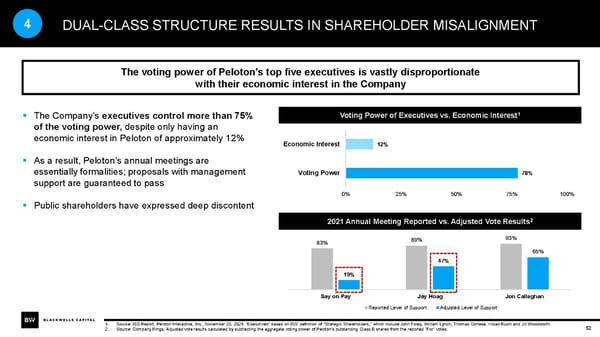

4 DUAL-CLASS STRUCTURE RESULTS IN SHAREHOLDER MISALIGNMENT The voting power of Peloton’s top five executives is vastly disproportionate with their economic interest in the Company ▪ The Company’s executives control more than 75% Voting Power of Executives vs. Economic Interest1 of the voting power, despite only having an economic interest in Peloton of approximately 12% Economic Interest 12% ▪ As a result, Peloton’s annual meetings are essentially formalities; proposals with management Voting Power 78% support are guaranteed to pass 0% 25% 50% 75% 100% ▪ Public shareholders have expressed deep discontent 2021 Annual Meeting Reported vs. Adjusted Vote Results2 83% 89% 93% 65% 47% 19% Say on Pay Jay Hoag Jon Callaghan Reported Level of Support Adjusted Level of Support 1. Source: ISS Report, Peloton Interactive, Inc., November 23, 2021. “Executives” based on ISS’ definition of “Strategic Shareholders,” which include John Foley, William Lynch, Thomas Cortese, Hisao Kushi and Jill Woodworth. 52 2. Source: Company filings. Adjusted vote results calculated by subtracting the aggregate voting power of Peloton’s outstanding Class B shares from the reported “For” votes.

BW Peloton Presentation Feb 07 2022 Page 51 Page 53

BW Peloton Presentation Feb 07 2022 Page 51 Page 53