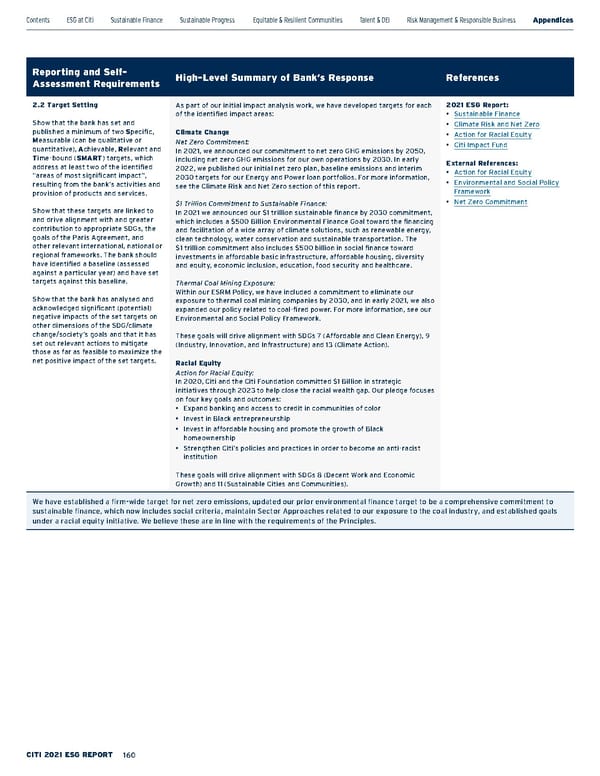

Reporting and Self- Assessment Requirements High-Level Summary of Bank’s Response References 2.2 Target Setting Show that the bank has set and published a minimum of two S pecific, M easurable (can be qualitative or quantitative), A chievable, R elevant and T ime-bound ( SMART ) targets, which address at least two of the identified “areas of most significant impact”, resulting from the bank’s activities and provision of products and services. Show that these targets are linked to and drive alignment with and greater contribution to appropriate SDGs, the goals of the Paris Agreement, and other relevant international, national or regional frameworks. The bank should have identified a baseline (assessed against a particular year) and have set targets against this baseline. Show that the bank has analysed and acknowledged significant (potential) negative impacts of the set targets on other dimensions of the SDG/climate change/society’s goals and that it has set out relevant actions to mitigate those as far as feasible to maximize the net positive impact of the set targets. As part of our initial impact analysis work, we have developed targets for each of the identified impact areas: Climate Change Net Zero Commitment: In 2021, we announced our commitment to net zero GHG emissions by 2050, including net zero GHG emissions for our own operations by 2030. In early 2022, we published our initial net zero plan, baseline emissions and interim 2030 targets for our Energy and Power loan portfolios. For more information, see the Climate Risk and Net Zero section of this report. $1 Trillion Commitment to Sustainable Finance: In 2021 we announced our $1 trillion sustainable finance by 2030 commitment, which includes a $500 Billion Environmental Finance Goal toward the financing and facilitation of a wide array of climate solutions, such as renewable energy, clean technology, water conservation and sustainable transportation. The $1 trillion commitment also includes $500 billion in social finance toward investments in affordable basic infrastructure, affordable housing, diversity and equity, economic inclusion, education, food security and healthcare. Thermal Coal Mining Exposure: Within our ESRM Policy, we have included a commitment to eliminate our exposure to thermal coal mining companies by 2030, and in early 2021, we also expanded our policy related to coal-fired power. For more information, see our Environmental and Social Policy Framework. These goals will drive alignment with SDGs 7 (Affordable and Clean Energy), 9 (Industry, Innovation, and Infrastructure) and 13 (Climate Action). Racial Equity Action for Racial Equity: In 2020, Citi and the Citi Foundation committed $1 Billion in strategic initiatives through 2023 to help close the racial wealth gap. Our pledge focuses on four key goals and outcomes: • Expand banking and access to credit in communities of color • Invest in Black entrepreneurship • Invest in affordable housing and promote the growth of Black homeownership • Strengthen Citi’s policies and practices in order to become an anti-racist institution These goals will drive alignment with SDGs 8 (Decent Work and Economic Growth) and 11 (Sustainable Cities and Communities). 2021 ESG Report: • Sustainable Finance • Climate Risk and Net Zero • Action for Racial Equity • Citi Impact Fund External References: • Action for Racial Equity • Environmental and Social Policy Framework • Net Zero Commitment We have established a firm-wide target for net zero emissions, updated our prior environmental finance target to be a comprehensive commitment to sustainable finance, which now includes social criteria, maintain Sector Approaches related to our exposure to the coal industry, and established goals under a racial equity initiative. We believe these are in line with the requirements of the Principles. Contents ESGatCiti SustainableFinance SustainableProgress Equitable&ResilientCommunities Talent&DEI RiskManagement&ResponsibleBusiness Appendices ESGS ataC ius niblnG 160

Citi ESG Report Page 159 Page 161

Citi ESG Report Page 159 Page 161