BW Peloton Presentation Feb 07 2022

Peloton: A Call For Action Presented by Backwells Capital

IR

hedge fund

Peloton Interactive

Activist Investor

PELOTON A CALL FOR ACTION PRESENTED BY BLACKWELLS CAPITAL February 2022 Peloton Interactive, Inc. (NASDAQ: PTON)

DISCLAIMER The views expressed in this presentation (the “Presentation”) represent the opinions of The securities or investment ideas listed are not presented in order to suggest or show profitability Blackwells Capital LLC and/or certain of its affiliates (“Blackwells”) and the investment funds it of any or all transactions. There should be no assumption that any specific portfolio securities managesthat hold shares in Peloton Interactive, Inc. (the “Company”, “Peloton”, or “PTON”). The identified and described in the Presentation were or will be profitable. Under no circumstances is Presentation is for informational purposes only, and it does not have regard to the specific the Presentation to be used or considered as an offer to sell or a solicitation of an offer to buy any investment objective, financial situation, suitability or particular need of any specific person who security. mayreceive the Presentation, and should not be taken as advice on the merits of any investment decision. The views expressed in the Presentation represent the opinions of Blackwells, and are This document is the property of Blackwells and may not be published or distributed without the basedonpublicly available information and Blackwells’ analyses. express written consent of Blackwells. All registered or unregistered service marks, trademarks and trade names referred to in the Presentation are the property of their respective owners, and Certain financial information and data used in the Presentation have been derived or obtained Blackwells’ use herein does not imply an affiliation with, or endorsement by, the owners of these from filings made with the Securities and Exchange Commission (“SEC”) by the Company or service marks, trademarks and trade names. other companies that Blackwells considers comparable, as well as from third party sources. Blackwells has not sought or obtained consent from any third party to use any statements or The information herein contains “forward-looking statements.” Specific forward-looking statements information indicated in the Presentation as having been obtained or derived from a third party. can be identified by the fact that they do not relate strictly to historical or current facts and include, Any such statements or information should not be viewed as indicating the support of such third without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” party for the views expressed in the Presentation. Information contained in the Presentation has “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could,” “should” or the negative of such not been independently verified by Blackwells. Blackwells disclaims any obligation to correct or terms or other variations on such terms or comparable terminology. Similarly, statements that update the Presentation or to otherwise provide any additional materials. Blackwells recognizes describe our objectives, plans or goals are forward-looking. Forward-looking statements are that the Company may possess confidential information that could lead it to disagree with subject to various risks and uncertainties and assumptions. There can be no assurance that any Blackwells’ views and/or conclusions. idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if Blackwells’ underlying assumptions prove to be incorrect, the actual results may Blackwells currently beneficially owns, and/or has an economic interest in, shares of the vary materially from outcomes indicated by these statements. Accordingly, forward-looking Company. Blackwells is in the business of trading—buying and selling—securities. Blackwells statements should not be regarded as a representation by Blackwells that the future plans, may buy or sell or otherwise change the form or substance of any of its investments in any estimates or expectations contemplated will ever be achieved. manner permitted by law and expressly disclaims any obligation to notify any recipient of the Presentation of any such changes. There may be developments in the future that cause Blackwells to engage in transactions that change its beneficial ownership and/or economic interest in the Company. 2

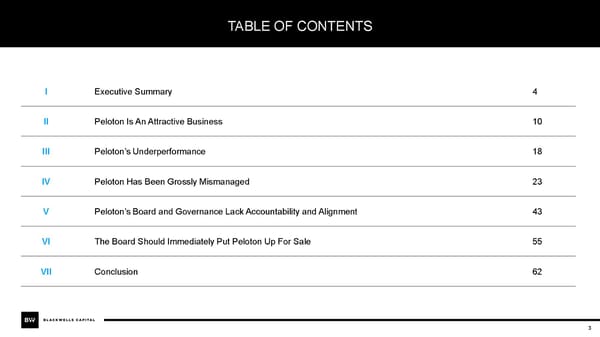

TABLE OF CONTENTS I Executive Summary 4 II Peloton Is An Attractive Business 10 III Peloton’s Underperformance 18 IV Peloton Has Been Grossly Mismanaged 23 V Peloton’s Board and Governance Lack Accountability and Alignment 43 VI The Board Should Immediately Put Peloton Up For Sale 55 VII Conclusion 62 3

PELOTON INTERACTIVE, INC. Executive Summary

EXECUTIVE SUMMARY:OVERVIEW OF PELOTON 2021 Total Shareholder Returns ▪ Peloton is an interactive fitness platform with millions of 20% members, offering connected, technology-enabled fitness 0% classes that utilize its proprietary hardware ▪ The Company’s Connected Fitness products include the Peloton -20% Bike, Bike+, Peloton Tread and Tread+ -40% ▪ Peloton generates strong recurring revenue from its Members, -60% who pay subscription fees to access Peloton’s app or Connected Fitness products -80% -76% ▪ The Company has been challenged by a series of execution -100% errors; as a result, Q1 2022 revenue was down ~36% from the Jan-21 Apr-21 Jul-21 Oct-21 Company’s peak in Q3 2021 LTM Revenue by Source Total Revenue ($M) Enterprise Value $8,753 Million $1,262 Market Cap $8,043 Million $1,065 $937 25% $805 LTM Revenue $4,069 Million LTM Adj. EBITDA ($99) Million 75% EV/LTM Revenue 2.2x Employees (as of June 30, 2021) 8,976 Connected Fitness Revenue Subscription Revenue 2Q 21 3Q 21 4Q 21 1Q 21 LTM Revenue/Employee $453,342 Source: Bloomberg, Company filings. Note: Data as of February 4, 2022 unless specified otherwise. 5

EXECUTIVE SUMMARY:A HIGHLY COVETED ASSET Peloton has the hallmarks of an extremely valuable and attractive business, which need to be protected ▪ Large addressable market; early days for market penetration ▪ Largest interactive fitness platform ▪ Admired brand with top-ranked NPS scores ▪ Recurring subscription-based revenue model with high incremental margins ▪ Network effects from ecosystem and stickiness from “star” instructors ▪ Highly engaged subscriber base with low churn ▪ Multiple growth drivers, including unrealized pricing power ▪ Significant intellectual property 6

EXECUTIVE SUMMARY: PELOTON’S PERFORMANCE HAS BEEN ABYSMAL Peloton’s 2021 total shareholder return of -76% was the worst of any company in the Nasdaq 300 Index 2021 Total Shareholder Return of Nasdaq 300 Companies -76% -100% -50% 0% 50% 100% 150% 200% Source: FactSet. Calendar year 2021 7

