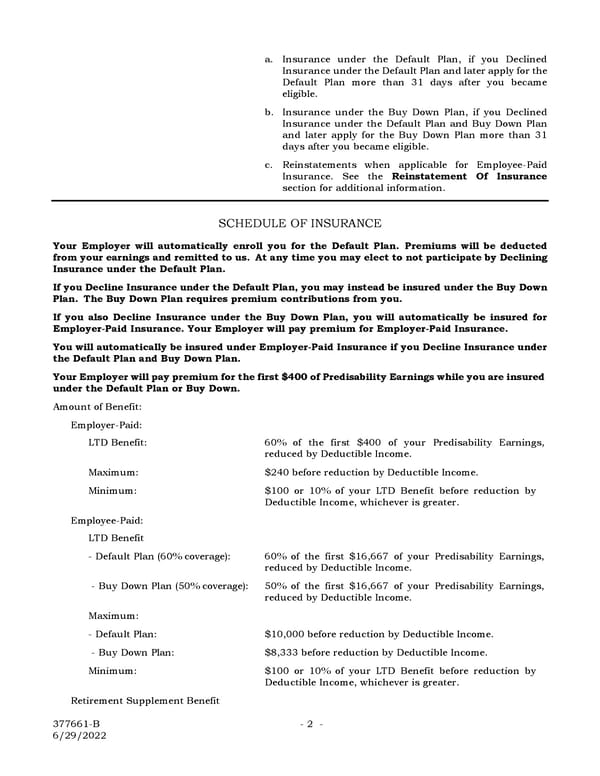

a. Insurance under the Default Plan, if you Declined Insurance under the Default Plan and later apply for the Default Plan more than 31 days after you became eligible. b. Insurance under the Buy Down Plan, if you Declined Insurance under the Default Plan and Buy Down Plan and later apply for the Buy Down Plan more than 31 days after you became eligible. c. Reinstatements when applicable for Employee-Paid Insurance. See the Reinstatement Of Insurance section for additional information. SCHEDULE OF INSURANCE Your Employer will automatically enroll you for the Default Plan. Premiums will be deducted from your earnings and remitted to us. At any time you may elect to not participate by Declining Insurance under the Default Plan. If you Decline Insurance under the Default Plan, you may instead be insured under the Buy Down Plan. The Buy Down Plan requires premium contributions from you. If you also Decline Insurance under the Buy Down Plan, you will automatically be insured for Employer-Paid Insurance. Your Employer will pay premium for Employer-Paid Insurance. You will automatically be insured under Employer-Paid Insurance if you Decline Insurance under the Default Plan and Buy Down Plan. Your Employer will pay premium for the first $400 of Predisability Earnings while you are insured under the Default Plan or Buy Down. Amount of Benefit: Employer-Paid: LTD Benefit: 60% of the first $400 of your Predisability Earnings, reduced by Deductible Income. Maximum: $240 before reduction by Deductible Income. Minimum: $100 or 10% of your LTD Benefit before reduction by Deductible Income, whichever is greater. Employee-Paid: LTD Benefit - Default Plan (60% coverage): 60% of the first $16,667 of your Predisability Earnings, reduced by Deductible Income. - Buy Down Plan (50% coverage): 50% of the first $16,667 of your Predisability Earnings, reduced by Deductible Income. Maximum: - Default Plan: $10,000 before reduction by Deductible Income. - Buy Down Plan: $8,333 before reduction by Deductible Income. Minimum: $100 or 10% of your LTD Benefit before reduction by Deductible Income, whichever is greater. Retirement Supplement Benefit 377661-B - 2 - 6/29/2022

Benefits Booklet Page 5 Page 7

Benefits Booklet Page 5 Page 7