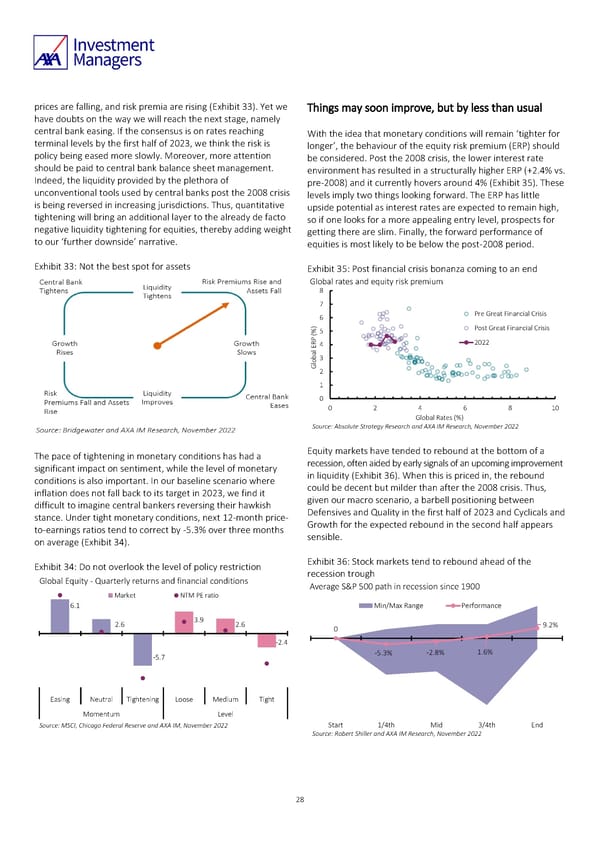

prices are falling, and risk premia are rising (Exhibit 33). Yet we Things may soon improve, but by less than usual have doubts on the way we will reach the next stage, namely central bank easing. If the consensus is on rates reaching With the idea that monetary conditions will remain ‘tighter for terminal levels by the first half of 2023, we think the risk is longer’, the behaviour of the equity risk premium (ERP) should policy being eased more slowly. Moreover, more attention be considered. Post the 2008 crisis, the lower interest rate should be paid to central bank balance sheet management. environment has resulted in a structurally higher ERP (+2.4% vs. Indeed, the liquidity provided by the plethora of pre-2008) and it currently hovers around 4% (Exhibit 35). These unconventional tools used by central banks post the 2008 crisis levels imply two things looking forward. The ERP has little is being reversed in increasing jurisdictions. Thus, quantitative upside potential as interest rates are expected to remain high, tightening will bring an additional layer to the already de facto so if one looks for a more appealing entry level, prospects for negative liquidity tightening for equities, thereby adding weight getting there are slim. Finally, the forward performance of to our ‘further downside’ narrative. equities is most likely to be below the post-2008 period. Exhibit 33: Not the best spot for assets Exhibit 35: Post financial crisis bonanza coming to an end Global rates and equity risk premium 8 7 6 Pre Great Financial Crisis %) (5 Post Great Financial Crisis P ER4 2022 la obGl3 2 1 0 0 2 4 6 8 10 Global Rates (%) Source: Absolute Strategy Research and AXA IM Research, November 2022 The pace of tightening in monetary conditions has had a Equity markets have tended to rebound at the bottom of a significant impact on sentiment, while the level of monetary recession, often aided by early signals of an upcoming improvement conditions is also important. In our baseline scenario where in liquidity (Exhibit 36). When this is priced in, the rebound inflation does not fall back to its target in 2023, we find it could be decent but milder than after the 2008 crisis. Thus, difficult to imagine central bankers reversing their hawkish given our macro scenario, a barbell positioning between stance. Under tight monetary conditions, next 12-month price- Defensives and Quality in the first half of 2023 and Cyclicals and to-earnings ratios tend to correct by -5.3% over three months Growth for the expected rebound in the second half appears on average (Exhibit 34). sensible. Exhibit 34: Do not overlook the level of policy restriction Exhibit 36: Stock markets tend to rebound ahead of the Global Equity - Quarterly returns and financial conditions recession trough Average S&P 500 path in recession since 1900 Market NTM PE ratio 6.1 Min/Max Range Performance 2.6 3.9 2.6 9.2% 0 -2.4 -5.7 -5.3% -2.8% 1.6% Easing Neutral Tightening Loose Medium Tight Momentum Level Source: MSCI, Chicago Federal Reserve and AXA IM, November 2022 Start 1/4th Mid 3/4th End Source: Robert Shiller and AXA IM Research, November 2022 28

AXA IM Outlook 2023 full report Page 27 Page 29

AXA IM Outlook 2023 full report Page 27 Page 29