EXECUTIVE SUMMARY: UNDERPERFORMANCE CAN BE TRACED TO SEVERAL FACTORS Peloton’s escalating problems stem from poor decisions and misaligned incentives 1 Lack of Management Qualifications 2 Poor Decision Making 3 Lack of Financial Discipline 4 Misalignment of Interests 5 Loss of Credibility 8

EXECUTIVE SUMMARY: THE BOARD MUST EXAMINE A SALE OF THE COMPANY Peloton’s Board should compare the risk-adjusted Potential Acquirors Could Include standalone value to a sale Types of Acquirers Examples ▪ A stand-alone Peloton cannot achieve its full potential given: – Lack of management capability and credibility Media and Content – A stressed balance sheet and ongoing significant cash burn ▪ It will take years of operational restructuring, organizational re- Technology and Devices development and positive results for the company to regain investor confidence and multiple expansion ▪ Peloton would be extremely attractive to several technology, Sporting Goods streaming, media, metaverse and sportswear companies interested in extending into the rapidly growing health and wellness category Online Subscriptions 9

PELOTON INTERACTIVE, INC. Peloton is an Attractive Business

PELOTON HAS UNIQUE AND APPEALING CHARACTERISTICS ✓ High quality, intelligently-designed products that become the centerpiece of a home gym ✓ Subscription model with a wide variety of fresh, immersive fitness classes leading to resilient memberships ✓ Talented “star” instructors, great music, cool technology and an interactive competitive experience (live and on-demand) ✓ Top-ranked brand and industry-leading Net Promotor Scores (NPS) enable new product extensions into additional fitness equipment, apparel and accessories ✓ Extremely difficult for competitors to replicate the business model, technological innovation and community supporters ✓ Retail stores and direct-to-consumer delivery and service capabilities create a powerful advantage over competitors 11

DISRUPTIVE BUSINESS UPENDING TRADITIONAL HEALTH & FITNESS MODELS Peloton’s disruptive business model fundamentally Global Digital Disruption improves the fitness experience across two key variables: Convenience and Cost Disrupted Disruptor ▪ Convenience Movies ~40,000 local and regional theater operators – Unlimited fitness classes anytime, anywhere, on any device ~13,000 local and regional – Nearly 1,000 new classes per month: cycling, Video Games dedicated arcades running, strength training, bootcamp, stretching, yoga and meditation ~3,300 independent ▪ Cost Music record stores – Entire household for $39.00 per month compares favorably to ~$300 per month per person for Books ~38,500 local and boutique fitness classes national bookstores – Financing program for bikes and treadmills unlocks ~36,500 health clubs and demand from cohort of gym goers that would Fitness boutique fitness operators otherwise be unable to afford the offering Source: Company website and Company filings. 12

LARGE ADDRESSABLE MARKET IN EARLY INNINGS OF MARKET PENETRATION Numerous drivers as Peloton transitions from a largely US bike business into a global fitness platform Large Addressable Market Increased Penetration of Existing Markets ▪ Global wellness spending ~ $4.2 trillion of which fitness is ✓ U.S. ~ $600 billion ✓ Canada ▪ Approximately 180 million gym memberships globally in ✓ U.K. 2018 including approximately 62 million in the U.S. ✓ Germany ✓ Australia Early Innings of Market Penetration New International Markets ▪ In 2020, there were 74 million people who went to gyms ✓ Northern Europe in the United States ✓ Western Europe ▪ Planet Fitness alone has ~14 million members ✓ Mexico ✓ Asia Expanded Connected Fitness Product Portfolio Source: Global Wellness Institute, Gym membership data per JPMorgan Equity Research, BMO Connected Fitness Primer, Livestrong.com. 13

HIGHLY ENGAGED SUBSCRIBER BASE WITH LOW CHURN & SAAS BUSINESS UNIT ECONOMICS Highly engaged subscriber base with low churn creates a strong, recurring revenue stream Connected Fitness Subscribers 2,331 Attractive Underlying Unit Economics 2,081 1,667 1,091 1,334 712 886 ✓Ability to drive significant operating leverage as business scales 362 457 511 562 123 168 217 245 276 • High subscription contribution margin of 60% to 70% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2018 2018 2018 2018 2019 2019 2019 2019 2020 2020 2020 2020 2021 2021 2021 2021 • Significant content leverage across existing studios (U.S. and U.K.) and instructors Total Workouts 149,541 ✓Attractive Lifetime Value 134,334 98,075 • Low churn 77,767 76,817 44,155 • Historically offset cost of customer acquisition with gross profit 24,345 17,988 19,171 5,902 6,223 7,069 9,336 17,759 earned on Connected Fitness Products 2,501 3,231 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2018 2018 2018 2018 2019 2019 2019 2019 2020 2020 2020 2020 2021 2021 2021 2021 Source: Company filings. 14

POWERFUL NETWORK EFFECTS “Star” instructors and social media creates competitive moat and network effect ▪ Peloton’s instructors provide differentiated experience and Monthly Workouts Per Subscriber have grown significant social media followings ▪ Frequency of workouts has increased, reflecting customer 24.7 26.0 satisfaction 20.7 21.1 19.9 17.7 ▪ The platform has a social aspect, so satisfied customers are 13.9 12.0 12.6 9.7 11.7 likely to refer friends 9.6 8.7 8.9 7.1 7.4 ▪ This virtuous circle that allows company to invest in more content and the social aspects of the platform Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2018 2018 2018 2018 2019 2019 2019 2019 2020 2020 2020 2020 2021 2021 2021 2021 Instructors Instagram Followings Robin Ally Cody Emma Jess Alex Kendall Matt Erik Hannah Arzon Love Rigsby Lovewell King Toussaint Toole Wilpers Jager Corbin 946 k 826 k 1 m 555 k 412 k 536 k 632 k 218 k 82.5 k 213 k Source: Company filings and Instagram. Instagram follower data as of February 4, 2022. 15

PELOTON STOCK IS UNDERVALUED: EV/REVENUE Peloton is worth substantially more than its current stock price using Revenue multiples ▪ Peloton’s peers currently trade at an average of 5.6x EV / NTM Revenue Peers EV / NTM Revenue ▪ Applying a range of EV / Revenue on Peloton’s FYE 6/30/23 expected revenue yields an implied price per share of $57.79 - $87.75 10.5x Peloton Est. Revenue $4,986 ($ in million) FYE 6/2023 6.1x 5.1x EV/Revenue Multiple 4x 5x 6x 3.9x 2.6x Implied Share Price $57.79 $72.77 $87.75 SPOT SIRI ROKU NFLX MTCH Sources: Company filings. Consensus data from CapitalIQ. Company closing stock price trading session as of February 4, 2022, per Bloomberg. 16 Note: Based on net debt of $711 million and 333 million shares outstanding.

