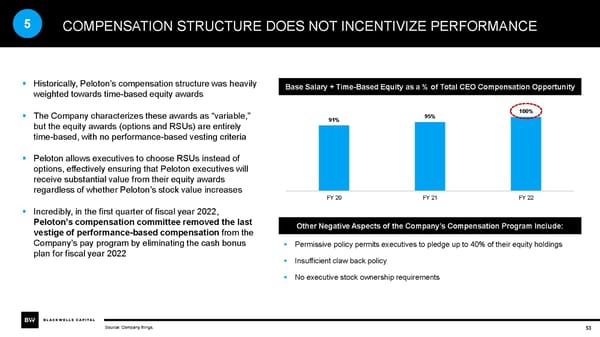

5 COMPENSATION STRUCTURE DOES NOT INCENTIVIZE PERFORMANCE ▪ Historically, Peloton’s compensation structure was heavily Base Salary + Time-Based Equity as a % of Total CEO Compensation Opportunity weighted towards time-based equity awards ▪ The Company characterizes these awards as “variable,” 95% 100% but the equity awards (options and RSUs) are entirely 91% time-based, with no performance-based vesting criteria ▪ Peloton allows executives to choose RSUs instead of options, effectively ensuring that Peloton executives will receive substantial value from their equity awards regardless of whether Peloton’s stock value increases FY 20 FY 21 FY 22 ▪ Incredibly, in the first quarter of fiscal year 2022, Peloton’s compensation committee removed the last Other Negative Aspects of the Company’s Compensation Program Include: vestige of performance-based compensation from the Company’s pay program by eliminating the cash bonus ▪ Permissive policy permits executives to pledge up to 40% of their equity holdings plan for fiscal year 2022 ▪ Insufficient claw back policy ▪ No executive stock ownership requirements Source: Company filings. 53

BW Peloton Presentation Feb 07 2022 Page 52 Page 54

BW Peloton Presentation Feb 07 2022 Page 52 Page 54