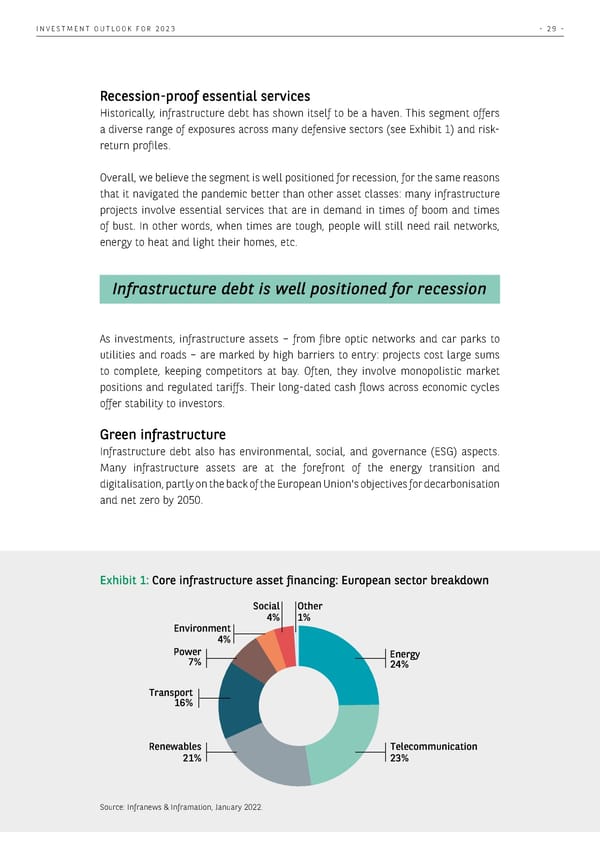

INVESTMENT OUTLOOK FOR 2023 - 29 - Recession-proof essential services Historically, infrastructure debt has shown itself to be a haven. This segment offers a diverse range of exposures across many defensive sectors (see Exhibit 1) and risk- return profiles. Overall, we believe the segment is well positioned for recession, for the same reasons that it navigated the pandemic better than other asset classes: many infrastructure projects involve essential services that are in demand in times of boom and times of bust. In other words, when times are tough, people will still need rail networks, energy to heat and light their homes, etc. Infrastructure debt is well positioned for recession As investments, infrastructure assets – from fibre optic networks and car parks to utilities and roads – are marked by high barriers to entry: projects cost large sums to complete, keeping competitors at bay. Often, they involve monopolistic market positions and regulated tariffs. Their long-dated cash flows across economic cycles offer stability to investors. Green infrastructure Infrastructure debt also has environmental, social, and governance (ESG) aspects. Many infrastructure assets are at the forefront of the energy transition and digitalisation, partly on the back of the European Union's objectives for decarbonisation and net zero by 2050. Exhibit 1: Core infrastructure asset financing: European sector breakdown Social Oter 4% 1% Environment 4% Power Energy 7% 24% Transport 16% Renewables Telecommunication 21% 23% Source: Infranews & Inframation, January 2022.

BNP Paribas The Investment Outlook for 2023 Page 28 Page 30

BNP Paribas The Investment Outlook for 2023 Page 28 Page 30