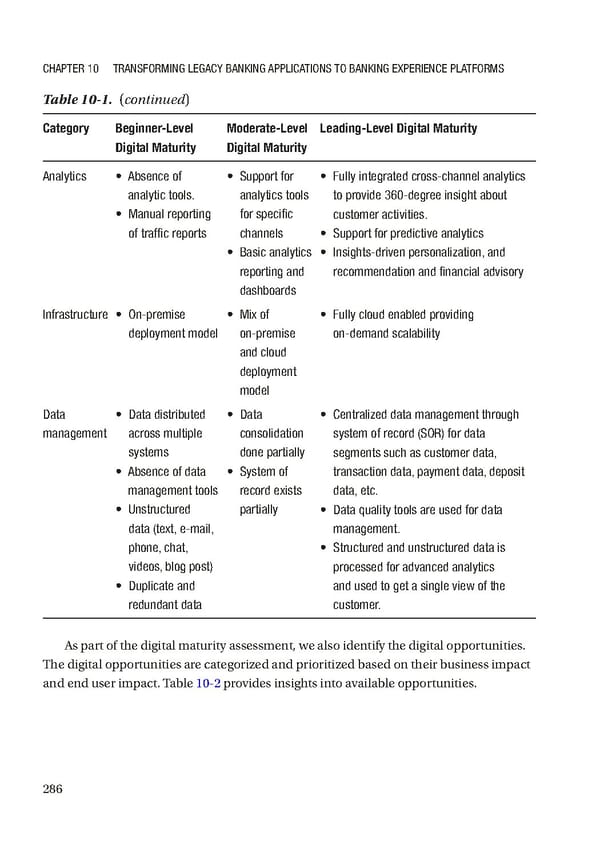

Chapter 10 transforming LegaCy Banking appLiCations to Banking experienCe pLatforms Table 10-1. (continued) Category Beginner-Level Moderate-Level Leading-Level Digital Maturity Digital Maturity Digital Maturity analytics • absence of • support for • fully integrated cross-channel analytics analytic tools. analytics tools to provide 360-degree insight about • manual reporting for specific customer activities. of traffic reports channels • support for predictive analytics • Basic analytics • insights-driven personalization, and reporting and recommendation and financial advisory dashboards infrastructure • on-premise • mix of • fully cloud enabled providing deployment model on- premise on- demand scalability and cloud deployment model Data • Data distributed • Data • Centralized data management through management across multiple consolidation system of record (sor) for data systems done partially segments such as customer data, • absence of data • system of transaction data, payment data, deposit management tools record exists data, etc. • Unstructured partially • Data quality tools are used for data data (text, e-mail, management. phone, chat, • structured and unstructured data is videos, blog post) processed for advanced analytics • Duplicate and and used to get a single view of the redundant data customer. As part of the digital maturity assessment, we also identify the digital opportunities. The digital opportunities are categorized and prioritized based on their business impact and end user impact. Table 10-2 provides insights into available opportunities. 286

Building Digital Experience Platforms Page 298 Page 300

Building Digital Experience Platforms Page 298 Page 300