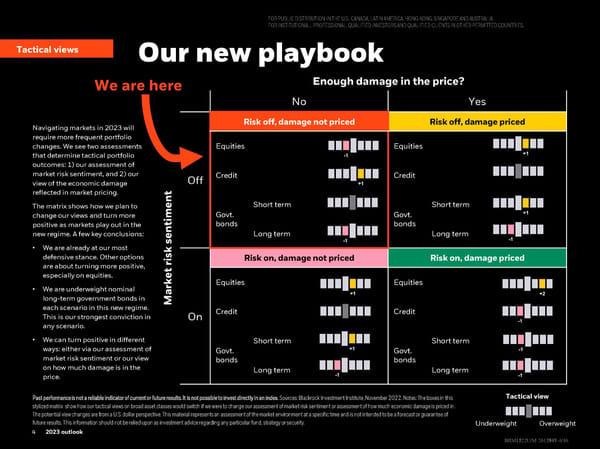

FOR PUBLIC DISTRIBUTION IN THE U.S., CANADA, LATIN AMERICA, HONGKONG, SINGAPORE AND AUSTRALIA. FOR INSTITUTIONAL, PROFESSIONAL, QUALIFIED INVESTORS AND QUALIFIED CLIENTS IN OTHER PERMITTED COUNTRIES. Tactical views Our new playbook We are here Enough damage in the price? No Yes Navigating markets in 2023 will Risk off, damage not priced Risk off, damage priced require more frequent portfolio changes. We see two assessments Equities Equities that determine tactical portfolio outcomes: 1) our assessment of market risk sentiment, and 2) our Off Credit Credit view of the economic damage reflected in market pricing. The matrix shows how we plan to Short term Short term change our views and turn more timent Govt. Govt. positive as markets play out in the n bonds bonds new regime. A few key conclusions: Long term Long term se • We are already at our most k defensive stance. Other options ris Risk on, damage not priced Risk on, damage priced are about turning more positive, especially on equities. et rk Equities Equities • We are underweight nominal long-term government bonds in Ma each scenario in this new regime. Credit Credit This is our strongest conviction in On any scenario. • We can turn positive in different Short term Short term ways: either via our assessment of Govt. Govt. market risk sentiment or our view bonds bonds on how much damage is in the Long term Long term price. Past performance is not a reliable indicator of current or future results. It is not possible to invest directly in an index. Sources: Blackrock Investment Institute, November 2022. Notes: The boxes in this Tactical view stylized matrix show how our tactical views on broad asset classes would switch if we were to change our assessment of market risk sentiment or assessment of how much economic damage is priced in. The potential view changes are from a U.S. dollar perspective. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast or guarantee of future results. This information should not be relied upon as investment advice regarding any particular fund, strategy or security. Underweight Overweight 44 2023 outlook 4 2022 midyear outlook BBIIIIMM1122U/M1222U/M--26121472617935--44/16/16

BlackRock 2023 Global Outlook Page 3 Page 5

BlackRock 2023 Global Outlook Page 3 Page 5