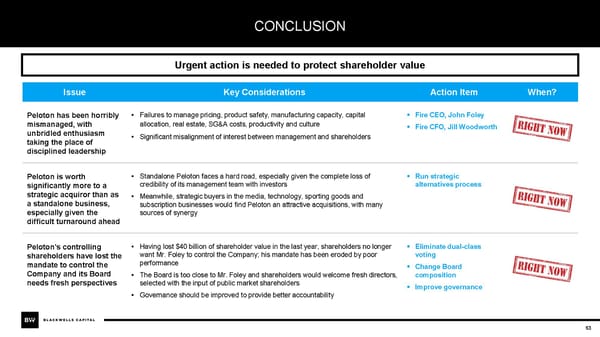

CONCLUSION Urgent action is needed to protect shareholder value Issue Key Considerations Action Item When? Peloton has been horribly • Failures to manage pricing, product safety, manufacturing capacity, capital ▪ Fire CEO, John Foley mismanaged, with allocation, real estate, SG&A costs, productivity and culture ▪ Fire CFO, Jill Woodworth unbridled enthusiasm • Significant misalignment of interest between management and shareholders taking the place of disciplined leadership Peloton is worth • Standalone Peloton faces a hard road, especially given the complete loss of ▪ Run strategic significantly more to a credibility of its management team with investors alternatives process strategic acquiror than as • Meanwhile, strategic buyers in the media, technology, sporting goods and a standalone business, subscription businesses would find Peloton an attractive acquisitions, with many especially given the sources of synergy difficult turnaround ahead Peloton’s controlling • Having lost $40 billion of shareholder value in the last year, shareholders no longer ▪ Eliminate dual-class shareholders have lost the want Mr. Foley to control the Company; his mandate has been eroded by poor voting mandate to control the performance ▪ Change Board Company and its Board • The Board is too close to Mr. Foley and shareholders would welcome fresh directors, composition needs fresh perspectives selected with the input of public market shareholders ▪ Improve governance • Governance should be improved to provide better accountability 63

BW Peloton Presentation Feb 07 2022 Page 62 Page 64

BW Peloton Presentation Feb 07 2022 Page 62 Page 64