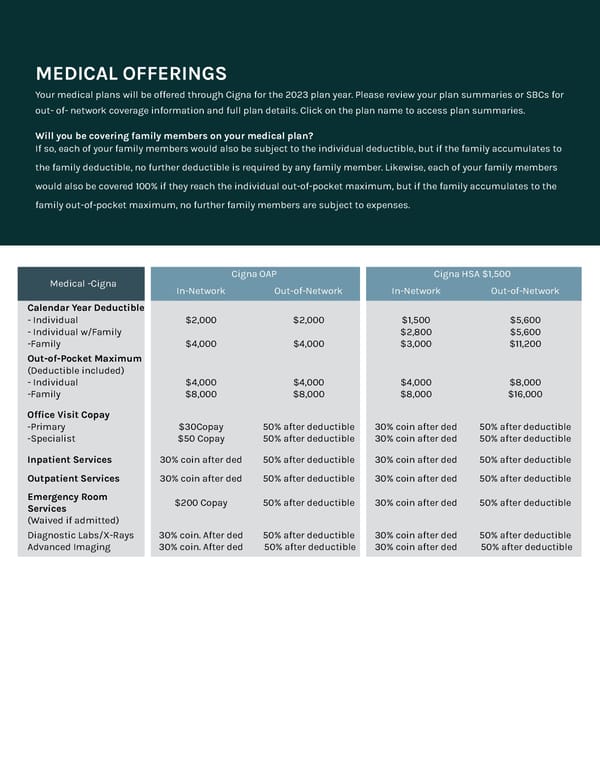

Medical -Cigna Cigna In-Network OAP Out-of-Network Cigna In-Network HSA $1,500 Out-of-Network Calendar Year Deductible - Individual $2,000 $2,000 $1,500 $5,600 - Individual w/Family $2,800 $5,600 -Family $4,000 $4,000 $3,000 $11,200 Out-of-Pocket Maximum (Deductible included) - Individual $4,000 $4,000 $4,000 $8,000 -Family $8,000 $8,000 $8,000 $16,000 Office Visit Copay -Primary $30Copay 50% after deductible 30% coin after ded 50% after deductible -Specialist $50 Copay 50% after deductible 30% coin after ded 50% after deductible Inpatient Services 30% coin after ded 50% after deductible 30% coin after ded 50% after deductible Outpatient Services 30% coin after ded 50% after deductible 30% coin after ded 50% after deductible Emergency Room Services (Waived if admitted) $200 Copay 50% after deductible 30% coin after ded 50% after deductible Diagnostic Labs/X-Rays 30% coin. After ded 50% after deductible 30% coin after ded 50% after deductible Advanced Imaging 30% coin. After ded 50% after deductible 30% coin after ded 50% after deductible MEDICAL OFFERINGS Your medical plans will be offered through Cigna for the 2023 plan year. Please review your plan summaries or SBCs for out- of- network coverage information and full plan details. Click on the plan name to access plan summaries. Will you be covering family members on your medical plan? If so, each of your family members would also be subject to the individual deductible, but if the family accumulates to the family deductible, no further deductible is required by any family member. Likewise, each of your family members would also be covered 100% if they reach the individual out-of-pocket maximum, but if the family accumulates to the family out-of-pocket maximum, no further family members are subject to expenses.

Benefits Resource Guide Page 5 Page 7

Benefits Resource Guide Page 5 Page 7