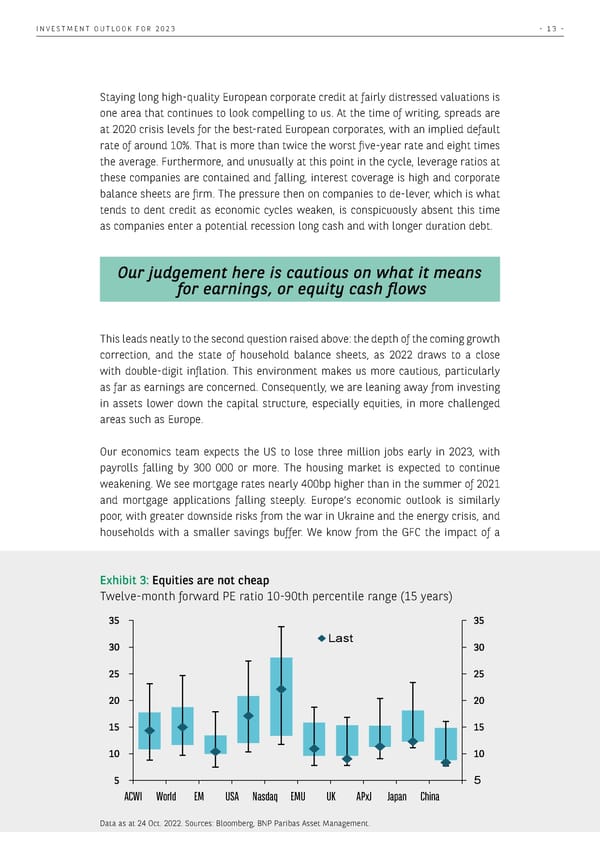

INVESTMENT OUTLOOK FOR 2023 - 13 - Staying long high-quality European corporate credit at fairly distressed valuations is one area that continues to look compelling to us. At the time of writing, spreads are at 2020 crisis levels for the best-rated European corporates, with an implied default rate of around 10%. That is more than twice the worst five-year rate and eight times the average. Furthermore, and unusually at this point in the cycle, leverage ratios at these companies are contained and falling, interest coverage is high and corporate balance sheets are firm. The pressure then on companies to de-lever, which is what tends to dent credit as economic cycles weaken, is conspicuously absent this time as companies enter a potential recession long cash and with longer duration debt. Our judgement here is cautious on what it means for earnings, or equity cash flows This leads neatly to the second question raised above: the depth of the coming growth correction, and the state of household balance sheets, as 2022 draws to a close with double-digit inflation. This environment makes us more cautious, particularly as far as earnings are concerned. Consequently, we are leaning away from investing in assets lower down the capital structure, especially equities, in more challenged areas such as Europe. Our economics team expects the US to lose three million jobs early in 2023, with payrolls falling by 300 000 or more. The housing market is expected to continue weakening. We see mortgage rates nearly 400bp higher than in the summer of 2021 and mortgage applications falling steeply. Europe’s economic outlook is similarly poor, with greater downside risks from the war in Ukraine and the energy crisis, and households with a smaller savings buffer. We know from the GFC the impact of a Exhibit 3: Equities are not cheap Twelve-month forward PE ratio 10-90th percentile range (15 years) 35 35 30 Last 30 25 25 20 20 15 15 10 10 5 5 ACWI World EM USA Nasdaq EMU UK APxJ Japan China Data as at 24 Oct. 2022. Sources: Bloomberg, BNP Paribas Asset Management.

BNP Paribas The Investment Outlook for 2023 Page 12 Page 14

BNP Paribas The Investment Outlook for 2023 Page 12 Page 14