PELOTON STOCK IS UNDERVALUED: EV/GROSS PROFIT Peloton is worth substantially more than its current stock price using Gross Profit multiples ▪ Peloton’s peers currently trade at an average of 11.5x EV / NTM Gross Profit Peers EV / NTM Gross Profit ▪ Applying a range of EV / Gross Profit on Peloton’s FYE 6/30/23 expected gross profit yields an implied price per share of $59.36 - $83.96 13.8x 14.0x 13.2x Peloton Est. Gross Profit $2,047 9.8x ($ in millions) FYE 6/2023 6.5x EV/Gross Profit Multiple 10x 12x 14x Implied Share Price $59.36 $71.66 $83.96 SIRI SPOT ROKU NFLX MTCH Sources: Company filings. Consensus data from CapitalIQ. Company closing stock price trading session as of February 4, 2022, per Bloomberg. 17 Note: Based on net debt of $711 million and 333 million shares outstanding.

PELOTON INTERACTIVE, INC. Peloton’s Underperformance

PELOTON’S STOCK HAS PERFORMED POORLY Peloton One-Year Stock Price Performance $160.00 $140.00 $120.00 $100.00 -84% $80.00 $60.00 $40.00 IPO Price $29.00 $20.00 $0.00 Feb-21 May-21 Aug-21 Nov-21 Source: FactSet. Note: Data as of February 4, 2022. 19

JOHN FOLEY BELIEVES PELOTON IS PERFORMING WELL We think we are playing chess where others are – to be honest, aren’t even playing checkers. John Foley September 22, 2021 Source: Peloton Interactive Goldman Sachs Communacopia Conference transcript. 20

YET, PELOTON’S RELATIVE SHAREHOLDER RETURNS HAVE BEEN ABYSMAL… 1-Year Total Shareholder Return Total Shareholder Return Since IPO Subscription Peers -26% Subscription Peers 52% Proxy Peers -45% Proxy Peers 52% Russell 1000 Growth 10% Russell 1000 Growth 74% Nasdaq 1% Nasdaq 76% S&P 500 18% S&P 500 57% -84% -5% -100% -75% -50% -25% 0% 25% 50% -25% 0% 25% 50% 75% 100% 2021 Total Shareholder Return Total Shareholder Return Since March 2020 Subscription Peers -13% Subscription Peers 19% Proxy Peers -31% Proxy Peers 29% Russell 1000 Growth 28% Russell 1000 Growth 66% Nasdaq 22% Nasdaq 64% S&P 500 29% S&P 500 57% -76% -8% -100% -75% -50% -25% 0% 25% 50% -25% 0% 25% 50% 75% 100% Source: FactSet. Note: Data as of February 4, 2022. Peer data refers to peer median. “Subscription Peers” include Match Group, Netflix, Roku, Sirius XM Holdings and Spotify. 21

…AND INVESTORS AND ANALYSTS REMAIN SKEPTICAL Despite Peloton’s low multiple, investors are still actively betting against the stock, and the analyst community appears to doubt management’s ability to execute EV/2022E Revenue Short Interest % “Sell” or “Hold” Ratings 10.3x Nasdaq 300 1% 23% Proxy Peers 7.0x 2% 25% 5.8x 3% Proxy Peers 27% Subscription Peers 5.2x 5% 37% 5.2x Subscription Peers 5% Subscription Peers 37% Nasdaq 300 4.9x Proxy Peers 5% Nasdaq 300 37% 4.0x 5% 47% 2.3x 12% 48% 2.2x 24% 49% 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 0% 5% 10% 15% 20% 25% 30% 0% 10% 20% 30% 40% 50% 60% Source: FactSet. Note: Data as of February 4, 2022. Peer data refers to peer median. “Subscription Peers” include Match Group, Netflix, Roku, Sirius XM Holdings and Spotify. 22

PELOTON INTERACTIVE, INC. Peloton Has Been Grossly Mismanaged

PELOTON’S UNDERPERFORMANCE IS DUE TO MISMANAGEMENT Peloton’s escalating problems stem from poor decisions and misaligned incentives 1 Lack of Qualification: CEO John Foley is right to be insecure about his capabilities and qualifications 2 Poor Decision Making: Mr. Foley has made a series of poor decisions relating to product, pricing, demand, safety and capital allocation 3 Lack of Financial Discipline: Under Mr. Foley’s management, the Company suffers from a lack of financial discipline and ineffective internal controls 4 Misalignment of Interests: Mr. Foley’s interests and incentives are misaligned with employees and shareholders 5 Loss of Credibility: Mr. Foley has lost credibility with discontent employees, shareholders and analysts 24

1 LACK OF QUALIFICATION: FOLEY ON FOLEY I think I’m not a very good manager ¹ I interview almost nobody ² Interview with John Foley, Peloton CEO³ Is there anything about being CEO that you How would your colleagues, your co-founders, don’t like, that you like to delegate? describe your strengths as a manager? John Foley’s Response John Foley’s Response Finance. Our CFO does 99% of finance. I engage because I want to know how we’re doing. But to say I don’t add value to her operation is an understatement. I’m not sure they’d say I have many strengths at all. You can also say the same with technology. Our CTO doesn’t get any help from me. I’ll go sometimes months without talking to our CTO, which as a CEO of a technology company, that’s kind of rare. 1. ABC News interview, May 5, 2016: https://abcnews.go.com/Business/peloton-fitness-apple-technology/story?id=38886911. 25 2. LinkedIn interview, March 13, 2019: https://www.linkedin.com/pulse/one-believed-pelotons-ceo-he-built-company-heres-how-john-daniel-roth/ 3. Time Magazine interview, May 26, 2020: https://time.com/5839552/peloton-ceo-john-foley/

1 LACK OF QUALIFICATION: MR. FOLEY MANAGES WITH UNBRIDLED OPTIMISM RATHER THAN DISCIPLINE Peloton’s Share Price in 2021 $180.00 $160.00 “[O]ur domestic business “[W]e’ve never been more is just growing so fast, and excited about our future it’s still such a beautiful “[W]e have never been $140.00 road map.”2 growth story…”3 more excited about our future than we are today.”4 $120.00 $100.00 “[W]e remain very, very bullish on our opportunity. $80.00 We haven’t seen any softening of demand.”1 $60.00 ▪ Quarter over quarter revenue declined 14% during the most recent quarter ▪ Quarter over quarter user growth declined from 23% to 5% during CY 2021 $40.00 ▪ Monthly workouts per active user have declined from 26.0 to 16.6 during the - 76% same period $20.00 ▪ Meanwhile, inventory has more than doubled to $1.3 billion $0.00 Jan-21 Apr-21 Jul-21 Oct-21 1. Peloton Interactive Q2 2021 Earnings Call transcript. 3. Peloton Interactive Goldman Sachs Communacopia Conference transcript. 26 2. Peloton Interactive Q3 2021 Earnings Call transcript. 4. Peloton Interactive Q1 2022 Earnings Call transcript.

