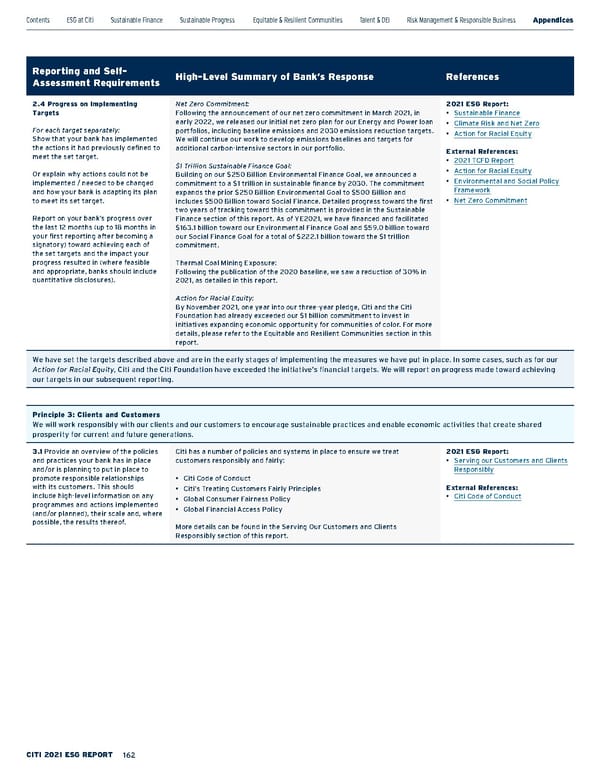

Reporting and Self- Assessment Requirements High-Level Summary of Bank’s Response References 2.4 Progress on Implementing Targets For each target separately: Show that your bank has implemented the actions it had previously defined to meet the set target. Or explain why actions could not be implemented / needed to be changed and how your bank is adapting its plan to meet its set target. Report on your bank’s progress over the last 12 months (up to 18 months in your first reporting after becoming a signatory) toward achieving each of the set targets and the impact your progress resulted in (where feasible and appropriate, banks should include quantitative disclosures). Net Zero Commitment: Following the announcement of our net zero commitment in March 2021, in early 2022, we released our initial net zero plan for our Energy and Power loan portfolios, including baseline emissions and 2030 emissions reduction targets. We will continue our work to develop emissions baselines and targets for additional carbon-intensive sectors in our portfolio. $1 Trillion Sustainable Finance Goal: Building on our $250 Billion Environmental Finance Goal, we announced a commitment to a $1 trillion in sustainable finance by 2030. The commitment expands the prior $250 Billion Environmental Goal to $500 Billion and includes $500 Billion toward Social Finance. Detailed progress toward the first two years of tracking toward this commitment is provided in the Sustainable Finance section of this report. As of YE2021, we have financed and facilitated $163.1 billion toward our Environmental Finance Goal and $59.0 billion toward our Social Finance Goal for a total of $222.1 billion toward the $1 trillion commitment. Thermal Coal Mining Exposure: Following the publication of the 2020 baseline, we saw a reduction of 30% in 2021, as detailed in this report. Action for Racial Equity: By November 2021, one year into our three-year pledge, Citi and the Citi Foundation had already exceeded our $1 billion commitment to invest in initiatives expanding economic opportunity for communities of color. For more details, please refer to the Equitable and Resilient Communities section in this report. 2021 ESG Report: • Sustainable Finance • Climate Risk and Net Zero • Action for Racial Equity External References: • 2021 TCFD Report • Action for Racial Equity • Environmental and Social Policy Framework • Net Zero Commitment We have set the targets described above and are in the early stages of implementing the measures we have put in place. In some cases, such as for our Action for Racial Equity , Citi and the Citi Foundation have exceeded the initiative’s financial targets. We will report on progress made toward achieving our targets in our subsequent reporting. Principle 3: Clients and Customers We will work responsibly with our clients and our customers to encourage sustainable practices and enable economic activities that create shared prosperity for current and future generations. 3.1 Provide an overview of the policies and practices your bank has in place and/or is planning to put in place to promote responsible relationships with its customers. This should include high-level information on any programmes and actions implemented (and/or planned), their scale and, where possible, the results thereof. Citi has a number of policies and systems in place to ensure we treat customers responsibly and fairly: • Citi Code of Conduct • Citi’s Treating Customers Fairly Principles • Global Consumer Fairness Policy • Global Financial Access Policy More details can be found in the Serving Our Customers and Clients Responsibly section of this report. 2021 ESG Report: • Serving our Customers and Clients Responsibly External References: • Citi Code of Conduct Contents ESGatCiti SustainableFinance SustainableProgress Equitable&ResilientCommunities Talent&DEI RiskManagement&ResponsibleBusiness Appendices ESGS ataC ius niblnG 162

Citi ESG Report Page 161 Page 163

Citi ESG Report Page 161 Page 163