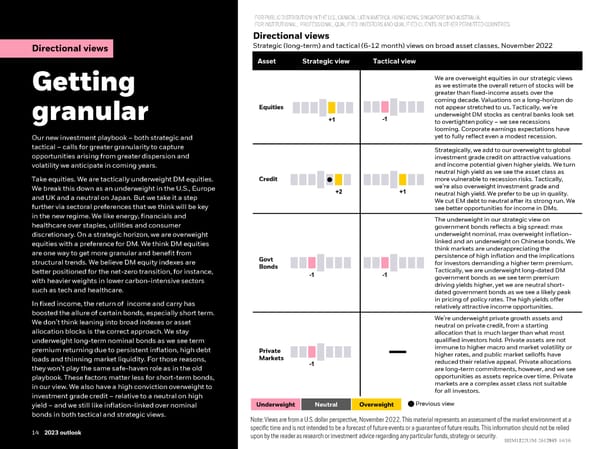

FOR PUBLIC DISTRIBUTION IN THE U.S., CANADA, LATIN AMERICA, HONGKONG, SINGAPORE AND AUSTRALIA. FOR INSTITUTIONAL, PROFESSIONAL, QUALIFIED INVESTORS AND QUALIFIED CLIENTS IN OTHER PERMITTED COUNTRIES. Directional views Directional views Strategic (long-term) and tactical (6-12 month) views on broad asset classes, November 2022 Asset Strategic view Tactical view We are overweight equities in our strategic views Getting as we estimate the overall return of stocks will be greater than fixed-income assets over the coming decade. Valuations on a long-horizon do Equities not appear stretched to us. Tactically, we’re granular underweight DM stocks as central banks look set to overtighten policy – we see recessions looming. Corporate earnings expectations have Our new investment playbook –both strategic and yet to fully reflect even a modest recession. tactical – calls for greater granularity to capture Strategically, we add to our overweight to global opportunities arising from greater dispersion and investment grade credit on attractive valuations volatility we anticipate in coming years. and income potential given higher yields. We turn neutral high yield as we see the asset class as Take equities. We are tactically underweight DM equities. Credit more vulnerable to recession risks. Tactically, We break this down as an underweight in the U.S., Europe we’re also overweight investment grade and and UK and a neutral on Japan. But we take it a step neutral high yield. We prefer to be up in quality. further via sectoral preferences that we think will be key We cut EM debt to neutral after its strong run. We see better opportunities for income in DMs. in the new regime. We like energy, financials and The underweight in our strategic view on healthcare over staples, utilities and consumer government bonds reflects a big spread: max discretionary. On a strategic horizon, we are overweight underweight nominal, max overweight inflation- equities with a preference for DM. We think DM equities linked and an underweight on Chinese bonds. We are one way to get more granular and benefit from think markets are underappreciating the Govt persistence of high inflation and the implications structural trends. We believe DM equity indexes are Bonds for investors demanding a higher term premium. better positioned for the net-zero transition, for instance, Tactically, we are underweight long-dated DM with heavier weights in lower carbon-intensive sectors government bonds as we see term premium such as tech and healthcare. driving yields higher, yet we are neutral short- dated government bonds as we see a likely peak In fixed income, the return of income and carry has in pricing of policy rates. The high yields offer relatively attractive income opportunities. boosted the allure of certain bonds, especially short term. We’re underweight private growth assets and We don’t think leaning into broad indexes or asset neutral on private credit, from a starting allocation blocks is the correct approach. We stay allocation that is much larger than what most underweight long-term nominal bonds as we see term qualified investors hold. Private assets are not premium returning due to persistent inflation, high debt Private immune to higher macro and market volatility or loads and thinning market liquidity. For those reasons, Markets higher rates, and public market selloffs have reduced their relative appeal. Private allocations they won’t play the same safe-haven role as in the old are long-term commitments, however, and we see playbook. These factors matter less for short-term bonds, opportunities as assets reprice over time. Private in our view. We also have a high conviction overweight to markets are a complex asset class not suitable investment grade credit –relative to a neutral on high for all investors. yield – and we still like inflation-linked over nominal Underweight Neutral Overweight nPrevious view bonds in both tactical and strategic views. Note: Views are from a U.S. dollar perspective, November 2022. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied 14 14 2022 midyear outlook 14 2023 outlook upon by the reader as research or investment advice regarding any particular funds, strategy or security. BBIIIIMM1122U/M1222U/M--26121472617935--1414/16/16

BlackRock 2023 Global Outlook Page 13 Page 15

BlackRock 2023 Global Outlook Page 13 Page 15