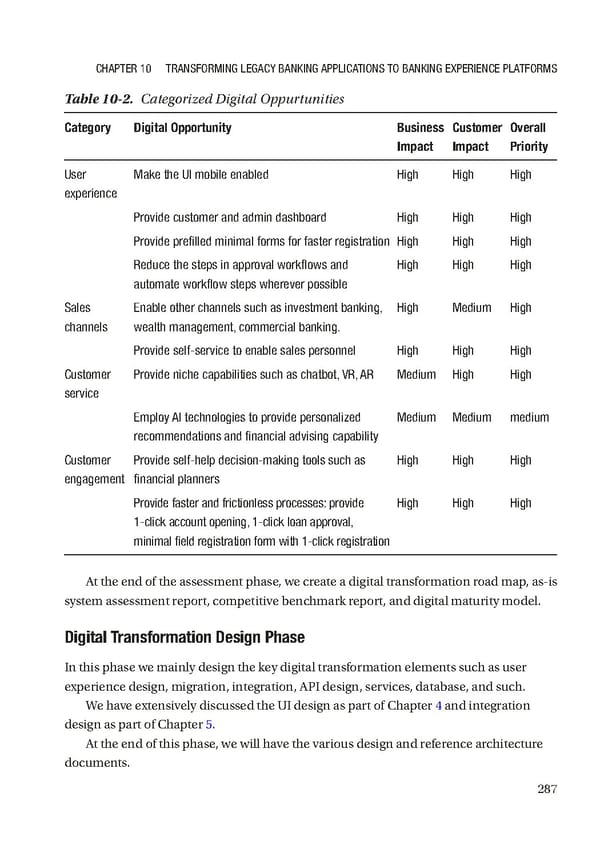

Chapter 10 transforming LegaCy Banking appLiCations to Banking experienCe pLatforms Table 10-2. Categorized Digital Oppurtunities Category Digital Opportunity Business Customer Overall Impact Impact Priority User make the Ui mobile enabled high high high experience provide customer and admin dashboard high high high provide prefilled minimal forms for faster registration high high high reduce the steps in approval workflows and high high high automate workflow steps wherever possible sales enable other channels such as investment banking, high medium high channels wealth management, commercial banking. provide self-service to enable sales personnel high high high Customer provide niche capabilities such as chatbot, Vr, ar medium high high service employ ai technologies to provide personalized medium medium medium recommendations and financial advising capability Customer provide self-help decision-making tools such as high high high engagement financial planners provide faster and frictionless processes: provide high high high 1-click account opening, 1-click loan approval, minimal field registration form with 1-click registration At the end of the assessment phase, we create a digital transformation road map, as-is system assessment report, competitive benchmark report, and digital maturity model. Digital Transformation Design Phase In this phase we mainly design the key digital transformation elements such as user experience design, migration, integration, API design, services, database, and such. We have extensively discussed the UI design as part of Chapter 4 and integration design as part of Chapter 5. At the end of this phase, we will have the various design and reference architecture documents. 287

Building Digital Experience Platforms Page 299 Page 301

Building Digital Experience Platforms Page 299 Page 301