2 POOR DECISION MAKING: INCONSISTENT GO-TO-MARKET STRATEGY “What’s the optimal price point, $1000?”¹ “I don’t know.” –John Foley Management does not have a well-informed pricing strategy and continues to vacillate on pricing strategy, confusing the market and harming shareholders August 26, 2021 January 18, 2022 1. Interview question to Mr. Foley regarding pricing: “Peloton CEO John Foley Talks Cheaper Bikes and Making the Most of Staying Home”, Time Magazine, May 26, 2020. 27

2 POOR DECISION MAKING: INABILITY TO FORECAST DEMAND The actual hardware sales are incredibly predictable. It’s a beautiful business. ¹ ▪ Foley insisted demand would only ever increase “How [do] you envision managing, – Foley massively increased production capacity in 2020, meeting the incredible demand that building inventory you’re seeing now versus the risk of overbuilding [supply]…” – In February 2021, Foley boasted: “We've increased the [manufacturing] capacity by 6x, which is pretty herculean, but we're definitely not going to stop there. We bought Precor. John Foley’s Response We're going to be investing in U.S. manufacturing.”4 ▪ But then demand slowed. Foley noted (at the same “[T]hat’s a term that’s never come up February conference): “We're now making more bikes in the Peloton senior leadership and treads than we're selling”4 rooms or boardrooms…We see that we’re going to be able to market into – “One employee said warehouses resembled ‘jigsaw puzzles’ with a massive opportunity that we’re 2 employees trying to figure out where to stuff another bike.” going to need supply chain capacity ▪ Peloton has now been forced to moth-ball production² for years and years.”³ 1. Source: John Foley on CNBC. November 5, 2019. https://www.youtube.com/watch?v=jZO-IBmp39o 3. Mr. Foley responding to a question from a Goldman Sachs analyst on Q4 2020 Earnings Call. 28 2. Source: https://www.businessinsider.com/leaked-slides-show-peloton-planning-production-pause-2022-1. 4. Mr. Foley at Goldman Sachs Investor Conference, February 11, 2021.

2 POOR DECISION MAKING: DISASTROUS BUNGLING OF TREADMILL SAFETY ISSUES Child Dies in Accident Involving Peloton Treadmill¹ April 17 April 17 May 5 CPSC Issues Statement Peloton Irresponsibly and Peloton Belatedly Warning Consumers About Reflexively Denies the Issue Acknowledges Issues Peloton’s Tread+ and Apologizes “The U.S. CPSC is warning “The company is troubled by the Statement from John Foley consumers about the danger of Consumer Product Safety “Peloton made a mistake in our popular Peloton Tread+ exercise Commission's (CPSC) unilateral press initial response to the Consumer machineafter multiple incidents of release about the Peloton Tread+ Product Safety Commission’s request small children and a pet being injured because it is inaccurate and that we recall the Tread+. We should beneath the machines.”² misleading. There is no reason to have engaged more productively stop using the Tread+…”³ with them from the outset.”4 Foley’s lack of leadership has jeopardized health and safety 1. Source: https://www.nytimes.com/2021/03/18/business/peloton-tread-death.html. 3. Source: Peloton press release issued April 17, 2021. 29 2. Source: “CPSC Warns Consumers: Stop Using the Peloton Tread+”: https://www.cpsc.gov/Newsroom/News- 4. Source: https://www.onepeloton.com/press/articles/tread-and-tread-recall. Releases/2021/CPSC-Warns-Consumers-Stop-Using-the-Peloton-Tread.

2 POOR DECISION MAKING: POOR CAPITAL ALLOCATION ▪ Foley invested $800 million in acquisitions and capex with pride as his lodestar ▪ Foley bought troubled Precor for $431 million believing he could fix it and expand Peloton’s reach into different types of commercial customers: “Precor’s product portfolio and “The slowdown in demand for Peloton sales team will also accelerate our commercial business, makes its past decisions particularly where we see a significant opportunity to grow Precor’s franchise while introducing the Peloton platform…”1 challenging. The company acquired exercise – Months later, he was forced to admit it was a mistake: equipment manufacturer Precor for $420 “[W]e have reduced expectations for our commercial million in 2020 and announced it would build a channel or legacy Precor business, given both supply US manufacturing facility for about $400 2 million. But Peloton may not need that extra and demand dynamics.” capacity if demand doesn't recover to the ▪ Then, Foley invested another $400 million to develop 1 million levels it saw during the pandemic.”3 square feet of production capacity – Seven months later, Foley delayed the progress, admitting the capacity was not needed 1. Source: Peloton Interactive Q2 2021 Earnings Call transcript. 30 2. Source: Peloton Interactive Q1 2022 Earnings Call transcript. 3. Source: https://markets.businessinsider.com/news/stocks/peloton-stock-falls-below-ipo-price-production-halt-demand-drop-2022-1.

2 POOR DECISION MAKING: UNNECESSARY & EXPENSIVE OFFICE SPACE IN NYC Peloton signed a 15-year lease that totals more than $450 million to be paid over the period ▪ At the end of 2018, Peloton signed a 15-year ▪ The move represented a +6x increase of space lease for 300,000 square feet in Manhattan from the company’s prior location in Manhattan Source: Company filings. 31

3 LACK OF FINANCIAL DISCIPLINE: BLOATED SG&A COSTS WEIGHS ON CASH BALANCE Out-of-control employee and SG&A expenses reflect a lack of discipline ▪ Over the past four years Peloton’s employee count Peloton Employee Growth 2017 – Today has grown by over 20x 8,662 8,976 ▪ SG&A costs have nearly tripled in the last three years 3,694 1,954 ▪ Compared to other subscription-based companies, 443 Peloton has the lowest revenue per employee FY 17 FY 19 FY 20 FY 21 Curent ▪ The Company now appears to be reversing course: rumors Revenue Per Employee Peloton Vs. Subscription Peers are that it will fire a significant portion of its workforce $2,956,881 $2,373,055 $1,887,939 “We’re insanely disciplined”1 $1,608,808 $1,451,986 –Foley, on CNBC the day of Peloton’s IPO $471,397 NFLX SPOT MTCH SIRI ROKU PTON Source: CapIQ, Company filings. 32 1. Source: Mr. Foley on CNBC September 26, 2019: https://www.youtube.com/watch?v=L-PcR2f0EKE.

