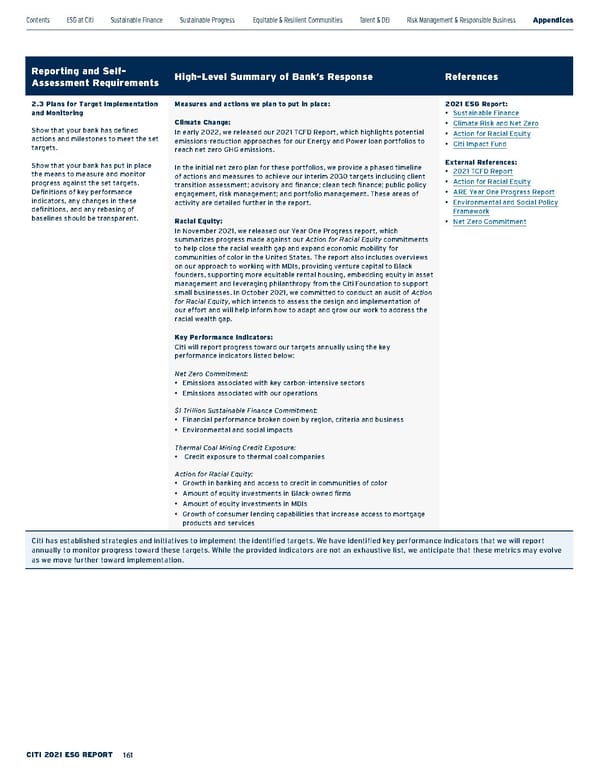

Reporting and Self- Assessment Requirements High-Level Summary of Bank’s Response References 2.3 Plans for Target Implementation and Monitoring Show that your bank has defined actions and milestones to meet the set targets. Show that your bank has put in place the means to measure and monitor progress against the set targets. Definitions of key performance indicators, any changes in these definitions, and any rebasing of baselines should be transparent. Measures and actions we plan to put in place: Climate Change: In early 2022, we released our 2021 TCFD Report, which highlights potential emissions-reduction approaches for our Energy and Power loan portfolios to reach net zero GHG emissions. In the initial net zero plan for these portfolios, we provide a phased timeline of actions and measures to achieve our interim 2030 targets including client transition assessment; advisory and finance; clean tech finance; public policy engagement, risk management; and portfolio management. These areas of activity are detailed further in the report. Racial Equity: In November 2021, we released our Year One Progress report, which summarizes progress made against our Action for Racial Equity commitments to help close the racial wealth gap and expand economic mobility for communities of color in the United States. The report also includes overviews on our approach to working with MDIs, providing venture capital to Black founders, supporting more equitable rental housing, embedding equity in asset management and leveraging philanthropy from the Citi Foundation to support small businesses. In October 2021, we committed to conduct an audit of Action for Racial Equity , which intends to assess the design and implementation of our effort and will help inform how to adapt and grow our work to address the racial wealth gap. Key Performance Indicators: Citi will report progress toward our targets annually using the key performance indicators listed below: Net Zero Commitment: • Emissions associated with key carbon-intensive sectors • Emissions associated with our operations $1 Trillion Sustainable Finance Commitment: • Financial performance broken down by region, criteria and business • Environmental and social impacts Thermal Coal Mining Credit Exposure: • Credit exposure to thermal coal companies Action for Racial Equity: • Growth in banking and access to credit in communities of color • Amount of equity investments in Black-owned firms • Amount of equity investments in MDIs • Growth of consumer lending capabilities that increase access to mortgage products and services 2021 ESG Report: • Sustainable Finance • Climate Risk and Net Zero • Action for Racial Equity • Citi Impact Fund External References: • 2021 TCFD Report • Action for Racial Equity • ARE Year One Progress Report • Environmental and Social Policy Framework • Net Zero Commitment Citi has established strategies and initiatives to implement the identified targets. We have identified key performance indicators that we will report annually to monitor progress toward these targets. While the provided indicators are not an exhaustive list, we anticipate that these metrics may evolve as we move further toward implementation. Contents ESGatCiti SustainableFinance SustainableProgress Equitable&ResilientCommunities Talent&DEI RiskManagement&ResponsibleBusiness Appendices ESGS ataC ius niblnG 161

Citi ESG Report Page 160 Page 162

Citi ESG Report Page 160 Page 162