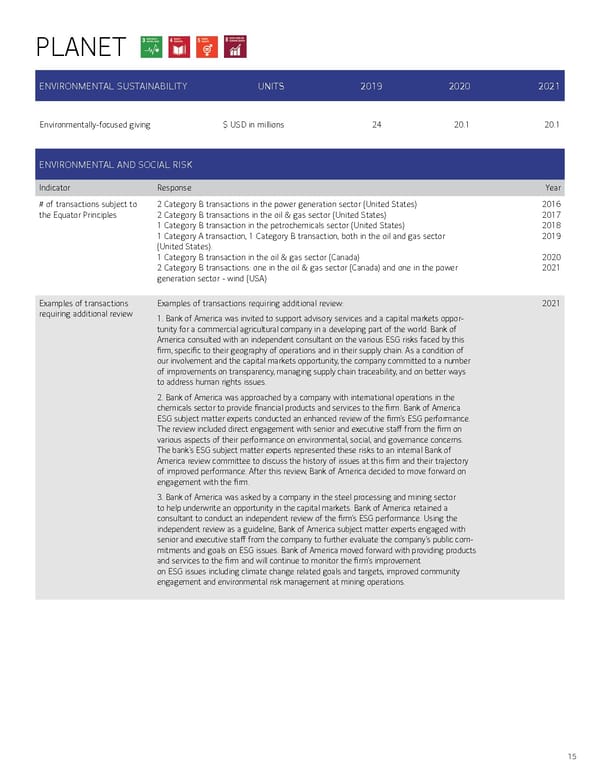

15 PLANET ENVIRONMENTAL SUSTAINABILITY UNITS 2019 2020 2021 Environmentally-focused giving $ USD in millions 24 20.1 20.1 ENVIRONMENTAL AND SOCIAL RISK Indicator Response Year # of transactions subject to the Equator Principles 2 Category B transactions in the power generation sector (United States) 2016 2 Category B transactions in the oil & gas sector (United States) 2017 1 Category B transaction in the petrochemicals sector (United States) 2018 1 Category A transaction, 1 Category B transaction, both in the oil and gas sector (United States). 2019 1 Category B transaction in the oil & gas sector (Canada) 2020 2 Category B transactions: one in the oil & gas sector (Canada) and one in the power generation sector - wind (USA) 2021 Examples of transactions requiring additional review Examples of transactions requiring additional review: 1. Bank of America was invited to support advisory services and a capital markets oppor tunity for a commercial agricultural company in a developing part of the world. Bank of America consulted with an independent consultant on the various ESG risks faced by this firm, specific to their geography of operations and in their supply chain. As a condition of our involvement and the capital markets opportunity, the company committed to a number of improvements on transparency, managing supply chain traceability, and on better ways - to address human rights issues. 2. Bank of America was approached by a company with international operations in the chemicals sector to provide financial products and services to the firm. Bank of America ESG subject matter experts conducted an enhanced review of the firm’s ESG performance. The review included direct engagement with senior and executive staff from the firm on various aspects of their performance on environmental, social, and governance concerns. The bank’s ESG subject matter experts represented these risks to an internal Bank of America review committee to discuss the history of issues at this firm and their trajectory of improved performance. After this review, Bank of America decided to move forward on engagement with the firm. 3. Bank of America was asked by a company in the steel processing and mining sector to help underwrite an opportunity in the capital markets. Bank of America retained a consultant to conduct an independent review of the firm’s ESG performance. Using the independent review as a guideline, Bank of America subject matter experts engaged with senior and executive staff from the company to further evaluate the company’s public com mitments and goals on ESG issues. Bank of America moved forward with providing products and services to the firm and will continue to monitor the firm’s improvement - on ESG issues including climate change related goals and targets, improved community engagement and environmental risk management at mining operations. 2021

Bank of America ESG Report Page 14 Page 16

Bank of America ESG Report Page 14 Page 16