3 LACK OF FINANCIAL DISCIPLINE: INTERNAL CONTROLS ISSUES Peloton fails to maintain adequate internal accounting controls ▪ Peloton has failed to develop basic public company accounting We have identified a material processes under Mr. Foley weakness in our internal control ▪ There is no excuse for having inadequate accounting procedures and controls at a multi-billion-dollar company Source: Peloton Interactive, Inc. Fiscal Year 2021 10-K. Filed on August 27, 2021. 33

4 MISALIGNMENT OF INTERESTS: MR. FOLEY’S WIFE RUNS ONE OF THE BUSINESSES …[W]e don’t really need to make money on our apparel business, because it’s not our core business. ¹ - John Foley, CEO Peloton ▪ John Foley put his wife in charge Performance Has Suffered of the Peloton apparel business ▪ Recent results in the apparel line “Momentum in the [Apparel] unit, which is run by have been disappointing and it Chief Executive John Foley’s wife, seems to be appears internal projections have fading heading into the next year...”² been cut ▪ It is unclear if Ms. Foley is the best person to lead this business, or is “[Apparel] penetration into our member base just the person closest to Mr. Foley is so low. How do we drive more revenue from our existing member base?”² “[I]t’s just... the dynamic is a little ▪ Shareholders deserve leadership - Tim Shannehan, Global Chief Sales Officer awkward with Jill and John.” from the best available managers, - Tim Shannehan, Global Chief not nepotism Sales Officer2 1. Source: Goldman Sachs Technology & Internet Virtual Conference (February 11, 2021) transcript. 34 2. Source: “Peloton internal docs show it slashed 2022 sales goals for apparel unit after segment revenue more than doubled last year.” CNBC, January 31, 2022.

4 MISALIGNMENT OF INTERESTS: EXCESSIVE INSIDER SELLING While managing with unbridled optimism, Mr. Foley sold nearly $100 million in Peloton shares in 2021 Peloton’s Share Price vs. John Foley’s Cumulative Proceeds from Stock Sales in 2021 $180.00 “[W]e’ve never been more “[O]ur domestic business “[W]e have never been excited about our future is just growing so fast that more excited about our $160.00 road map.”2 it’s still such a beautiful future than we are growth story… ”3 today.”4 $140.00 $120.00 $100.00 +$96 Million $80.00 “[W]e remain very, very bullish on our opportunity. $60.00 We haven’t seen any softening of demand.”1 $40.00 - 76% $20.00 $0.00 Jan-21 Apr-21 Jul-21 Oct-21 Peloton Share Price Cumulative Proceeds from Sales ($m) 1. Peloton Interactive Q2 2021 Earnings Call transcript. 3. Peloton Interactive Goldman Sachs Communacopia Conference transcript. 2. Peloton Interactive Q3 2021 Earnings Call transcript. 4. Peloton Interactive Q1 2022 Earnings Call transcript. 35

4 MISALIGNMENT OF INTERESTS: INSIDER SHARE PLEDGING ▪ Mr. Foley and five other insiders have pledged % of Economic Interest Pledged as of September 30, 2021 a large portion of their Peloton shares 100% ▪ Pledging is problematic because it can lead to forced stock sales in the event of a margin call and accelerate a downward spiral in the stock price 65% 60% ▪ The pledges also appear to violate Peloton’s 50% own Insider Trading Policy 42% 41% Erik Blachford John Foley Thomas Cortese Hisao Kushi Entities Affiliated William Lynch Director CEO Chief Product Chief Legal w/ TCV President Officer Officer and Secretary Source: Company filings. Note: Ownership excludes options and restricted stock that had not been exercised or vested as of September 30, 2021. 36

5 LOSS OF CREDIBILITY: MIS-EXECUTION HAS CRUSHED EMPLOYEE MORALE Foley has lost credibility internally, driving employee morale to an all-time low “Morale is at an all-time low. The Company is spinning out so fast.”1 2 3 Peloton Hit with Minnesota Wage and Hour Class Action by CHRISTINA TABACCO October 29, 2021 Alawsuitfiled on Wednesday accuses tech-fitness company Peloton Interactive Inc. of skimping on wages owed to some hourly employees. 1. Source: https://markets.businessinsider.com/news/stocks/peloton-stock-falls-below-ipo-price-production-halt-demand-drop-2022-1. 37 2. Source: https://www.bloomberg.com/news/articles/2022-01-28/peloton-s-extreme-sales-quotas-led-to-unpaid- overtime-suit-says. 3. Source: https://lawstreetmedia.com/news/tech/peloton-hit-with-minnesota-wage-and-hour-class-action/.

5 LOSS OF CREDIBILITY: MISLED INVESTORS ON NEAR-TERM CAPITAL NEEDS Peloton stock dives further after $1 billion public stock offering¹ On Peloton’s first quarter 2022 earnings call on Just twelve days later, on November 16, 2021, November 4, 2021, CFO Jill Woodworth reiterated Peloton announced a new $1.1 billion public that Peloton did not need any additional capital stock offering³ “…we don’t see the need “[Peloton] today for any additional capital announced the pricing of raise based on our an underwritten public current outlook.”2 offering of 23,913,043 Jill Woodworth, Peloton CFO shares of its Class A common stock…”3 Peloton’s stock declined to a new 17-month low on the news 1. Source: https://www.marketwatch.com/story/peloton-stock-dives-further-after-1-billion-public-stock-offering-2021-11-16. 38 2. Jill Woodworth on Peloton Interactive Q1 2022 Earnings Call. 3. Source: Peloton Interactive, Inc. Announces Pricing Of Public Offering Of Class A Common Stock Press Release on November 16, 2021.

