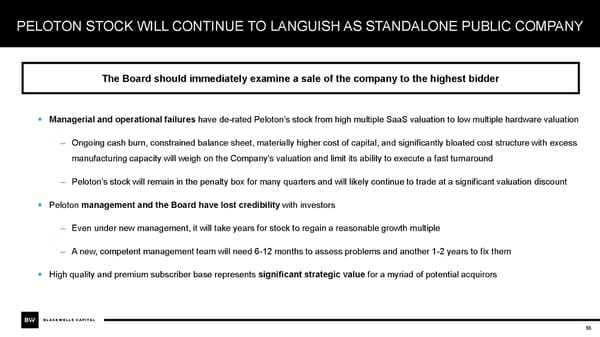

PELOTON STOCK WILL CONTINUE TO LANGUISH AS STANDALONE PUBLIC COMPANY The Board should immediately examine a sale of the company to the highest bidder ▪ Managerial and operational failures have de-rated Peloton’s stock from high multiple SaaS valuation to low multiple hardware valuation – Ongoing cash burn, constrained balance sheet, materially higher cost of capital, and significantly bloated cost structure with excess manufacturing capacity will weigh on the Company’s valuation and limit its ability to execute a fast turnaround – Peloton’s stock will remain in the penalty box for many quarters and will likely continue to trade at a significant valuation discount ▪ Peloton management and the Board have lost credibility with investors – Even under new management, it will take years for stock to regain a reasonable growth multiple – A new, competent management team will need 6-12 months to assess problems and another 1-2 years to fix them ▪ High quality and premium subscriber base represents significant strategic value for a myriad of potential acquirors 56

BW Peloton Presentation Feb 07 2022 Page 55 Page 57

BW Peloton Presentation Feb 07 2022 Page 55 Page 57