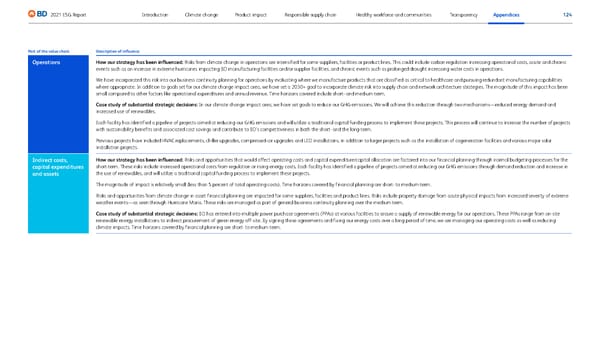

124 2021 ESG Report Transparency Appendices Responsible supply chain Product impact Climate change Introduction Healthy workforce and communities Part of the value chain Description of influence Operations How our strategy has been influenced: Risks from climate change in operations are intensified for some suppliers, facilities or product lines. This could include carbon regulation increasing operational costs, acute and chronic events such as an increase in extreme hurricanes impacting BD manufacturing facilities and/or supplier facilities, and chronic events such as prolonged drought increasing water costs in operations. We have incorporated this risk into our business continuity planning for operations by evaluating where we manufacture products that are classified as critical to healthcare and pursuing redundant manufacturing capabilities where appropriate. In addition to goals set for our climate change impact area, we have set a 2030+ goal to incorporate climate risk into supply chain and network architecture strategies . T he magnitude of this impact has been small compared to other factors like operational expenditures and annual revenue. Time horizons covered include short- and medium-term. Case study of substantial strategic decisions: In our climate change impact area, we have set goals to reduce our GHG emissions. We will achieve this reduction through two mechanisms—reduced energy demand and increased use of renewables. Each facility has identified a pipeline of projects aimed at reducing our GHG emissions and will utilize a traditional capital funding process to implement these projects. This process will continue to increase the number of projects with sustainability benefits and associated cost savings and contribute to BD’s competitiveness in both the short- and the long-term. Previous projects have included HVAC replacements, chiller upgrades, compressed-air upgrades and LED installations, in addition to larger projects such as the installation of cogeneration facilities and various major solar installation projects. Indirect costs, capital expenditures and assets How our strategy has been influenced: Risks and opportunities that would affect operating costs and capital expenditure/capital allocation are factored into our financial planning through normal budgeting processes for the short-term. These risks include increased operational costs from regulation or rising energy costs. Each facility has identified a pipeline of projects aimed at reducing our GHG emissions through demand reduction and increase in the use of renewables, and will utilize a traditional capital funding process to implement these projects. The magnitude of impact is relatively small (less than 5 percent of total operating costs). Time horizons covered by financial planning are short- to medium-term. Risks and opportunities from climate change in asset financial planning are impacted for some suppliers, facilities and product lines. Risks include property damage from acute physical impacts from increased severity of extreme weather events—as seen through Hurricane Maria. These risks are managed as part of general business continuity planning over the medium-term. Case study of substantial strategic decisions: BD has entered into multiple power purchase agreements (PPAs) at various facilities to secure a supply of renewable energy for our operations. These PPAs range from on-site renewable energy installations to indirect procurement of green energy off-site. By signing these agreements and fixing our energy costs over a long period of time, we are managing our operating costs as well as reducing climate impacts. Time horizons covered by financial planning are short- to medium-term.

BD ESG Report Page 123 Page 125

BD ESG Report Page 123 Page 125