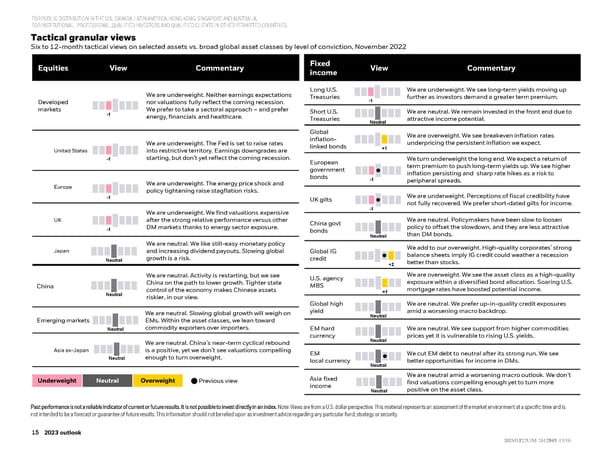

FOR PUBLIC DISTRIBUTION IN THE U.S., CANADA, LATIN AMERICA, HONGKONG, SINGAPORE AND AUSTRALIA. FOR INSTITUTIONAL, PROFESSIONAL, QUALIFIED INVESTORS AND QUALIFIED CLIENTS IN OTHER PERMITTED COUNTRIES. Tactical granular views Six to 12-month tactical views on selected assets vs. broad global asset classes by level of conviction, November 2022 Equities View Commentary Fixed View Commentary income We are underweight. Neither earnings expectations Long U.S. We are underweight. We see long-term yields moving up Treasuries further as investors demand a greater term premium. Developed nor valuations fully reflect the coming recession. markets We prefer to take a sectoral approach – and prefer Short U.S. We are neutral. We remain invested in the front end due to energy, financials and healthcare. Treasuries attractive income potential. Global We are overweight. We see breakeven inflation rates We are underweight. The Fed is set to raise rates inflation- underpricing the persistent inflation we expect. United States into restrictive territory. Earnings downgrades are linked bonds starting, but don’t yet reflect the coming recession. European We turn underweight the long end. We expect a return of government term premium to push long-term yields up. We see higher bonds inflation persisting and sharp rate hikes as a risk to We are underweight. The energy price shock and peripheral spreads. Europe policy tightening raise stagflation risks. UK gilts We are underweight. Perceptions of fiscal credibility have not fully recovered. We prefer short-dated gilts for income. We are underweight. We find valuations expensive UK after the strong relative performance versus other China govt We are neutral. Policymakers have been slow to loosen DM markets thanks to energy sector exposure. bonds policy to offset the slowdown, and they are less attractive than DM bonds. We are neutral. We like still-easy monetary policy We add to our overweight. High-quality corporates’ strong Japan and increasing dividend payouts. Slowing global Global IG balance sheets imply IG credit could weather a recession growth is a risk. credit better than stocks. We are neutral. Activity is restarting, but we see U.S. agency We are overweight. We see the asset class as a high-quality China China on the path to lower growth. Tighter state MBS exposure within a diversified bond allocation. Soaring U.S. control of the economy makes Chinese assets mortgage rates have boosted potential income. riskier, in our view. Global high We are neutral. We prefer up-in-quality credit exposures We are neutral. Slowing global growth will weigh on yield amid a worsening macro backdrop. Emerging markets EMs. Within the asset classes, we lean toward commodity exporters over importers. EM hard We are neutral. We see support from higher commodities currency prices yet it is vulnerable to rising U.S. yields. We are neutral. China’s near-term cyclical rebound Asia ex-Japan is a positive, yet we don’t see valuations compelling EM We cut EM debt to neutral after its strong run. We see enough to turn overweight. local currency better opportunities for income in DMs. Underweight Neutral Overweight nPrevious view Asia fixed We are neutral amid a worsening macro outlook. We don’t income find valuations compelling enough yet to turn more positive on the asset class. Past performance is not a reliable indicator of current or future results. It is not possible to invest directly in an index. Note: Views are from a U.S. dollar perspective. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast or guarantee of future results. This information should not be relied upon as investment advice regarding any particular fund, strategy or security. 15 15 2022 midyear outlook 15 2023 outlook BBIIIIMM1122U/M1222U/M--26121472617935--1515/16/16

BlackRock 2023 Global Outlook Page 14 Page 16

BlackRock 2023 Global Outlook Page 14 Page 16