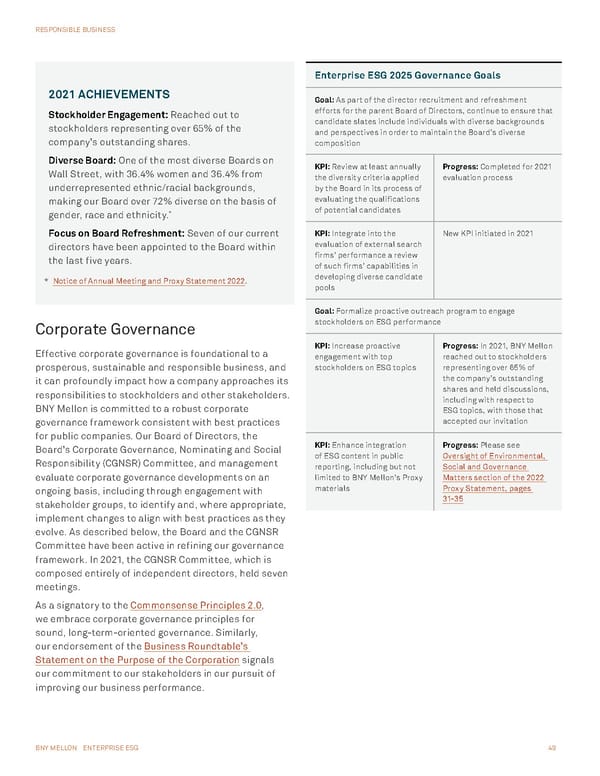

BNY MELLON ENTERPRISE ESG 49 RESPONSIBLE BUSINESS 2021 ACHIEVEMENTS Stockholder Engagement: Reached out to stockholders representing over 65% of the company’s outstanding shares. Diverse Board: One of the most diverse Boards on Wall Street, with 36.4% women and 36.4% from underrepresented ethnic/racial backgrounds, making our Board over 72% diverse on the basis of gender, race and ethnicity. * Focus on Board Refreshment: Seven of our current directors have been appointed to the Board within the last five years. * Notice of Annual Meeting and Proxy Statement 2022 . Corporate Governance Effective corporate governance is foundational to a prosperous, sustainable and responsible business, and it can profoundly impact how a company approaches its responsibilities to stockholders and other stakeholders. BNY Mellon is committed to a robust corporate governance framework consistent with best practices for public companies. Our Board of Directors, the Board’s Corporate Governance, Nominating and Social Responsibility (CGNSR) Committee, and management evaluate corporate governance developments on an ongoing basis, including through engagement with stakeholder groups, to identify and, where appropriate, implement changes to align with best practices as they evolve. As described below, the Board and the CGNSR Committee have been active in refining our governance framework. In 2021, the CGNSR Committee, which is composed entirely of independent directors, held seven meetings. As a signatory to the Commonsense Principles 2.0 , we embrace corporate governance principles for sound, long-term-oriented governance. Similarly, our endorsement of the Business Roundtable’s Statement on the Purpose of the Corporation signals our commitment to our stakeholders in our pursuit of improving our business performance. Enterprise ESG 2025 Governance Goals Goal: As part of the director recruitment and refreshment efforts for the parent Board of Directors, continue to ensure that candidate slates include individuals with diverse backgrounds and perspectives in order to maintain the Board’s diverse composition KPI: Review at least annually the diversity criteria applied by the Board in its process of evaluating the qualifications of potential candidates Progress: Completed for 2021 evaluation process KPI: Integrate into the evaluation of external search firms’ performance a review of such firms’ capabilities in developing diverse candidate pools New KPI initiated in 2021 Goal: Formalize proactive outreach program to engage stockholders on ESG performance KPI: Increase proactive engagement with top stockholders on ESG topics Progress: In 2021, BNY Mellon reached out to stockholders representing over 65% of the company’s outstanding shares and held discussions, including with respect to ESG topics, with those that accepted our invitation KPI: Enhance integration of ESG content in public reporting, including but not limited to BNY Mellon’s Proxy materials Progress: Please see Oversight of Environmental, Social and Governance Matters section of the 2022 Proxy Statement, pages 31-35

BNY Mellon ESG Report Page 48 Page 50

BNY Mellon ESG Report Page 48 Page 50