5 LOSS OF CREDIBILITY: PATTERN OF PROMOTIONAL PUFFERY “You know, this thing, I see clear as day, it's going to be one of the few trillion-dollar companies…I don't see any other way that we're not worth some staggering valuation”¹ “We have built a team that I believe is ready to run a $500 billion company. Pick a number. A FAANG-style leadership team”² Peloton declined to comment on Foley’s puzzling statement, or his definition of “weirdly,” citing quiet period restrictions leading up to the company’s IPO. The company said on Tuesday that it plans to list shares “I see a couple hundred million people on the Nasdaq exchange under the ticker symbol “PTON.” on the Peloton platform in 15 years.”² 1. Source: Peloton CEO John Foley: We’re ‘Weirdly Profitable’ For A Growing, Young Company | CNBC, May 23, 2018: https://www.youtube.com/watch?v=kAdp0R8B_rU 39 2. Source: Time Magazine interview, May 26, 2020: https://time.com/5839552/peloton-ceo-john-foley/.

5 LOSS OF CREDIBILITY: VISIONS OF GRANDEUR Estimates of lofty growth are at odds with the current demand environment and further erode investor trust 3 ▪ Mr. Foley once claimed that Peloton could reach QoQ Member Growth “a couple hundred million” members in 15 years1 40% 30% 30% 22% 23% ▪ Meeting Mr. Foley’s target of 200 million users in 20% 19% 16% 2035 would require a compound annual growth 10% 9% 5% rate of over 30% for the next 15 years 0% 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 3 QoQ Connected Fitness Subscription Growth “We'll continue to be a high 30% 25% 25% or hyper growth company for 24% 23% 22% years and years to come”2 20% 12% –Foley, Earnings Call, August 26, 2021 10% 7% 0% 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 1. Source: Time Magazine interview, May 26, 2020: https://time.com/5839552/peloton-ceo-john-foley/. 2. Source: Peloton Interactive Q4 2021 Earnings Call transcript. 3. Source: Company filings. 40

5 LOSS OF CREDIBILITY: SELL-SIDE COMMUNITY IS SKEPTICAL “We’ve been discussing the fact that management has been “Time will be needed to restore pitching long-term excitement investor confidence” while selling over ~$700 million in shares since September 2020.” Baird Equity Research, January 20, 2022 BMO Equity Research, January 20, 2022 41

5 LOSS OF CREDIBILITY: MANAGEMENT ADMITS IT NEEDS HELP ▪ Seemingly admitting the lack of internal capability, discipline and experience, Foley is looking to outsiders for answers ▪ Hiring McKinsey is a clear declaration of failure ▪ Even if McKinsey is able to develop a rescue plan, it is unclear that Mr. Foley is capable of executing it ▪ The Company needs a new CEO, rather than consultants to rectify past errors 42

PELOTON INTERACTIVE, INC. Peloton’s Board & Governance Lack Accountability and Alignment

PELOTON’S BOARD & GOVERNANCE LACK ACCOUNTABILITY AND ALIGNMENT 1 Inadequate ▪ Peloton’s governance structure frustrates accountability and lacks basic protections Shareholder Rights ▪ The Company’s corporate governance scores are among the worst in corporate America 2 Lack of Board ▪ Directors have prior or current relationships that impair effective oversight Independence 3 Troubling Insider Selling ▪ Insiders have sold more than $700 million in shares since Peloton’s IPO and Pledging ▪ The notional value of pledged shares by insiders exceeds $500 million 4 Misalignment of Executive ▪ The Company’s dual-class share structure decouples economic interests from voting interests Economic Interest ▪ Peloton’s executives control more than 75% of the voting power despite an economic interest of less than 15% 5 Pay-for-Performance ▪ There is no performance-based compensation within any of the executives’ compensation plans Misalignment and Poor Compensation Plan Design Source: Company filings. 44

1 PELOTON’S CORPORATE GOVERANCE IS AMONG THE WORST IN AMERICA X Peloton has an overall Governance QualityScore of 9/10 and a 10/10, the worst score possible, for Shareholder Rights from ISS ISS recommended against every Peloton director up for election Quality Score X at the 2020 and the 2021 Annual Meetings 10 = Highest Possible Risk X Peloton has the worst possible score for environmental disclosure and governance risk, and nearly the worst possible score for social and human rights disclosure X Peloton’s governance provides very few mechanisms to hold the Board accountable ▪ A second class of supervoting shares (at a ratio of 20-to-1) ▪ No Proxy Access provision ▪ No ability to call a special meeting or act by written consent ▪ No majority vote standard to elect directors ▪ Classified Board structure ▪ Bylaw amendments require a supermajority vote Source: ISS Report, Peloton Interactive, Inc., November 23, 2021 45

1 PELOTON’S CORE GOVERNANCE PRACTICES ARE OUT-OF-STEP Peloton’s governance is not in line with peers or market practice % of Companies with Dual-Class Shares with Unequal Voting % of Companies with a Classified Board 25% 28% 8% 11% 12% 13% S&P 500 NASDAQ 100 Russell 1000 S&P 500 NASDAQ 100 Russell 1000 % of Companies with No Majority Voting Standard for Director Elections % of Companies That Do Not Allow Shareholders to Call Special Meetings 46% 44% 28% 33% 23% 10% S&P 500 NASDAQ 100 Russell 1000 S&P 500 NASDAQ 100 Russell 1000 Source: FactSet. Note: Data as of February 4, 2022. 46

2 PELOTON’S BOARD LACKS TRUE INDEPENDENCE Erik Blachford Jay Hoag Pamela Thomas- Blachford was President & Graham CEO of Expedia and IAC Travel at the same time Foley was President & CEO of Evite while both were owned by IAC John Foley William Lynch Ms. Thomas- Lynch was CEO of Barnes Hoag and Callaghan are Graham and & Noble while Foley was both VC Investors who Ms. Boone both President of ecommerce serve on the Zillow Board currently serve as directors for Rivian Jon Callaghan Karen Boone Callaghan is managing member of True Ventures which led Peloton’s Series Callaghan’s VC Fund led Modern C in 2015 Animal’s Series A, where Karen Boone is a Board member Source: Company filings and publicly available information. 47

2 THE BOARD NEEDS TO BE REFRESHED Through all election cycles as a public company, ISS has not recommended voting for ANY directors Director ISS Director ISS Recommendation Recommendation Jon Callaghan WITHHOLD Erik Blachford WITHHOLD Independent Director Independent Director Jay Hoag WITHHOLD Howard Draft WITHHOLD Independent Director Ex-Independent Director Pamela Thomas-Graham WITHHOLD Independent Director Source: ISS Report, Peloton Interactive, Inc., November 20, 2020 and November 23, 2021 48

