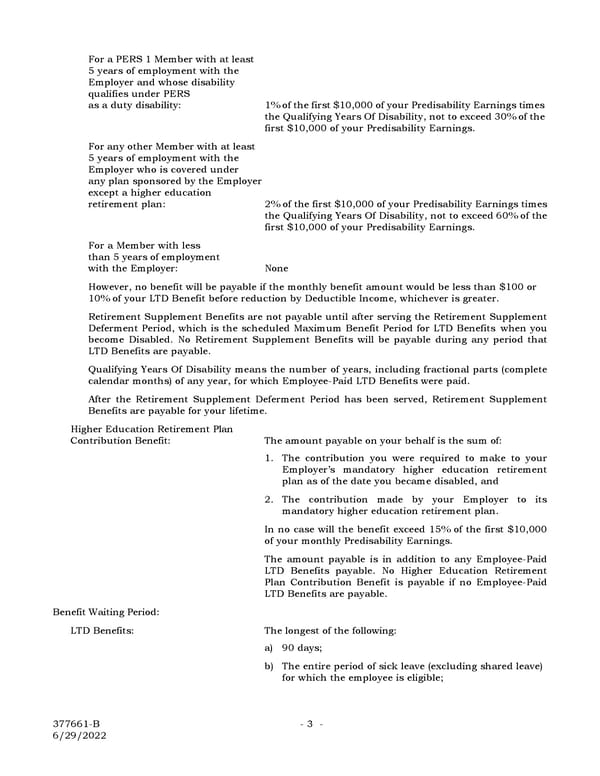

For a PERS 1 Member with at least 5 years of employment with the Employer and whose disability qualifies under PERS as a duty disability: 1% of the first $10,000 of your Predisability Earnings times the Qualifying Years Of Disability, not to exceed 30% of the first $10,000 of your Predisability Earnings. For any other Member with at least 5 years of employment with the Employer who is covered under any plan sponsored by the Employer except a higher education retirement plan: 2% of the first $10,000 of your Predisability Earnings times the Qualifying Years Of Disability, not to exceed 60% of the first $10,000 of your Predisability Earnings. For a Member with less than 5 years of employment with the Employer: None However, no benefit will be payable if the monthly benefit amount would be less than $100 or 10% of your LTD Benefit before reduction by Deductible Income, whichever is greater. Retirement Supplement Benefits are not payable until after serving the Retirement Supplement Deferment Period, which is the scheduled Maximum Benefit Period for LTD Benefits when you become Disabled. No Retirement Supplement Benefits will be payable during any period that LTD Benefits are payable. Qualifying Years Of Disability means the number of years, including fractional parts (complete calendar months) of any year, for which Employee-Paid LTD Benefits were paid. After the Retirement Supplement Deferment Period has been served, Retirement Supplement Benefits are payable for your lifetime. Higher Education Retirement Plan Contribution Benefit: The amount payable on your behalf is the sum of: 1. The contribution you were required to make to your Employer’s mandatory higher education retirement plan as of the date you became disabled, and 2. The contribution made by your Employer to its mandatory higher education retirement plan. In no case will the benefit exceed 15% of the first $10,000 of your monthly Predisability Earnings. The amount payable is in addition to any Employee-Paid LTD Benefits payable. No Higher Education Retirement Plan Contribution Benefit is payable if no Employee-Paid LTD Benefits are payable. Benefit Waiting Period: LTD Benefits: The longest of the following: a) 90 days; b) The entire period of sick leave (excluding shared leave) for which the employee is eligible; 377661-B - 3 - 6/29/2022

Benefits Booklet Page 6 Page 8

Benefits Booklet Page 6 Page 8