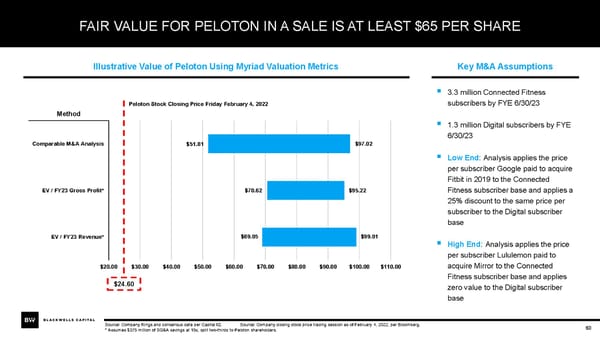

FAIR VALUE FOR PELOTON IN A SALE IS AT LEAST $65 PER SHARE Illustrative Value of Peloton Using Myriad Valuation Metrics Key M&A Assumptions ▪ 3.3 million Connected Fitness Peloton Stock Closing Price Friday February 4, 2022 subscribers by FYE 6/30/23 Method ▪ 1.3 million Digital subscribers by FYE 6/30/23 Comparable M&A Analysis $51.81 $97.02 ▪ Low End:Analysis applies the price per subscriber Google paid to acquire Fitbit in 2019 to the Connected EV / FY23 Gross Profit* $70.62 $95.22 Fitness subscriber base and applies a 25% discount to the same price per subscriber to the Digital subscriber base EV / FY23 Revenue* $69.05 $99.01 ▪ High End: Analysis applies the price per subscriber Lululemon paid to $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 $90.00 $100.00 $110.00 acquire Mirror to the Connected Fitness subscriber base and applies $24.60 zero value to the Digital subscriber base Source: Company filings and consensus data per Capital IQ. Source: Company closing stock price trading session as of February 4, 2022, per Bloomberg. 60 * Assumes $375 million of SG&A savings at 15x, split two-thirds to Peloton shareholders.

BW Peloton Presentation Feb 07 2022 Page 59 Page 61

BW Peloton Presentation Feb 07 2022 Page 59 Page 61