3 TROUBLINGINSIDER SELLING AND PLEDGING Peloton’s executives have realized hundreds of millions of dollars in proceeds from selling their stock ▪ Since the IPO, Peloton’s Management and Proceeds from Stock Sales Since IPO ($ in millions)1 Board have sold over $700 mm worth of stock while maintaining outsized voting $250 power through their Class B shares; they $213 sold $500 million in 2021 alone $200 $150 $127 $119 $103 $100 $50 $47 $29 $28 $20 $15 $0 Source: ISS Report, Peloton Interactive, Inc., November 23, 2021. 49

3 TROUBLING INSIDER SELLING AND PLEDGING (CONT’D) In 2021, Peloton’s insiders enriched themselves by selling shares as the Company’s market value plunged, generating nearly $500 million in proceeds for themselves $30,000 $600 +$496 Million $20,000 $400 $10,000 $200 $0 $0 ($10,000) -$200 ($20,000) -$400 - $27 ($30,000) Billion -$600 Jan-21 Apr-21 Jul-21 Oct-21 PTON Market Value Gain/Loss Cumulative Proceeds from Insider Stock Sales Source: FactSet. 50

3 TROUBLING INSIDER SELLING AND PLEDGING (CONT’D) ▪ As of September 30, Peloton executives had pledged % of Class B Shares Pledged2 approximately 6 million shares of stock with a notional value of more than $500 million1 ▪ Pledging of company stock by directors or executive officers 68% can pose a substantial risk to outside shareholders 65% ▪ Entities affiliated with TCV – of which director Jay Hoag is a 50% Insider General Partner – have 27% of their Class B shares and an Trading Policy incredible 89% of their Class A shares pledged 42% Limit: 40% ▪ The Company has an Insider Trading Policy that, even though extremely liberal, does purport to restrict pledging, 27% so the Board is seemingly aware of the risk ▪ However, this policy appears to be only loosely enforced, as John Foley, William Lynch, Thomas Cortese and Hisao Kushi all appear to be in violation of the policy John Foley Thomas Cortese Hisao Kushi William Lynch Entities Affiliated w/ TCV 1. Based on the closing stock price of $87.05 on September 30, 2021. 51 2. Source: ISS Report, Peloton Interactive, Inc., November 23, 2021.

4 DUAL-CLASS STRUCTURE RESULTS IN SHAREHOLDER MISALIGNMENT The voting power of Peloton’s top five executives is vastly disproportionate with their economic interest in the Company ▪ The Company’s executives control more than 75% Voting Power of Executives vs. Economic Interest1 of the voting power, despite only having an economic interest in Peloton of approximately 12% Economic Interest 12% ▪ As a result, Peloton’s annual meetings are essentially formalities; proposals with management Voting Power 78% support are guaranteed to pass 0% 25% 50% 75% 100% ▪ Public shareholders have expressed deep discontent 2021 Annual Meeting Reported vs. Adjusted Vote Results2 83% 89% 93% 65% 47% 19% Say on Pay Jay Hoag Jon Callaghan Reported Level of Support Adjusted Level of Support 1. Source: ISS Report, Peloton Interactive, Inc., November 23, 2021. “Executives” based on ISS’ definition of “Strategic Shareholders,” which include John Foley, William Lynch, Thomas Cortese, Hisao Kushi and Jill Woodworth. 52 2. Source: Company filings. Adjusted vote results calculated by subtracting the aggregate voting power of Peloton’s outstanding Class B shares from the reported “For” votes.

5 COMPENSATION STRUCTURE DOES NOT INCENTIVIZE PERFORMANCE ▪ Historically, Peloton’s compensation structure was heavily Base Salary + Time-Based Equity as a % of Total CEO Compensation Opportunity weighted towards time-based equity awards ▪ The Company characterizes these awards as “variable,” 95% 100% but the equity awards (options and RSUs) are entirely 91% time-based, with no performance-based vesting criteria ▪ Peloton allows executives to choose RSUs instead of options, effectively ensuring that Peloton executives will receive substantial value from their equity awards regardless of whether Peloton’s stock value increases FY 20 FY 21 FY 22 ▪ Incredibly, in the first quarter of fiscal year 2022, Peloton’s compensation committee removed the last Other Negative Aspects of the Company’s Compensation Program Include: vestige of performance-based compensation from the Company’s pay program by eliminating the cash bonus ▪ Permissive policy permits executives to pledge up to 40% of their equity holdings plan for fiscal year 2022 ▪ Insufficient claw back policy ▪ No executive stock ownership requirements Source: Company filings. 53

PELOTON’S BOARD NEEDS TO BE RECONSTITUTED AND ITS GOVERNANCE ENHANCED Given the magnitude of Peloton’s governance failures, we believe urgent action is needed to reconstitute the Board ▪ We believe the Board should immediately begin to search for new, fully independent directors with no prior ties to the current Board New independent directors with relevant and management team skills should be added to the Board ▪ We urge the Board to insist on collapsing the dual-class structure to ✓M&A allow for “one share, one vote,” which we believe is a fundamental principle of good corporate governance and especially important at an ✓Supply Chain Management underperforming company like Peloton ✓Logistics ▪ The Board should also revamp the Company’s executive compensation programs by introducing performance-based ✓Operations compensation triggers such that at least 50% of each executive’s compensation is performance-based ✓Capital Allocation 54

PELOTON INTERACTIVE, INC. The Board Should Immediately Put Peloton Up For Sale

PELOTON STOCK WILL CONTINUE TO LANGUISH AS STANDALONE PUBLIC COMPANY The Board should immediately examine a sale of the company to the highest bidder ▪ Managerial and operational failures have de-rated Peloton’s stock from high multiple SaaS valuation to low multiple hardware valuation – Ongoing cash burn, constrained balance sheet, materially higher cost of capital, and significantly bloated cost structure with excess manufacturing capacity will weigh on the Company’s valuation and limit its ability to execute a fast turnaround – Peloton’s stock will remain in the penalty box for many quarters and will likely continue to trade at a significant valuation discount ▪ Peloton management and the Board have lost credibility with investors – Even under new management, it will take years for stock to regain a reasonable growth multiple – A new, competent management team will need 6-12 months to assess problems and another 1-2 years to fix them ▪ High quality and premium subscriber base represents significant strategic value for a myriad of potential acquirors 56

PELOTON IS A STRATEGICALLY VALUABLE ASSET TO MULTIPLE SUITORS Significant value creation ✓Largest interactive fitness platform in the world with premium brand and content opportunities ✓Engaged subscriber base with low churn creates strong recurring revenue stream ▪ Bundle with existing subscription and ✓Large addressable market in early innings of market penetration streaming services (e.g., Plug and Play) ✓Unrealized pricing power ▪ Loweredcostofacquisition in combined entity ✓Network effects from ecosystem ▪ Ability to raise prices for subscriptions ✓Significant value creation opportunities ▪ Significant SG&A savings ▪ Distribution & logistics synergies 57

