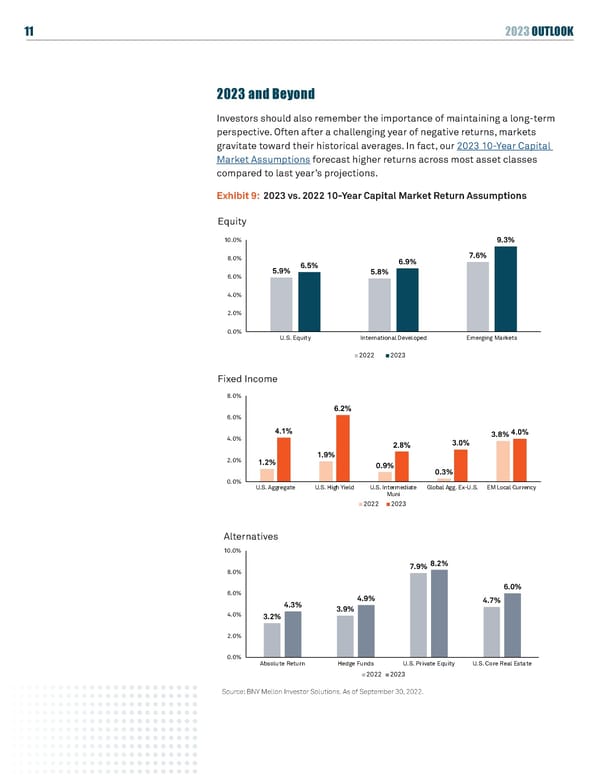

11 2023 OUTLOOK 2023 and Beyond Investors should also remember the importance of maintaining a long-term perspective. Often after a challenging year of negative returns, markets gravitate toward their historical averages. In fact, our 2023 10-Year Capital Market Assumptions forecast higher returns across most asset classes compared to last year’s projections. Exhibit 9: 2023 vs. 2022 10-Year Capital Market Return Exhibit 9: 2023 vs. 2022 10-Year Capital Market Return Assumptions Assumptions Equity 10.0% 9.3% 8.0% 6.9% 7.6% 5.9% 6.5% 5.8% 6.0% 4.0% 2.0% 0.0% U.S. Equity International Developed Emerging Markets Exhibit 9: 2023 vs. 2022 10-Year Capital Market Return Assumptions 2022 2023 Source: BNY Mellon Investor Solutions. Data as of September 30, 2022 Fixed Income 8.0% 6.2% 6.0% 4.1% 3.8%4.0% 4.0% 2.8% 3.0% 9 1.9% 2.0% 1.2% 0.9% 0.3% 0.0% U.S. Aggregate U.S. High Yield U.S. Intermediate Global Agg. Ex-U.S. EM Local Currency Muni 2022 2023 Exhibit 9: 2023 vs. 2022 10-Year Capital Market Return Source: BNY Mellon Investor Solutions. Data as of September 30, 2022 Assumptions Alternatives 10.0% 7.9% 8.2% 8.0% 6.0% 6.0% 4.9% 4.3% 4.7% 10 3.9% 4.0% 3.2% 2.0% 0.0% Absolute Return Hedge Funds U.S. Private Equity U.S. Core Real Estate 2022 2023 Source: BNY Mellon Investor Solutions. As of September 30, 2022. Source: BNY Mellon Investor Solutions. Data as of September 30, 2022 11

BNY Mellon 2023 Outlook Page 10 Page 12

BNY Mellon 2023 Outlook Page 10 Page 12