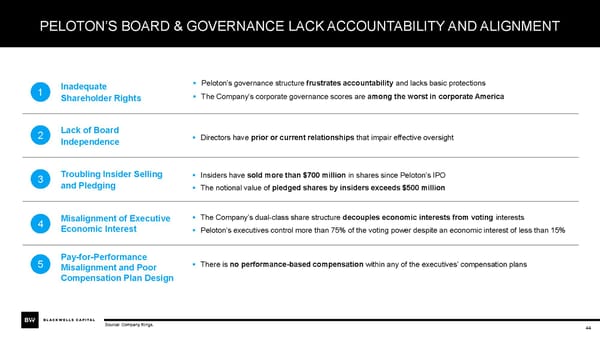

PELOTON’S BOARD & GOVERNANCE LACK ACCOUNTABILITY AND ALIGNMENT 1 Inadequate ▪ Peloton’s governance structure frustrates accountability and lacks basic protections Shareholder Rights ▪ The Company’s corporate governance scores are among the worst in corporate America 2 Lack of Board ▪ Directors have prior or current relationships that impair effective oversight Independence 3 Troubling Insider Selling ▪ Insiders have sold more than $700 million in shares since Peloton’s IPO and Pledging ▪ The notional value of pledged shares by insiders exceeds $500 million 4 Misalignment of Executive ▪ The Company’s dual-class share structure decouples economic interests from voting interests Economic Interest ▪ Peloton’s executives control more than 75% of the voting power despite an economic interest of less than 15% 5 Pay-for-Performance ▪ There is no performance-based compensation within any of the executives’ compensation plans Misalignment and Poor Compensation Plan Design Source: Company filings. 44

BW Peloton Presentation Feb 07 2022 Page 43 Page 45

BW Peloton Presentation Feb 07 2022 Page 43 Page 45