A SALE PROCESS WILL LIKELY ATTRACT SEVERAL STRATEGIC BIDDERS February 6, 2022 Wedbush issued a research report highlighting several reasons why Peloton would be a strong strategic fit for Apple “For Cook & Co., acquiring Peloton would be a major strategic coup and catalyze the company’s aggressive health and fitness initiatives over the coming years.” Source: Wedbush Equity Research, February 6, 2022. 58

POTENTIAL STRATEGIC ACQUIRORS FOR PELOTON PTON Subscriber Base Existing Health & Cost Synergies Can Lower Cost of Complementary Ability to Sell Valuable Fitness Business Customer Acq. Hardware / Wearables Additional Products ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ g s n d rtio ✓ ✓ ✓ ✓ ✓ ✓ o Go Sp ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ 8 ✓ ✓ 8 ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ on ✓ 8 ✓ ✓ 8 ✓ i pt ri c ✓ 8 ✓ ✓ 8 ✓ Subs ✓ 8 ✓ ✓ 8 ✓ d an ✓ 8 ✓ ✓ 8 ✓ nt te ✓ 8 ✓ ✓ 8 ✓ on C ✓ 8 ✓ ✓ 8 ✓ ✓ 8 ✓ ✓ 8 ✓ ✓ 8 ✓ ✓ 8 ✓ y ✓ ✓ ✓ ✓ ✓ ✓ g o l ✓ ✓ ✓ ✓ ✓ ✓ o n h c ✓ 8 ✓ ✓ 8 ✓ Te ✓ 8 ✓ ✓ ✓ ✓ 59

FAIR VALUE FOR PELOTON IN A SALE IS AT LEAST $65 PER SHARE Illustrative Value of Peloton Using Myriad Valuation Metrics Key M&A Assumptions ▪ 3.3 million Connected Fitness Peloton Stock Closing Price Friday February 4, 2022 subscribers by FYE 6/30/23 Method ▪ 1.3 million Digital subscribers by FYE 6/30/23 Comparable M&A Analysis $51.81 $97.02 ▪ Low End:Analysis applies the price per subscriber Google paid to acquire Fitbit in 2019 to the Connected EV / FY23 Gross Profit* $70.62 $95.22 Fitness subscriber base and applies a 25% discount to the same price per subscriber to the Digital subscriber base EV / FY23 Revenue* $69.05 $99.01 ▪ High End: Analysis applies the price per subscriber Lululemon paid to $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 $90.00 $100.00 $110.00 acquire Mirror to the Connected Fitness subscriber base and applies $24.60 zero value to the Digital subscriber base Source: Company filings and consensus data per Capital IQ. Source: Company closing stock price trading session as of February 4, 2022, per Bloomberg. 60 * Assumes $375 million of SG&A savings at 15x, split two-thirds to Peloton shareholders.

STRATEGIC BUYERS COULD EASILY PAY $75 / SHARE Conversion of Existing Subs Value Creation at Value Creation at Required for 2.5% Penetration of 5% Penetration of ▪ At a $75 per share purchase Subscribers Value Accretion Subscribers Subscribers price, an acquisition of Peloton 222 mm 1.3% $42 bn $84 bn would be accretive to many strategic buyers with very 180 mm 0.3% $45 bn $91 bn modest cross-selling and penetration assumptions 172 mm 2.3% $24 bn $49 bn ▪ Amazon, for example, would 118 mm 3.0% $18 bn $36 bn need just 2.3% penetration of its Prime subscribers to make the 74 mm 5.2% $11 bn $21 bn acquisition accretive 47 mm 20.6% $3 bn $5 bn 44 mm 8.1% $7 bn $14 bn 35 mm 17.2% $3 bn $6 bn Note: Assumes PTON incremental margin of 60%, below managements guidance of 70%, on current subscription prices. Accretion based on 2022E EBITDA multiples per Capital IQ. 61 Sources: Company filings and publicly available data.

PELOTON INTERACTIVE, INC. Conclusion

CONCLUSION Urgent action is needed to protect shareholder value Issue Key Considerations Action Item When? Peloton has been horribly • Failures to manage pricing, product safety, manufacturing capacity, capital ▪ Fire CEO, John Foley mismanaged, with allocation, real estate, SG&A costs, productivity and culture ▪ Fire CFO, Jill Woodworth unbridled enthusiasm • Significant misalignment of interest between management and shareholders taking the place of disciplined leadership Peloton is worth • Standalone Peloton faces a hard road, especially given the complete loss of ▪ Run strategic significantly more to a credibility of its management team with investors alternatives process strategic acquiror than as • Meanwhile, strategic buyers in the media, technology, sporting goods and a standalone business, subscription businesses would find Peloton an attractive acquisitions, with many especially given the sources of synergy difficult turnaround ahead Peloton’s controlling • Having lost $40 billion of shareholder value in the last year, shareholders no longer ▪ Eliminate dual-class shareholders have lost the want Mr. Foley to control the Company; his mandate has been eroded by poor voting mandate to control the performance ▪ Change Board Company and its Board • The Board is too close to Mr. Foley and shareholders would welcome fresh directors, composition needs fresh perspectives selected with the input of public market shareholders ▪ Improve governance • Governance should be improved to provide better accountability 63

SHAREHOLDERS DESERVE MORE INFORMATION Blackwells has submitted a formal demand to inspect Blackwells’ Demand to Inspect Peloton’s Books and Records Peloton’s books and records for the following purposes: ▪ Investigating possible breaches of fiduciary duty, mismanagement, and other violations of law by members of the Company’s Board and management in connection with: ▪ Testing the veracity of the statements of Directors and Officers concerning revenue, profits, and inventory ▪ Testing the propriety of the Company’s public disclosures regarding safety of its Tread and Tread+ products ▪ Investigating Mr. Foley’s and Ms. Foley’s suitability for office Source: https://www.blackwellscap.com/wp-content/uploads/2022/02/2022.02.07-Letter-from-C.-Duffy-to-H.-Kushi.pdf 64

CONTACT INFORMATION Daniel W. Lawrence Investor Relations Media Relations Chief Operating Officer & Portfolio Manager IR@blackwellscap.com Gagnier Communications Dan Gagnier / Jeffrey Mathews W. Gage Holzhauer 646-569-5897 Executive Director | Investments Blackwells@gagnierfc.com blackwellscap.com